Moneycontrol Research

The growth outlook for phthalic anhydride (PA) chemicals is one such area which has caught our attention. While the PA domestic industry, dominated by IG Petrochem and Thirumalai Chemicals, is driven by robust end markets of poly vinyl chloride (PVC), resins and pigments, the possibility of higher inexpensive import of PA is a cause for concern. On account of this, we are exiting our portfolio exposure to IG Petrochem and Thirumalai Chemicals in our midcap and Diwali portfolio, respectively.

PA anti-dumping protection under review

In its FY18 annual report, Thirumalai Chemicals highlighted 2 events which can materially change the business and margin dynamics of the PA business in India. First, anti-dumping duty on PA, which was in force from December 2012 to December 2017, is under review. In the interim, this duty safeguard has been extended till December 24, 2018. But the Directorate General of Trade Remedies has started the sunset review investigation concerning imports of PA originating in or exported from Korea, Taiwan and Israel. Interestingly, Korea and Taiwan already constitute about 56 percent of the imports of PA in FY17.

Regional Comprehensive Economic Partnership could be another dampener

Second, the annual report mentions that while existing free trade agreements (FTAs) with the Association of Southeast Asian Nations (ASEAN) and Korea have been negative for the industry, the proposed RCEP could be a serious threat. RCEP is a proposed FTA between ASEAN and six Asia-Pacific states, including India. Its noteworthy that there is an import duty of 7.5 percent on PA.

Import dependence for PA

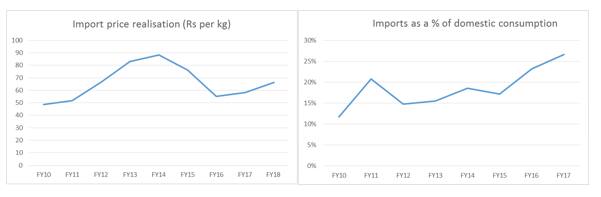

Domestic market for PA (375,000 tonne) has been import dependent partly due to lower installed capacity (349,000 tonne) and due to availability of inexpensive imports from Asian countries. In the recent past, this industry had thrived on various safeguard duties. Anti-dumping duty levied in FY12 had been instrumental in lowering import dependence in the interim and improving the realisation for PA. In recent years, imports have increased at 30 percent compounded annual growth rate (CAGR) for FY15-18 (annualised), partly benefitting from FTAs and now constitute about 27 percent of domestic consumption. Taking into account PA exports from India, net imports are 14 percent of domestic consumption at present.

PA import realisation (Rs per kg) and import as a percentage of domestic consumption (in quantity)

Source: www.chemicals.nic.in

Significant PA contribution to revenue

Both Thirumalai Chemicals and IG Petrochemicals have transformed their business model with increasingly higher contribution of derivative products of PA and maleic anhydride, which means exposure to promising end markets like construction chemicals, food and beverages and paints. PA still contributes about 80 percent and over 95 percent of turnover for Thirumalai Chemicals and IG Petrochemicals, respectively.

While its noteworthy that both companies have had a remarkable turnaround in their margin profile and return ratios over the years, partly due to improved demand and favourable import tariffs, potential change in the duty protection regime can be a dampener for the above mentioned stocks. Both companies have a significant capacity addition plans for PA, which together with higher imports can depress PA prices despite elevated crude oil prices.

On account of this, we are exiting our exposure to IG Petrochemicals and Thirumalai Chemicals in our midcap and Diwali portfolio, respectively, and wait for appropriate opportunity to deploy the resultant cash.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.