Highlights:

- Decline in realisations of carbon and advanced materials

- Steady operating performance, unlike peers, is noteworthy

- Higher allocation of green petcoke and traction in key projects are positive

- Other than end-market challenges, supply chain impact due to coronavirus needs a close watch

-------------------------------------------------

Rain Industries’ (CMP: Rs 103/share; market capitalisation: Rs 3,475 crore) quarterly result was weighted down by weak realisations for carbon and advance material products, majorly reflecting the sharp decline in the prices of oil derivatives. Sequentially, volumes sold was relatively better for carbon products, which is noticeable given the weak end-markets. Operating performance was much ahead of peers – Himadri Chemicals (coal tar pitch) and Goa Carbon (calcined petroleum coke).

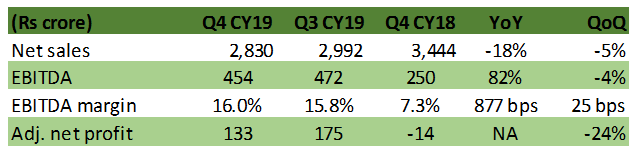

Q4 CY19 financials

Source: Company

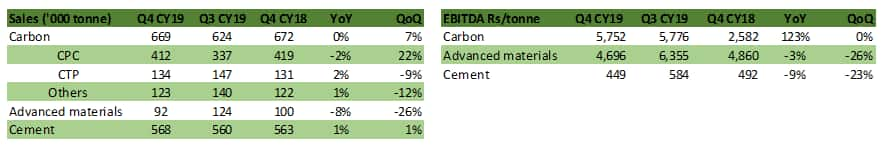

Q4 product sales volume trend

Source: Company

Key highlights

Carbon products (67 percent of Q4 CY19 sales) revenue declined 21 percent year-on-year on account of steep decrease in realisations.

Sequentially, lower realisations were particularly visible for CPC (calcined petroleum coke), but this was more than offset by better volumes. The average blended realisation for carbon products decreased by about 8 percent due to weaker end-market of aluminium. In spite of this, profitability per tonne for carbon products has been stable. In the preceding quarter, the company was able to get rid of its high-cost inventory, which has helped segmental margins to normalise to near historical levels.

In case of advance materials segment (24 percent of sales), sales volumes were affected by lower demand for products in steel, graphite and North America construction industries. The weak performance was also attributed to sluggish demand for resins by adhesive players and European automakers. Average blended realisation in this segment decreased by about 7 percent due to a decline in prices across the crude oil value chain.

Key observations:

Status on petcoke import restrictions

Sequential improvement in CPC volumes sold point towards a normalisation in production volume throughput, which have been affected by import restrictions for CPC import, and import quotas for GPC (green petcoke). Note that the company’s earlier business model required it to import CPC from its US plant, blend and re-export it. But due to the import ban, the company was not able to pursue this blending process, which aids margins as well.

However, there are couple of trends, which are helping it to meet these challenges.

Rain is able to operate the CPC plant at optimum levels despite the current GPC import quota as it can use domestically-sourced petcoke and adapt it for calcination purposes. Consequentially, the company is procuring anode-grade GPC from domestic refineries.

Another positive newsflow that helps in better capacity utilisations is the allocation of additional GPC of 103,852 tonne from the volume quota surrendered by other calciners. This has led to a 20 percent higher allocation for the current fiscal.

Additionally, the Supreme Court is expected to receive new guidelines for calcination plant emissions from the government in March. It is expected that FGD (flue-gas desulfurization) installation would be made mandatory for all CPC manufacturers. Since this may not make economic sense for small players to continue, it can lead to better market share gains and higher share in GPC quota. An FGD system helps in reducing sulphur dioxide emissions by more than 90 percent. Rain Industries' FGD system removes nearly 98 percent of the facility's sulphur dioxide emissions.

The company has also launched a new product called anhydrous carbon pellets (ACP), which is at par with the quality of GPC. The calcined version of ACP offers some unique advantages to anode producers like lower power consumption. Due to this advantage, some of the headwinds in the domestic CPC business can be compensated through ACP, which doesn’t faces challenges of import ban/quota and can be made from the refinery products available in India.

Hence, the company plans to commission two ACP plants at a total cost of USD 27 million, one each at India (capacity: 250,000 tonne) and another in the US (200,000 tonne). Its India ACP plant is expected to be commissioned by H2 2020, while the one in USA is expected to start operations in Q2 2020.

Initially, the company plans to sell a blend of ACP and CPC to aluminium smelters, which would offer better quality than a CPC-only product. In fact, the company has already imported the first shipment of ACP produced on a small-scale at a US pilot plant and the product acceptance would be tested in coming days.

Other capex projects

The company’s vertical shaft CPC plant at Visakhapatnam is on track and is expected to start operations in the current quarter. Further, the hydrogenated hydrocarbon resins (HHCR) plant in Germany is also slated to start operations from Q2 2020. This plant has a water-white resin (dicyclopentadiene) capacity of 30,000 tonne, which is used for waterproof applications such as food packaging and diapers, and high-end polymer applications such as high strength glues. Plant commissioning has been delayed due to hindrance in getting the supply of some equipment from Italy on account of the coronavirus scare.

OutlookBusiness cycle-related challenges due to weak end-markets such as automotive, aluminium, steel and graphite industries are expected to continue in the near term. In addition, the coronavirus-led supply chain and demand distortion is a bigger challenge.

The management said it does not supply CPC to China and hence shutdown of aluminium plants there will not impact it. Regarding GPC, it is not worried about sourcing of the same and is confident that it can protect segmental margins.

An encouraging sign is that the company is quickly moving past the recent regulatory headwinds. The company is likely to receive a higher GPC import quota as high cost calciners close down. Also, it is fast tracking commercialising a close substitute to CPC, which in turn is expected to offer varied other market applications as well.

The company’s balance sheet is on the mend. Currently net debt-to-EBITDA is 3.8 times, which the management plans to reduce below three times by CY20-end.

In sum, the company has been able to tackle few of the structural challenges to its business such as actions from regulatory agencies and loss-making product lines by resorting to reengineering product manufacturing and restructuring operations, respectively. At the same time, some business cycle-related challenges remain, which is dependent on a recovery in global growth.

We may see few more quarters of modest performance, but estimate that the near-term stress in the demand environment is already priced in its valuations. Since the stock trades at an inexpensive valuation of 4.5 times CY21 estimated earnings, investors can accumulate the stock on every dip.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!