Ruchi Agrawal

Moneycontrol Research

Owing to numerous geopolitical factors, crude prices went up steadily during the June quarter, and remained steady between $70 and $79 per barrel.

This uptick favoured upstream oil companies, whose realisations improved as a result. A parallel upward revision in gas prices ensured higher realisations for gas upstream companies as well.

While a rise in crude prices is good for these companies' revenues, it also exposes them to a risk of sharing subsidy with the government in prices rise further.

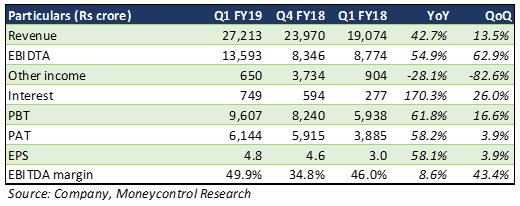

ONGC

Thanks to higher crude prices, ONGC reported a 43 percent year-on-year rise in realisations for the June quarter. The company's EBITDA margin expanded by a healthy 390 basis points.

After the acquisition of Hindustan Petroleum Corporation, which consumed a substantial portion of ONGC's surplus cash, its other income came in lower than in the same quarter last year.

Also, the debt that the company had to take onto its books for the deal ensured that its interest outgo also rose substantially in the quarter under review.

A rise in other expenses to the tune of around Rs 90 crore because of fluctuations in foreign exchange rates also ate into the company's profitability.

ONGC's oil production for the quarter, at 6.2 million tonnes, was 4 percent lower YoY and nearly unchanged on sequentially. Its gas production, at 6.2 billion cubic metres, was up 3 percent YoY and 2 percent sequentially.

With several new projects starting up around H2FY19, the ONGC management remained confident of ending the year with positive growth in oil production.

It also indicated that at the prevalent crude price levels, no subsidy burden is expected to come ONGC's way in FY19, which is a relief. However, investors need to stay cautious in a buoyant oil price environment.

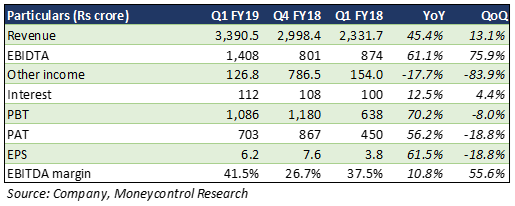

Oil India

Oil India reported a 45 percent YoY rise in revenue and a 61 percent YoY increase in EBITDA, primarily because of higher realisations.

The benefit of higher realisations was partially offset by higher other expenses (including a Rs 10 crore charge on account of forex loss), which rose 64 percent on year.

Lower other income coupled with higher interest and tax cost ate away at Oil India's net profit. The company's net profit margin expanded 400 basis points on year.

The company's production remained largely muted, which we see as a concern in coming months. Oil sale volumes were down 0.9 percent YoY to 0.81 million tonnes and gas sale volumes were largely flat at 0.6 billion cubic metres.

Outlook

After correcting 18 percent and 19 percent, respectively, from their 52-week highs, shares of ONGC and Oil India are now trading at multiples of 7.1 times and and 7.3 times their estimated earnings for 2019.

Given the overall momentum in crude oil prices, we expect both companies to be comfortable as far as revenue is concerned.

While oil volumes are expected to remain more or less flat, owing to the increased stress on cleaner fuels, with the uptrend of crude prices we expect improved realisations and a rise in volumes of gas. The parallel price rise in gas should have rub-off positively on overall realisations.

However, we advise investors to keep their eyes open for a situation in which crude prices rise further, increasing the subsidy sharing burden for companies like ONGC.

We see a steady topline for both Oil India and ONGC and recommend to keep both companies on the radar. At current levels, we see ONGC as a good pick to include in the portfolio. However, we would be looking for a better entry point for Oil India.Follow @Ruchiagrawal

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.