Ruchi Agrawal

Moneycontrol Research

Highlights:

Hindustan Oil Exploration Company (HOEC) reported a decent expansion in revenue in Q3. However, with changes in royalty payment structure and inventory losses, the margins and profits saw a noticeable sequential contraction during the quarter.

Key positives

-Healthy topline growth during the quarter mostly due to the bi-annual gas price revision implemented for the October 2018 – March 2019 period.

-The production volumes from the major blocks, Dirok and PY1, remained largely stable.

-B80 expansion work is on fast track and is going as per plan. The company expects to start producing from FY20-21 which could possibly be a rerating trigger for the stock

-The company continued to remain debt free despite expansion being undertaken.

Key negatives

-Despite an uptick in the revenue, the quarter saw a quarter-on-quarter (QoQ) cut in the operating and net margins, majorly owing to an increase in certain expenses like royalty payments, and inventory losses.

-Royalty payment has gone up in line with the new royalty payment structure wherein all partners have to bear the share of royalty in the ratio of their participating interest (PI). While this would be an added cost for the company in each subsequent quarter, the net cost would be lower as this royalty amount will now be cost recoverable now, which was not the case earlier.

-With a sharp correction in the global crude prices, there was an inventory loss during the quarter, which ate away a portion of profits. With crude prices now showing signs of little stability, we do not expect this loss in Q4.

-Employee benefit expense ticked up a bit on account bonuses paid to employees post the successful implementation of the PY1 drilling project.

Other observations

-With royalty being paid by all participants and with a cost recovery method, it puts the participants of the projects on an equal footing, which according to the management would enable in fetching higher investments for the project.

-The proposed north east gas grid would help ensure higher stability in offtake for HOEC in times to come. The company is planning a new pipeline to connect the Dirok block to the Duraijan hub, which connects with the Numaligarh hub on the north east grid.

-The operator of the PY3 basin (where HOEC has 21 percent interest) has submitted an application for the extension of the production sharing contract (PSC). The management now sounds more positive on the restart of the unit. While there is still ample scepticism to keep the unit out of estimates, any production from the block would mean incremental revenue and profits.

Outlook

-After successful implementation of project in Dirok and PY1, the company is now focussing on rapid development of the B80 block which is expected to start production from FY20-21. The company is also actively participating in acquiring new blocks which fall close to its developed infrastructure in order to better utilise its investments.

-The new royalty payment structure is expected to bring in added costs for the company in times to come.

-While the natural gas prices would remain at $3.36/mmbtu uptil March 2019, given the softness in natural gas and crude oil prices in the last few months, further upside to the price could be limited.

-HOEC has a debt free balance sheet and plans to fund further expansion through internal cash generation. This would mean a relatively stable position in the current market volatility.

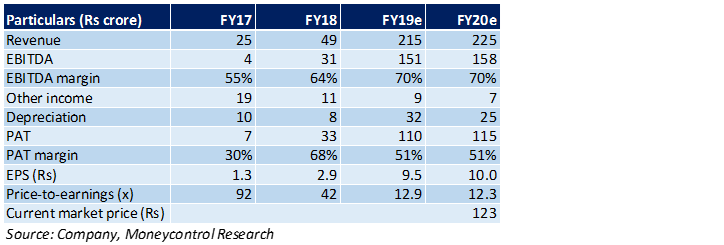

The stock has corrected 25 percent from its 52-week high. It is trading at a FY20e price-to-earnings of 12.3x times. The monetisation plan for the discovered blocks is moving as per plan. With stabilisation of the current production and with incremental volumes in the future, we stay positive on the stock.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.