Krishna Karwa

Moneycontrol Research

Electrical component manufacturers in India have been posting a strong show on the back of government’s emphasis on pan-India electrification and housing, coupled with the commonly talked about GST transition from unorganised entities to organised ones.

Havells India and V-Guard, amongst the industry leaders in this space, have been steady performers. This can be predominantly attributed to their robust fundamentals, clearly defined future strategies, and strong execution capabilities.

Both companies reported a very good set of numbers in the quarter gone by.

Havells India (market cap: Rs 36,461 crore)

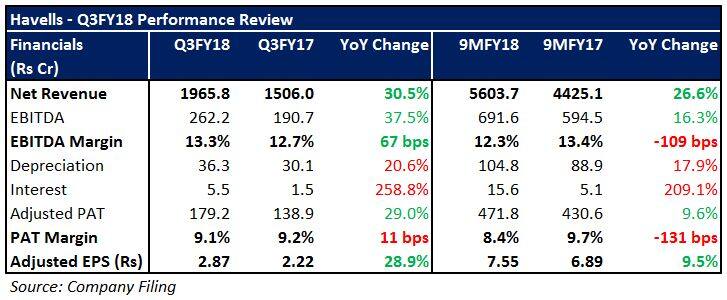

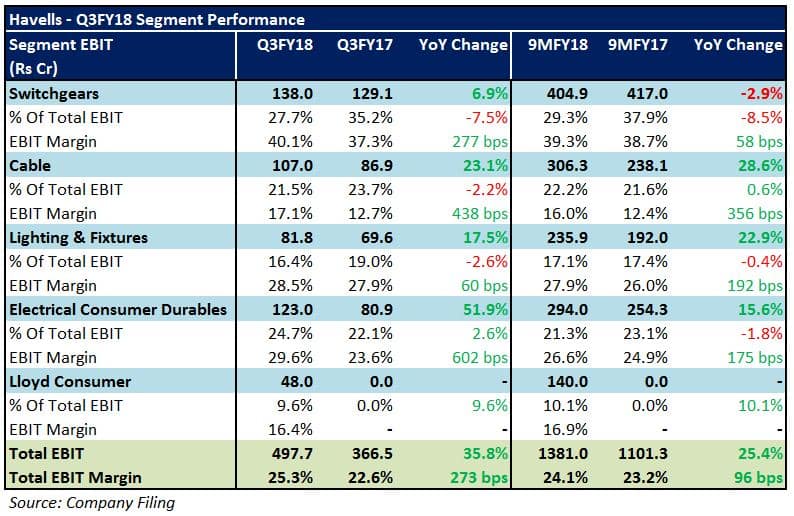

Despite several headwinds during the last few quarters, Havells’ top-line growth was impressive, particularly led by its lighting and electrical goods segments. The margin improvement was on account of discontinuation of some discount-related schemes, price hikes taken (to offset high raw material costs), and lower ad spends.

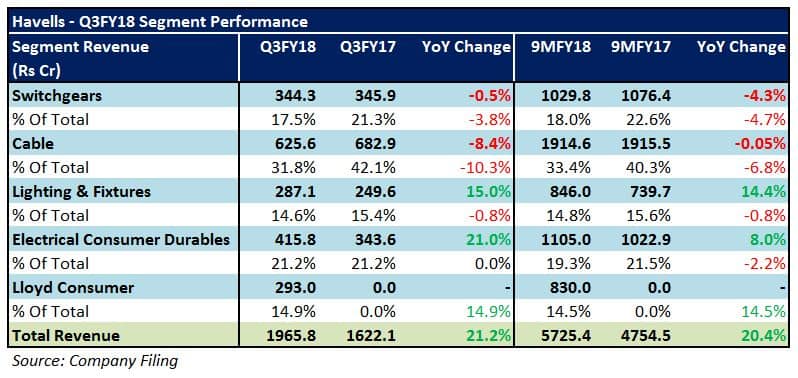

The demand for switchgears remains subdued because of weak construction activity. To arrest margin erosion, Havells intends to change the product mix in favour of high-end variants and focus more on new product launches.

The company’s cable & wires segment grappled with the issue of volume de-growth due to volatility in commodity prices, slowdown in project businesses, and postponement of purchases by consumers in anticipation of a GST rate cut (from 28 percent to 18 percent). A reduced rate may provide a fillip to the underground cable sub-segment from Q4FY18.

Havells’ lighting division sales are estimated to gain traction due to increased demand across the consumer and professional business sub-segments. In a bid to strengthen the order book, the company aims to increase the percentage contribution from the B2B (business to business) customers, which is very minimal at the moment, to 33 percent of the segment’s revenues.

Since 50-60 percent of the sales from the electrical consumer durables segment pertains to fans alone (balance 40 percent pertains to water heaters and other appliances), a demand uptick in the next two quarters (because of hot weather in most parts of India) is likely to boost the performance of this segment.

Going forward, the acquisition of Lloyd’s business will play a pivotal role in Havells’ growth since it gives the company an opportunity to explore under-penetrated categories like ACs, washing machines, and refrigerators (through multi-brand outlets such as Croma and Reliance). Q4, a seasonally strong quarter for such consumer durables, will be the one to watch out for.

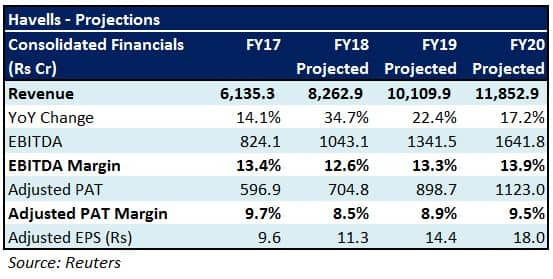

Barring a few bottlenecks in some segments, Havells’ integration across product categories and impetus on branding/premiumisation positions it strongly to achieve economies of scale. At 32x FY20 projected earnings, the stock, despite being priced to perfection, has what it takes to deliver consistent returns given its brand recall and market share.

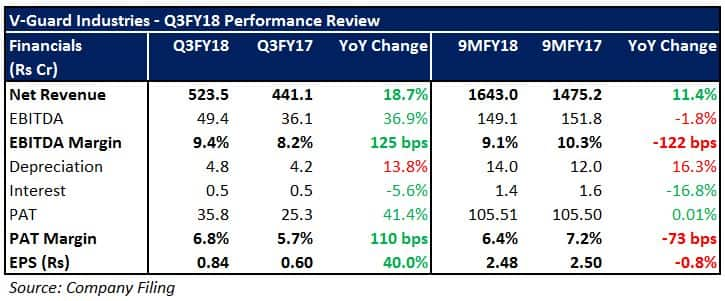

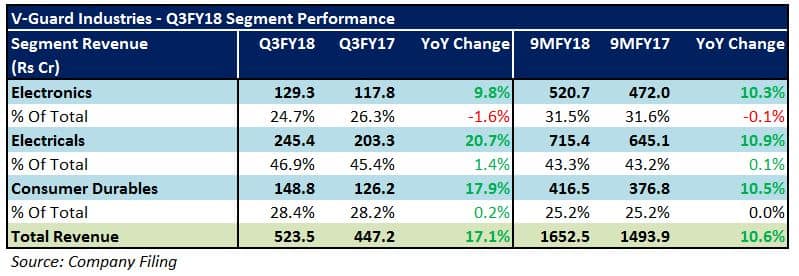

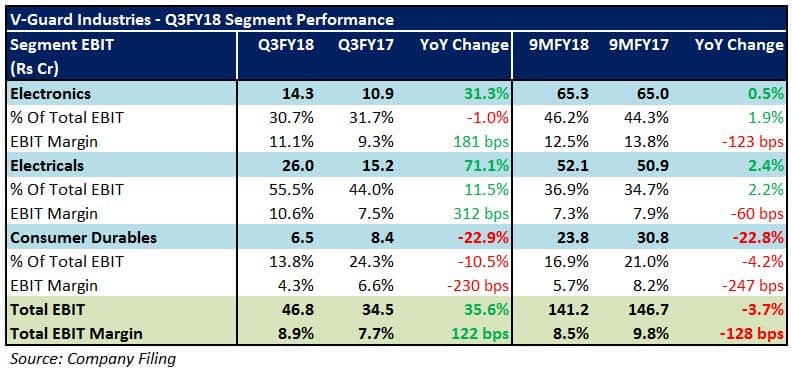

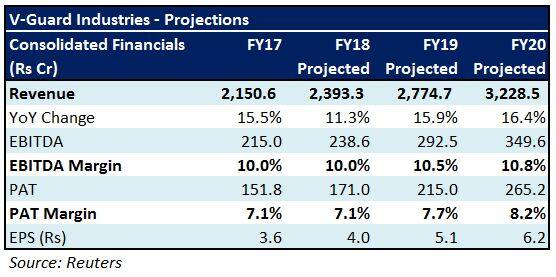

V-Guard Industries (market cap: Rs 10,125 crore)V-Guard reported healthy double-digit turnover growth across categories such as digital UPS, fans, cables and wires, kitchen appliances, and switchgears. On the other hand, sale of stabilisers, water heaters, and pumps was fairly tepid.

Market share gain in non-south markets (grew 25 percent year on year), increased visibility, brand penetration, product portfolio expansion, and accelerated shift towards organised players in southern India were some of the key reasons that led to a good financial performance in Q3FY18.

To cash in on the favourable demand scenario in the upcoming peak season (Q4), V-Guard’s plans to enhance the reach of its brands through higher advertisement and promotional spends. By doing so, the company will reposition itself as a pan-India multi-product player in the consumer electricals space.

V-Guard introduced rice cookers in the markets of Andhra Pradesh and Telangana, whereas modular switches (an extension of wire accessories and switchgear) were launched in Kerala. These will strengthen the company’s stronghold in its core region (south) and lead to incremental revenue from the fast-growing consumer durables and electricals segments.

In terms of network augmentation, V-Guard’s blueprint includes adding 15,000 retailers across India over the next five years, most of which will be in the non-South regions. The possibility of setting up an omnichannel is also under consideration. These measures may enable the company to achieve a 15 percent CAGR growth over the next 2-3 years.

To diversify geographical risks, V-Guard envisages increasing the contribution of non-south markets to total operating income from 40 percent at present to 50 percent or more over the next five years. A significant chunk of this growth will be achieved through brown goods (kitchen appliances) and high-quality switches.

V-Guard has all the building blocks to benefit from accelerated formalisation of the economy and a series of brand-building steps taken by it. The company is open to pursuing inorganic growth opportunities as well. Nonetheless, at 38x FY20 projected earnings, the stock leaves no valuation comfort for a prospective investor. Accumulation on corrections is recommended.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.