Neha DaveMoneycontrol Research

Moneycontrol Research has been quite upbeat about the prospects of paper sector ever since we published our first note on paper sector in May.

Paper companies turned around sharply in FY17 and we expect the momentum to continue in FY19 as well. The Q1 performance of paper companies reaffirms the earnings growth momentum indicating that profitability of the paper companies is on an uptrend.

While writing on JK Paper, we delved further to identify more companies in the paper sector that benefits from an upturn in the sector.

Without having to go much down the list, we found Tamil Nadu Newsprint and Papers (TNPL) as another relatively safer bet in the paper segment.

While many mid to small sized paper companies look interesting, we remain extremely selective considering the fact many players rely heavily on imports and may be adversely impacted by rupee depreciation. TNPL’s performance is also exposed to the volatility of global pulp prices as well as exchange rate for its newly commissioned plant. However, relatively stable and better performance of its older plant is expected to partially negate the impact.

Second largest player

TNPL, 35.32 percent owned by Tamilnadu Government, is the second largest player in the paper sector. Its plant at Kagithapuram in Tamil Nadu is the largest single location paper plant in India with an installed production capacity of 400,000 tonne per annum (tpa) in writing and printing paper (WPP). The company has also set up a new plant near Trichy, with an annual capacity of 200,000 tpa in the value-added coated board segment which commenced production from May 2016.

TNPL also has the manufacturing capability for newsprint. However, due to unfavorable economics of manufacturing newsprint in India , TNPL’s current production consists of writing and printing paper (WPP) and multi-layer double coated paperboard ( MCB).

Strong raw material sourcing capabilities

Let us understand where TNPL stands in terms of input sufficiency - raw material, water and power and its sourcing capabilities.

The three key raw materials used by TNPL are bagasse (45 percent-50 percent), wood (30 percent) and waste paper (20 percent).

Bagasse: TNPL uses bagasse as a key raw material sourced from local sugar mills on barter basis in exchange for coal or steam. Bagasse is relatively cheaper raw material compared to wood or imported pulp. Historically, this has helped TNPL enjoy superior profitability compared to its peer group with an exception of FY18. The prices of bagasse are dependent on sugar cane production in Tamil Nadu and cost of coal, mainly imported. Though TNPL has a long term tie up with several sugar mills for the supply of bagasse, of late it is facing some issues in sourcing bagasse due to reduced sugarcane production in Tamil Nadu. As a result, it is forced to source the same from sugar mills away from its vicinity pushing up the cost.

Wood: TNPL utilises captive plantations for its wood requirements. Additionally, it has long term supply contract to procure wood from the state government entity (Tamil Nadu Forest Plantation Corporation Limited).

Waste Paper: There is higher salience of imports as the recovery rate or the quality of wastepaper in India is quite low.

Diversified sources for procuring of raw materials mitigates raw material availability risks to some extent.

In addition to raw materials mentioned above, availability water and power is imperative for paper production. TNPL enjoys self –sufficiency with regard power requirement through captive power plants.

TNPL's operating margins were among the highest in the industry till FY16 owing to strong efficiencies arising out of backward integration, long-term supply tie-ups and captive power plant. Furthermore, operating from the country's largest single location paper plant gives TNPL significant economies of scale. However, non-availability of water adversely impacted TNPL last year.

FY18 was a wash down year due to non- availability of water

Due to severe water shortage following inadequate rains in TN, TNPL had to stop production in one of the three paper machines in its WPP plant. Also, it had to stop hard wood as well as bagasse pulping to conserve water. It relied mainly on high cost imported pulp and pulp produced from waste paper. Lower capacity utilisation coupled with higher raw material costs had an adverse impact on the financial performance leading to net losses in first two quarters of the FY18.

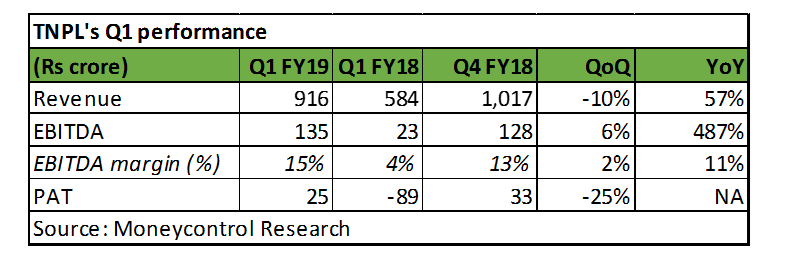

The water situation has improved subsequently and the company resumed operations from July 2017. As a result, the company was back in green in 2HFY18 and reported a strong growth in revenue in Q1FY19 as well. EBITDA margin are nevertheless low at around 15 percent relative to the historical levels of around 21 percent due to higher global pulp prices.

Strong growth in earnings expected

TNPL has sizeable dependence on imported pulp for its MCB unit and hence current margins are low at around 11% in this product line. While capacity utilization levels at the paper board (MCB) unit have been steadily improving, TNPL is also taking measures to improve its realizations through changes in MCB product mix. However, there will be negative impact of rupee depreciation as it depends imports.

Having said that, WPP margins continue to remain healthy at around 20 percent benefiting from strong operational efficiencies and favorable demand-supply scenario. Outlook on the paper sector in general and printing and writing companies in particular is positive.

TNPL's operating performance is expected to improve in FY19 supported by healthy demand for both WPP and MCB from end user industries combined with its efforts to improve profitability. Further, we see significant scope for improvement in EBITDA margins from the current sub-optimal level. We expect it to gradually improve from 11 percent in FY18 to 19 percent by FY20 resulting in strong earnings growth.

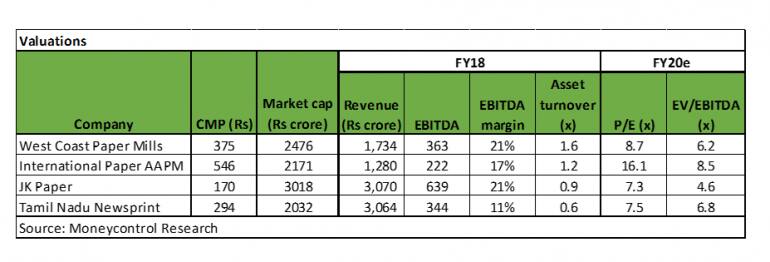

TNPL’s stock is currently trading at 7 times FY20e EV/EBITDA, which is reasonable considering the high earnings growth potential. Sectoral opportunities along with expected margin improvement provides strong earnings visibility and is a good enough reason to buy the stock.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!