Jitendra Kumar Gupta

Moneycontrol Research

Investors fearing permanent loss of capital given the recent heightened market volatility should look at adding some high dividend yield state-run stocks to their portfolio.

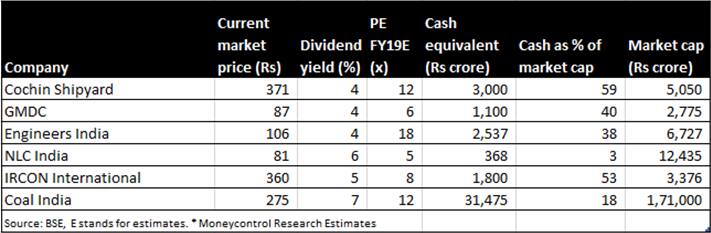

Listed below is six such state-run entities, which are strong businesses and command pole position in the industry. Even if earnings growth is not impressive, these stocks should protect investors against market volatility, considering their high dividend yield and possibility of higher payouts, given the government’s deteriorating fiscal situation. All these entities are debt free, reasonable growth, have low regulatory risks and high core return on equity.

Cochin Shipyard

Among shipyards, Cochin Shipyard has strong execution capability and a superior capital allocation policy. It’s a debt-free company. Adjusting for cash on its books to the tune of Rs 3,000 crore, which is almost equal to its networth and 59 percent of its current market capitalisation, core RoE is much better. The company is sitting on an order book of close to Rs 12,000 crore, or about 6.7 times its sales, providing decent revenue visibility even if one assumes a slight slowdown in defence deliveries. The stock is trading at 12 times FY19 estimated earnings, offering a dividend yield of close to 4 percent.

Gujarat Mineral Development Corporation (GMDC)

State-owned GMDC, which is into lignite mining and power generation, has corrected over 40 percent from its 52-week high. The company is sitting on a net cash of close to Rs 1,100 crore on a mcap of Rs 2,775 crore. Higher realisation, better volume growth in the lignite segment and improvement in the power businesses should ensure higher earnings and cash on its books. At the current market price, the stock is trading at six times its FY19 estimated earnings, offering a dividend yield of 4 percent.

Engineers India

Pick up in hydrocarbon capex in India and globally would bode well for Engineers India. Over the next two years, led by strong order book (Rs 7,800 crore or about four times its annual sales), the company is expected to report 15-17 percent annual earnings. The stock has corrected 45 percent from its 2018 high and currently trades at an attractive dividend yield (4 percent) and 15 times its FY20 estimated earnings.

NLC India

NLC India, formerly known as Neyveli Lignite Corporation, is probably the only state-run entity that has announced a buyback of its shares, indicating extreme confident by the management about future growth. The company is into power generation, generating annual cash flows of about Rs 1,000 crore, which is redeployed to expanding capacity. It recently added about 1,000 mw of new capacity, which will take care of near term growth.

At the current price, the stock offers a dividend yield of close to 6 percent and trades at an attractive valuation of 5 times FY19 estimated earnings.

IRCON International

The recently listed IRCON International, which is into railway projects, is a fast growing public sector enterprise with an order book of close to Rs 22,400 crore, or about 5.6 times its FY18 revenue. At the current market price, the stock is trading at less than 8 times its FY19 estimated earnings, offering a dividend yield close to 5 percent. Valuations are quite attractive, considering growth visibility, cash on the books and high RoE of about 23 percent.

Coal IndiaThe Coal India counter has not corrected much in the recent correction, which is more to do with growth expectations, led by higher realisations and volume growth. Most of its past issues such as evacuation challenges and wages revision are now easing. It’s a debt free company sitting on a cash equivalent of about Rs 31,400 crore. The stock currently trades around 12 times its FY19 estimated earnings, offering a dividend yield of about 7 percent.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!