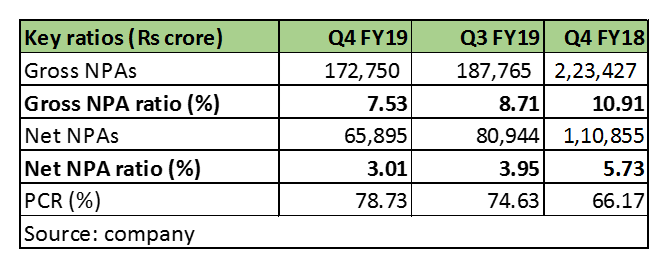

State Bank of India (SBI) reported a standalone net profit of Rs 838 crore for the quarter-ended March 2019, much below the street’s expectation due to a spike in loan loss provisions. Consequently, the provision coverage ratio (PCR) improved to a healthy 79 percent, increasing 12.6 percent year-on-year and 4.1 percent sequentially. So, while the profit & loss statement bled, its balance sheet strengthened.

On the asset quality front, slippages to non-performing assets (NPA) was contained at Rs 7,500 crore, which was encouraging. Corporate slippages came in at Rs 2,284 crore, of which Rs 1,220 crore was from its exposure to Jet Airways.

Limited slippages, higher recoveries and provisions led to substantial decline in gross and net NPA ratio to 7.53 percent and 3.01 percent, respectively, as at March-end.

Advances grew 12 percent YoY as strong domestic loan book growth at 14 percent was partially negated by a flat overseas loan book. The proportion of overseas loans in overall loans stood at 13 percent as at March-end.

Performance on liability front continued to be impressive, with low-cost current account-savings account (CASA) deposits at around 46 percent of total deposits.

In other operating metrics, the bank reported a small uptick in net interest margin (NIM) to 2.95 percent in Q4.

PCR on corporates undergoing resolution through the National Companies Law Tribunal (NCLTL) list 1 and 2 stood at 99 percent and 87 percent, respectively, as at March-end. Resolution of NCLT cases will lead to lower GNPAs and better margins.

It could also lead to possible write-back of provisions as the bank’s PCR on these cases is healthy. For instance, the management is expecting a provision write-back of Rs 16,000 crore from resolution of three accounts from list 1 (Essar Steel, Alok Industries and Bhushan Steel & Power).

SBI’s Tier 1 capital adequacy stood at 9.62 percent as of March-end. Hence, the bank will likely raise capital through a qualified institutional placement (QIP). It is also considering divesting stake in some of its profitable subsidiaries (general insurance and cards business) through an initial public offer (IPO), which can also add to its capital position buffer.

The management sounded confident of delivering return on asset (RoA) of a percent in FY20. While the earnings looks muted, its future outlook is improving on receding asset quality issues.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.