Jitendra Kumar GuptaMoneycontrol Research

The opportunities in the defence sector could be meaningful should they materialise. Riding on this prospect, a string of defence companies have recently come out with an IPO.

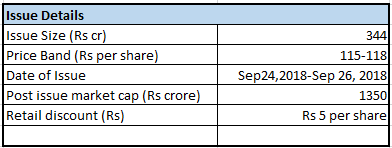

Garden Reach Shipbuilders & Engineers (GRSE) is one of them, hitting the primary market with an IPO, where government is making an offer for sale of about 2.92 crore shares (25.5 percent) at a price band of Rs 115-118 per share. At the upper band, the post-issue market capitalisation works out to Rs 1,351 crore.

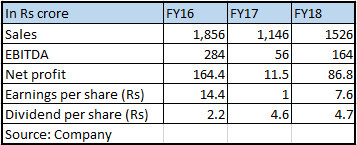

While the business has some merits, given the slowdown in the defence space, past performance of the company and the premium valuations (15 times FY18 earnings) the risk-reward looks tilted. Peers like Bharat Electronics, Hindustan Aeronautics, Cochin Shipyard are trading at about 10-13 times their FY18 earnings.

Growth visibility

GRSE, incorporated in 1965, has vast experience in the shipbuilding space having delivered about 97 ships, largely for defence requirements. However, of late, its deliveries have been delayed.

Today, the company is sitting on an order book of close to Rs 20,300 crore, which is about 15 times its FY18 revenues. This provides strong revenue visibility.

The company is counting on faster deliveries. Of the delayed lot, the company is expecting 10 high-value ships to get delivered over the next 18 months. If this materialises, it could substantially increase sales and profitability of the company. That apart, it is also expanding its current capacity of about 20 warships to about 24 warships.

With the increasing capacity, it will be able to convert orders into revenue. The company also plans to tap the international markets. It is also planning to get into the ship repair business. This partly explains why it is seeking slightly higher valuations.

A diversified portfolio

Barring volatility in growth, which is given for any shipbuilder, particularly in the defence space, the important thing is that GRSE has diversified over the years. While over 90 percent of its revenues come from defence, other segments could also provide higher revenue growth and contribute to the overall profitability.

Garden Reach has steel bridge fabrication facilities and has delivered over 5000 bridges to the army and other civil requirements. These are specialised services where GRSE commands 60 percent of the market shares. During FY18, the company supplied 67 portable bridges and it’s a growing market with the company having a technical edge.

The other important segment is engineering equipments, used in onboard deployment of a warship like deck machineries, helicopter traversing systems, anchors, boat davits and many others. Besides, Garden Reach is also a diesel engine manufacturer, which finds applications in shipbuilding and other industries. Under this segment, it has entered into an MOU to develop next-generation marine diesel engines.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.