Madhuchanda Dey

Moneycontrol Research

Does the government want higher or lower interest rates? Both, it seems. On the one hand, it has been busy trying to get the banks to lower interest rates on loans. On the other, it has increased interest rates on the Employees’ Provident Fund.

Another sop for the middle class

The Employees Provident Fund Organisation (EPFO) has raised interest rate on deposits for its 60 million subscribers by 10 basis points (100 bps=1 percentage point) to 8.65 percent for FY19 .

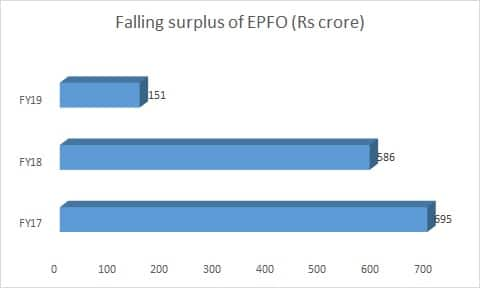

This pre-poll gesture should gladden the hearts of the middle class subscribers of EPFO. But it sends conflicting signals on interest rates and also leaves EPFO with a paltry surplus at a time when the investment climate looks shaky and unstable.

Source: Moneycontrol Research

This is especially worrying as EPFO has investments in Infrastructure Leasing & Financial Services (IL&FS), where most lenders are staring at a haircut.

Also see: Does interest rate increase make EPF an attractive investment option?

This contradicts its stance on interest rates

In view of falling inflation, the Reserve Bank of India (RBI) at its February policy meeting reduced the repo rate by 25 bps to 6.25 percent. The government is keen to ensure that the rate cut is passed on to borrowers and is taking up the matter with bankers.

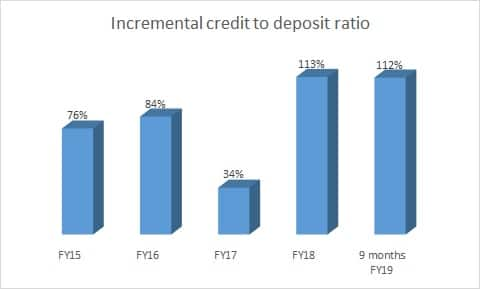

However, bankers are finding it difficult to pass on lower policy rates on account of a higher burden of provisioning and stickiness on costs, with incremental deposit growth lagging credit growth.

Source: RBI

Moreover, the share of demand deposits to total deposits, which was hovering around 12 percent in FY17 and FY18, has declined to 10 percent currently and this has made raising money costly. A higher rate in an alternative savings instrument such as the provident fund could make the task of lowering deposit rates even more challenging.

With an EPF rate hike, the government is communicating to savers that rates are firming up. But with a policy rate cut and asking bankers to transmit the same, it is signalling lower rates.

Politics trump economicsDoes it show the government is confused? Not really---this is just another instance of politics trumping good economics.

Such grand contradictions may send a political message but are rarely welcomed by financial markets.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!