Highlights

- Tile volume came in higher by 1 percent

- Operating margin declined by 30 bps YoY

- New capacities started production in September 2019- Valuations continue to remain expensive

-------------------------------------------------

Kajaria Ceramics is going through a challenging phase on many fronts. Its September quarter (Q2) results fell short of the crease, given the downward pressure from key factors such as tepid volume growth and drop in realisations.

Results highlights

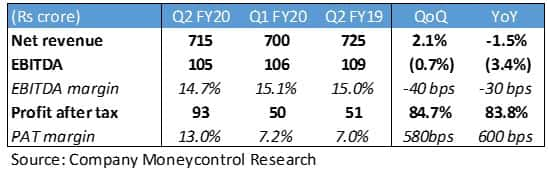

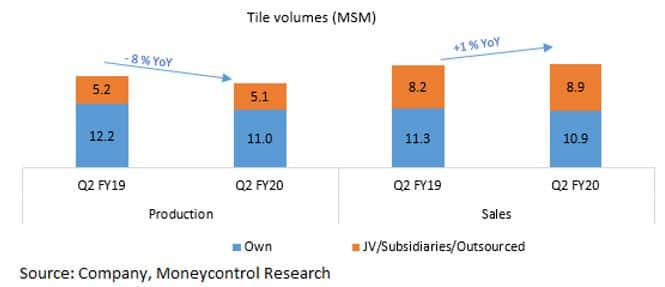

The point to note is Kajaria Ceramics had delivered a solid Q1 amid trying times. However, Q2 numbers turned soft as tile volume came in at 19.8 million square metre (MSM), a growth of just 1 percent year-on-year (YoY).

During the said quarter, the company cut down its tile production by 8 percent YoY. Stress in real estate, increased competitive intensity and lower contribution from outsourcing business resulted in 3 percent decline in realisations. Considering the market headwinds, tile segment revenue contracted 2 percent to Rs 665 crore.

Weak demand and a constrained liquidity environment took a toll on other segments as well. Sanitaryware and faucets shrank in volume in Q2, with sales at Rs 43 crore. However, plywood business displayed another strong quarter on a low base and contributed Rs 8 crore to top line.

Weak demand and a constrained liquidity environment took a toll on other segments as well. Sanitaryware and faucets shrank in volume in Q2, with sales at Rs 43 crore. However, plywood business displayed another strong quarter on a low base and contributed Rs 8 crore to top line.

Gross profit and margin took a hit from an adverse product mix -- a higher share of low-margin products. However, lower power and fuel expenses and cost rationalisation measures offset margin pressure at the operating level. Consolidated earnings before interest, tax, depreciation and amortisation (EBITDA) for July-September stood at Rs 105 crore compared to Rs 109 crore in the same period last year. Income tax reversal boosted bottom line to Rs 93 crore.

In Q2 FY20, the company completed capacity expansion of its tiles and sanitaryware segments. Kajaria’s new 5.0 MSM glazed vitrified tile plant in Andhra Pradesh started commercial production from September 2019. The sanitaryware capacity has been expanded to 7.5 lakh pieces (from 6 lakh pieces earlier) and gives the company enough headroom to double its sales in coming 2-3 years.

Kajaria’s balance sheet remains healthy, despite the deterioration in working capital cycle. The company is debt free, with cash and cash equivalents of Rs 7 crore at the end of September 2019.

The liquidity crunch in the real estate market has deepened and the sector continues to be on edge amid tepid home sales. This has affected the tile industry, which too is feeling the pinch. While the realty market is facing difficult times, the retail sales have been robust and new orders from the government are expected to drive demand for Kajaria. The management is hopeful of a demand recovery in the coming months and expects near double-digit volume growth in the second half of 2019-20.

Outlook and Recommendation

Kajaria’s has the best in class execution in the tile industry and its historical performance reflects the management’s ability to weather macro events and trends. The management team has been able to increase the volumes and stem the decline in margins despite inflationary cost pressures.

The company is dealing well with headwinds affecting its market share and profitability. The competition is stiff, but tight liquidity conditions, shutdown of coal gasifiers at Morbi ceramic cluster, increased tax compliance should pave the way for industry consolidation and reduce competition in the medium to long run.

Despite a sluggish industry backdrop, Kajaria has delivered robust financial performance in recent quarters. The growth prospects appear muted in the near term as the company is facing pressure on top line as well as bottom line.

A quick look at the operational metrics of Kajaria validates it as a solid long-term investment, but the heady valuations (33 times FY20 estimates) factor in a lot of earnings optimism and appear quite stretched from a near-term perspective.

Investors should, therefore, wait for corrections to build positions in the stock as Kajaria enjoys a market leadership position and strong brand recall.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!