Anubhav SahuMoneycontrol Research

The government is said to considering a plan to blend liquefied petroleum gas with methanol (20 percent), which could help bringing down the cooking gas subsidy by about a third.

If government pursues this initiative, it would be one of the major steps towards a methanol economy. Methanol, a key chemical feedstock and a potential fuel substitute, is majorly imported in India.

While domestic manufacturers have a high amount of un-utilised methane manufacturing capacity, the government's energy self-reliance initiative can potentially benefit companies like GNFC and Deepak Fertilisers in terms of both volume and pricing.

NITI Aayog's road map for methanol

Earlier this year, NITI Aayog said it was working on a roadmap to move to a methanol, economy which includes replacing 20 percent of crude oil imports with methanol, reducing import dependence, and bringing down pollution.

NITI Aayog's paper, titled "India's Leapfrog to Methanol Economy" brings to the fore global practices of incorporating methanol for fuel, and related usages.

China, which alone produces 65 percent of the world's methanol, utilizes the fuel for transport. In fact, methanol accounts for almost 9 percent of all transport fuel in China.

Countries like Israel, Italy, Japan and South Korea too have extensive methanol usage. Australia has adopted GEM fuels (gasoline, ethanol and methanol) and blends almost 56 percent methanol.

Methanol is also a preferred fuel in the marine sector worldwide, wherein there are instances of large ships running on 100 percent methanol.

Methanol – strong demand growth outlook

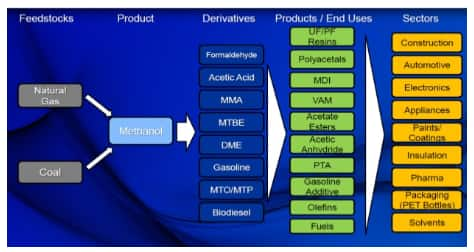

Methanol is majorly sourced from natural gas and coal, with other feedstock being municipal waste and biomass. It has varied uses, primary being chemical feedstock, wherein it is used in paints, adhesives, dyes, and olefins (ethylene, propylene).

Another key usage of methanol is for fuel and this accounts for more than a third of all demand (automotive, marine transportation, cooking gas).

Chart: Methanol value chain

Source: National Gas Company

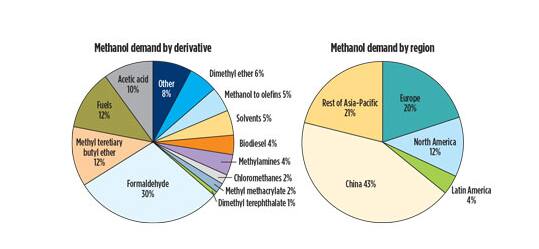

Chart: Methanol applications

Source: Methanex Corp. and ADI Analytics

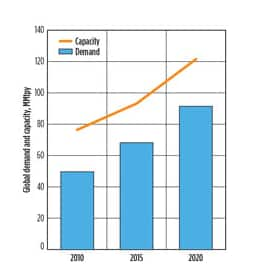

On account of rapidly growing demand (6-8 percent estimated) for methanol, aggregate demand is expected to reach 90 million tonne per annum by 2020, with China and India seen to be key drivers.

Currently, global supply of methanol exceeds demand for it. However, the current government's measures are focused on energy self-reliance, which should help in reviving demand for the fossil fuel alternative.

Chart: Global supply and demand for methanol

Source: IHS CERA, Methanex Corp., Mining and Metallurgical Society of

America, Jim Jordan & Associates, Reuters and ADI Analytics

Methanol – up till an import dependent market

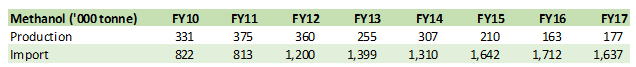

Notwithstanding new usages, methanol as a chemical feedstock has had a domestic consumption of the order of 1.8 million tonne. Of this, 90 percent of the demand was catered to by imports in FY17. However, this is not entirely due to lack of capacity in the domestic market. In fact, domestic manufacturing has an installed capacity of 474,000 which till FY17 was utilized only 37 percent.

This was due unfavourable pricing dynamics for the domestic players and hence imports have doubled in last six years while domestic production had halved.

Table: Domestic methanol production and imports

Source: Ministry of Chemicals and Fertilizers

Government’s plan – 5 million tonne by 2021

Now, the government plans to implement methanol roadmap starting with 20 percent blending program with LPG which can lead to savings of Rs 6,000 crore a year. To implement the roadmap, government targets methanol production of at least 5 million tonne by 2021 which would initially be augmented through existing manufacturers like GNFC, RCF and Assam Petro. Additionally, public sector units like BHEL, Coal India and SAIL are deliberating to produce Methanol though the coal route.

In the listed space, companies to watch out are Deepak Fertilisers and GNFC.

Deepak Fertilisers – Significant utilization improvement

Deepak Fertilisers and GNFC have installed capacity of 100,000 and 238,000 tonne respectively and together constitute 71 percent of domestic capacity.

Deepak Fertilisers (market cap: Rs 1,726 crore), is a diversified chemical company having an exposure to technical ammonium nitrate (TAN, 18.5 percent of FY18 sales), industrial chemicals (51.3 percent) and crop nutrition (30 percent). Last fiscal year, company witnessed good traction in TAN (led by mining revival) and chemicals (improving end markets of dyes, pharma, nitro aromatics).

As far methanol is concerned it constituted a minuscule 3 percent of company’s revenue from manufactured sales in FY18. However, company’s capacity utilization in this space is drastically improving from ~7 percent in FY17 to 44 percent in FY18 and now about 77 percent in Q1 FY19.

Company emphasize that going forward, the emerging application such as methanol blending in fuel may drive demand and result into higher production.

Having said that, key risk to monitor for the company is high raw material cost (ammonia) and interest cost (D/E ratio of 1.6x).

GNFC – Methanol was the key laggard in chemicals, till recently

In case of GNFC (market cap: Rs 5,152 crore), another diversified chemicals company wherein Chemicals (67 percent of FY18 sales) have led ~60 percent growth in profit before tax in FY18. Favorable business dynamics for the TDI business have been the biggest influencer on its profitability in recent quarters.

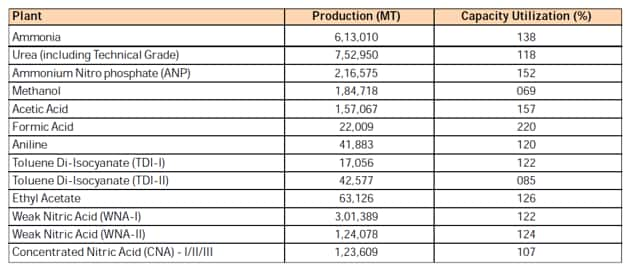

Except for methanol, most of the chemical products from its stable are manufactured at optimum capacity. In fact, in case of methanol as well, production volumes have jumped by 34 percent in FY18 and capacity utilization is expected to improve from here on.

Table: GNFC capacity utilization FY18

Source: Annual report

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.