Highlights:

- Refrigerant gases see improved pricing and volume growth

- Benefits flow from renewed upcycle in global agrochemicals

- Overall operating performance improves

- Exiting engineering plastics business; technical textiles a key drag

- Current level provides accumulation opportunity

-------------------------------------------------

SRF, India’s largest fluorochemical firm, reported strong Q4 earnings, driven by chemicals (32 percent of FY19 sales) and packaging film (34 percent) segments. Also read: Refrigerant gas plays turn investment worthy as they re-position for fluorine chemistry

Key positives

Sales for the March quarter surged 28.5 percent year-on-year, largely backed by 65.8 percent growth in chemicals and 18.3 percent in packaging film.

In the chemical space, growth was broad-based as the company gained from improved pricing and volume expansion in refrigerant gases as well as renewed upcycle in global agro-chemicals. Growth in refrigerant gases stood in contrast to Navin Fluorine’s numbers, which signals better traction for new-age refrigerant gas products.

Similarly, the packaging film segment benefited from new capacity additions last year. Steady demand helped BoPET films (biaxially-oriented polyethylene terephthalate) business, though adverse demand-supply situation continues to weigh on BOPP (biaxially-oriented polypropylene) films.

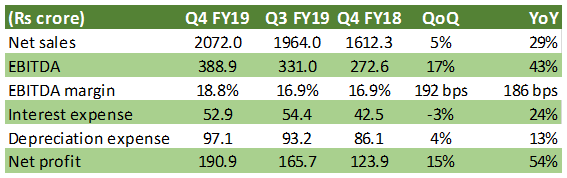

Despite a gross margin contraction of 60 bps, EBITDA (earnings before interest, tax, depreciation and amortisation) margin improved by 192 bps to 18.8 percent on a quarter-on-quarter basis.

Result snapshot Source: Company

Source: Company

Key negatives

Technical textiles, which accounts for 27 percent of sales, was a laggard as sales grew by just 4.2 percent. Segmental operating margin fell 270 bps due to inventory losses amid raw material volatility.

This segment faces challenges from subdued near-term outlook for the automotive sector for its product -- tyre cord fabric. The conveyor belting fabrics product category (used in mining end-market) is facing headwinds from cheap imports from China, leading to higher inventory in the system.

Other observations

The company has signed a definitive agreement with DSM, the life sciences and materials sciences company, to sell its engineering plastics business for Rs 320 crore. Scaling it up to a large business required significant time and hence passing it on to a credible player made business sense, the management said.

SRF is on track for approvals for HFC 134a pharma grade facility. Almost all major Indian players have approved this gas produced under Dymel brand for the pharma end-market.

OutlookWe continue to like SRF’s business transition, given the challenges in refrigerant gases industry and opportunities for value-added applications in the agrochemical industry.

SRF increasingly caters to the growing opportunity in ozone friendly hydrofluorocarbons (HFCs). The firm is spending about Rs 356 crore to build an integrated facility to produce its key HFCs (HFC 134a, HFC 32 and HFC 125). It has plans to commission the plant, which will double capacity to 50,000 tonne, by June-July. Based on this, the management is guiding for 20-25 percent growth in fluorochemicals in FY20.

In case of the specialty chemical business, the management has guided for 40-50 percent growth on the back of strong momentum in the agrochemical market. Recently, SRF announced Rs 140-crore spend for boosting capacity of agrochemical intermediates. It’s remarkable that chemicals business contribution to total revenue and operating profit has now risen to 41 percent and 49 percent, respectively, in Q4 FY19.

In the medium term, we expect continuous investment and R&D into complex fluorine applications to propel topline growth.

As far as the stock price is concerned, it remains steady in contrast to volatility in other chemical stocks and reflects improving fundamentals. Trading at 14.1 times FY21 estimated earnings, the stock provides a strong accumulation opportunity.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.