The FMCG sector was among the worst impacted by GST transition. However, Q2 results indicate that a broad-based volume growth, partly fueled by restocking, is underway. Further, FMCG companies are focusing on refining distribution strategy, new product launches amidst higher competitive intensity, which makes it an interesting space to look at.

Restocking led volume growth

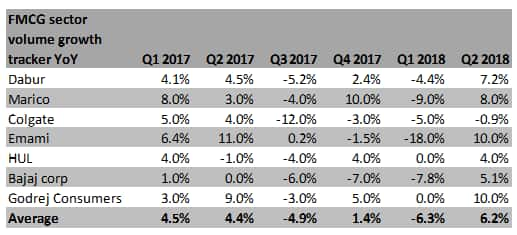

While Q1 2018 was impacted by severe destocking in the trade channel due to GST, Q2 2018 witnessed a sharp recovery partly led by restocking and festive season demand recovery. Average volume growth in Q2 2018 has been 6.2 percent YoY (vs. -6.3 percent in Q1 2018) led by Emami, Godrej consumers, Marico and Dabur.

Volume pick-up in rural areas was similar to that seen for urban areas. Most of the pricing action was with respect to passing on the GST rate benefits to consumers.

Headwinds in international businesses are stabilizing and improved demand is expected in H2 2018.

Further, there was a pick-up in new product launches backed by a sequential increase in advertising spending. Having said that competitive intensity remains elevated for the sector.

Trade channels – in transitionPost GST, trade channels are still grappling with the nuances of adapting to GST network. While most of GST registrations has happened at dealers’ level, normalization in inventory level in wholesale channel is still short of long-term averages (~70-75 percent). Most of these firms expect the wholesale channel to normalise by the Q4 2018 with the possibility that a relatively lower inventory level becomes a new normal.

There is higher emphasis on increasing the trade share of modern retail trade, direct reach. Sales though CSD (canteen stores department) remained weak for most of the FMCG firms. While a few of the firms witnessed a pickup in orderflows from the CSD channel there is a possible structural change due to government regulation.

Quicker adoption of e-commerce and higher media spend in that direction is another trend which has picked up. For instance, e-commerce contributes about 2-3 percent of Dabur’s domestic sales and expected to inch higher as it collaborates with Amazon.

Competition intensifies in few segments

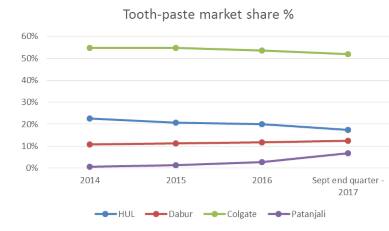

A few segments like oral care and hair oil continue to witness heightened competitive intensity. In oral care, Colgate continues to see de-growth in volume and resultant erosion in market share. HUL has similarly lost its market share due to the popularity of Patanjali’s Dant Kanti brand. Dabur, however, has been able to improve its share guided by presence in South India, new product launches.

Having said that this segment is witnessing an influx of new products and ad spend particularly in the naturals/ayurvedic category- Vedshakti (Colgate), Lever Ayush (HUL), Red Gel (Dabur).

In the hair care category, Bajaj corp and Marico have reportedly sustained their market share in the sub categories they are operating. However, most of the market research surveys don’t account for offtake from Patanjali’s own store and so a disrupting impact due to competition from Patanjali doesn’t get measured. At the same time, competition is getting intense for the basic versions and smaller SKUs of the hair oils wherein pricing by some of the manufacturers are aggressive. So that’s another space to watch for particularly when raw material costs have also surged recently.

Outlook and stock picksIn H2 2018, volume growth is expected to be in high single-digits to low double digit partly aided by a low base effect (particularly Q3 2017), rural recovery and new product launches. Among stock picks, we remain positive on JHS Svendgaard which benefits from improving business fundamentals of its key clients (Dabur, Patanjali). We are also positive on Emami and Dabur. While Emami is expected to post double-digit volume growth in H2, Dabur benefits from superior distribution strategy and product positioning.

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.