Neha DaveMoneycontrol Research

Paper companies posted a sharp turnaround in FY17, with momentum continuing in FY18 as well. Domestic paper demand remained buoyant as closure of stressed domestic capacities led to supply constraints. Reduced raw material and power prices, which form nearly 80 percent of operating cost, have aided profit growth. But can the superior performance sustain?

Positive demand-supply dynamics

India is the fastest growing market for paper globally and is expected to grow above six percent per annum over the next few years. With an estimated domestic turnover of about Rs 50,000 crore currently, it accounts for about three percent of the world’s paper production. This presents an exciting scenario as paper consumption is poised for a big leap forward in sync with economic growth.

In line with rising demand, domestic paper production is expected to increase to 39.7 million tonne (MT) in 2026-27 from 16.7 MT in 2016-17, as per Indian Paper Manufacturer Association (IPMA). In the last five years, the Indian paper sector has invested about Rs 20,000 crore on capacity enhancement, technology upgrade and acquisitions.

The industry has not added any significant capacities over the last three-to-four years following shortage of its key raw material (pulp wood) and rising prices of local waste paper. While demand is expected to strong, we see availability of raw material as a key factor driving new capacities and increase in domestic production. Going forward, given the demand buoyancy, the packaging paper and board segment is expected to witness ramp-up in capacity addition while the printing and writing segment may be relatively slower in adding capacities.

Is rising import a potential threat?

The mismatch between domestic production and consumption is met through imports, which accounted for around 10 percent of paper consumption in India from 2010-11 to 2016. However, there was a sharp 36 percent jump in imports in FY17 over FY16 as per data from the Directorate General of Commercial Intelligence and Statistics (DGCIS). Consequently, an anti-dumping probe into cheap import of ‘uncoated paper’ from Indonesia, Thailand and Singapore has been initiated by the Government as the Directorate General of Anti-Dumping and Allied Duties (DGAD). It found ‘sufficient prima facie evidence’ following complaints from some domestic companies.

Dependency on import for newsprint, however, would continue to exist. More than 50 percent of domestic newsprint demand is met through imports, given the nil customs duty on newsprint imports as per the free trade agreement with Association of Southeast Asian Nations (ASEAN) countries. The total import of paper (mostly newsprint) is expected to increase to 4.3 MT in 2026-27 from about 1 MT in 2010-11, as per IPMA.

Rising imports at predatory prices from surplus countries has been a major concern for local players. In light of this, outcome of the government investigation and any decision on imposition of anti-dumping duty is to be watched closely.

Raw material price has been favourable

The Indian paper industry can be classified into three categories as per their raw material consumption: 1) Wood based; 2) Waste paper based; and 3) Agro based. Input consumption has drastically changed in recent years in favour of waste paper usage due to environmental reasons.

Operating margin of paper companies was in the 13-14 percent range over FY12-15. Margins expanded by about 350 bps to 17 percent at the end of FY17: the highest when compared to the previous six fiscals due to a decline in raw materials (constituting 45-50 percent of net sales) and power costs (about 16 percent of net sales).

Wood: While global pulp prices have been on a rising trajectory in the past five years, decreased dependence on wood along with agroforestry initiatives and higher captive usage of wood has resulted in paper companies being less affected by rising prices. Moreover, the industry has requested the government for a policy to allow access to degraded forest land for paper mills to raise pulp wood plantations to enable sustainable source of raw materials.

Waste paper: Companies using waste paper have higher salience of imports as the recovery rate of waste paper in India is quite low (around 30 percent) due to lack of an effective collection mechanism.

While raw material price volatility is inherent to waste paper importing businesses, performance of these firms have improved significantly in the last six months. China, the largest importer of waste paper globally, announced ban on certain grades of waste paper in July last year, which came into force in January.

This development impacted the paper industry in two ways. First, the price of recycled packaging paper in China increased due to short supply of the raw material: waste paper. Second, the move led to drop in the prices of global waste paper. Indian paper companies using waste paper as input stands to benefit on account of lower global waste paper prices (on excess supply) and higher realisation for recycled paper.

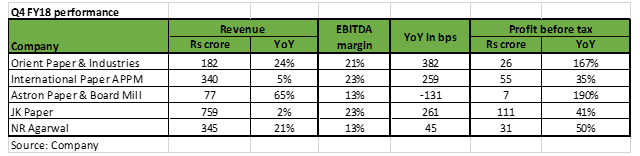

Quarterly performance of key paper companies

Sustained improvement in financials was visible for paper companies that reported earnings so far. This was on the back of positive change in industry dynamics (i.e. demand-supply equation), improvement in operating margin on reduced raw material costs, change in the product mix and expansion in the high margin segment.

Valuation and outlook

The paper industry is characterised by cyclicality on account of input price volatility and capital expenditure plans. The last two years have been favourable as input pressures have eased out, while demand held up well. Outlook on the sector in general and printing and writing companies in particular is positive. As per Crisil, over the next two years, writing and printing paper companies are expected to hold onto their healthy operating margin and generate an operating profit, which will be 33 percent higher than the previous five-year average.

Paper stocks have outperformed on the back of improving financials and strong earnings growth. Valuation re-rating for many paper companies seems to have played out. Sectoral tailwinds provides strong earnings visibility and as a result valuation will be sustained.

Within the sector, JK Paper is well positioned, due to its strong market position with a presence in high quality paper segments, established brand name, wide distribution network, cost leadership and integrated production capacities. Despite operating at full capacity, the company has increased its production volumes, indicating operational efficiencies. Favourable industry factors such as improved supply-demand dynamics and raw material availability in proximity will continue to aid profitability.

Since operating at full capacity, JK Paper plans to increase its capacity to achieve meaningful volume growth. It announced brownfield investment of Rs 1,450 crore for setting up additional capacity of 200,000 tonne per annum of packaging board and pulping facility of up to 160,000 TPA. The company is willing to expand through the inorganic route and is in the process of acquiring Sirpur Paper Mills. Though commercialisation of new capacity addition is likely to take more than 24- 30 months, inorganic growth can be the near-term trigger. With earnings visibility and upside triggers for a valuation re-rating, JK paper is a stock worth considering in the paper segment.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!