Highlights

Channel stocking in anticipation of summer demand

Channel stocking in anticipation of summer demand

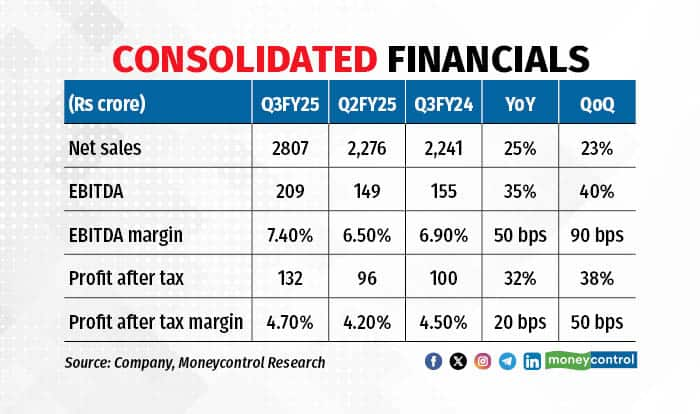

The Unitary Cooling Products (UCP) segment of Blue Star delivered an impressive revenue growth of 22 percent YoY in Q3, primarily driven by strong festive demand and dealer stocking in anticipation of the summer season. Demand for room air conditioners (RACs) significantly contributed to this growth during a typically slower period. Inventory levels in the trade channel remain low and dealers are stocking up in preparation for the summer demand. Blue Star's RAC market share improved to 14 percent, with the company aiming to reach 15 percent over the next two years, while maintaining an operating margin of 8.5 percent. The EBIT margin expanded by 100 basis points in Q3, driven by scale benefits from the growth in RAC sales.

The commercial refrigeration segment, which includes deep freezers, water coolers, and modular cold rooms, faced setbacks due to new regulatory requirements and delays in ramping up deep freezer production. Fortunately, regulatory challenges related to water coolers and deep freezers have been resolved, positioning Blue Star well for the upcoming summer season. Demand for modular cold rooms is particularly strong, especially from the quick commerce and food delivery sectors. Additionally, the VISI cooler market is experiencing an uptick as retailers upgrade their stores. Despite some delays in ramping up production of a new range of advanced glass-top deep freezers, Blue Star maintains its leadership position in deep freezers with a market share of 28 percent.

The Electro-Mechanical Projects (EMP) segment of Blue Star experienced a robust growth of 32 percent YoY, primarily driven by strong demand from the manufacturing and data centre sectors. Additionally, there was an increase in inquiries from healthcare and retail industries, indicating a broadening of the customer base. However, the company noted muted demand from the commercial real estate and infrastructure segments, which could pose challenges in those areas. Despite this, the growing order book, which stood at over Rs 5,146 crore as of December 2024 — a 10.7 percent YoY increase — provides solid revenue visibility for the next 12-18 months.

Commercial Air Conditioning experienced heightened demand from the education, healthcare, and retail sectors. However, the company is facing liquidity challenges in certain sectors, leading to delays in the finalisation of process orders. This situation may result in volatility in the profitability of the business, particularly due to the adverse effects of exchange rate fluctuations and movements in material costs.

Despite these challenges, demand from Tier 3 and Tier 4 cities remained strong, with significant orders for chillers and Variable Refrigerant Flow (VRF) systems coming from these markets. Blue Star has successfully maintained its leadership position in ducted systems, ranking as the number one provider, while also holding the number two spot in the VRF and chillers segments.

Revenue from the Professional Electronics and Industrial Systems segment declined by 22 percent YoY in Q3. During this quarter, while the Industrial Solution business continues to demonstrate momentum and growth, both the Med-Tech and Data Security businesses have experienced muted performance. The operating cycles in these sectors have yet to recover, which is adversely affecting order inflows.

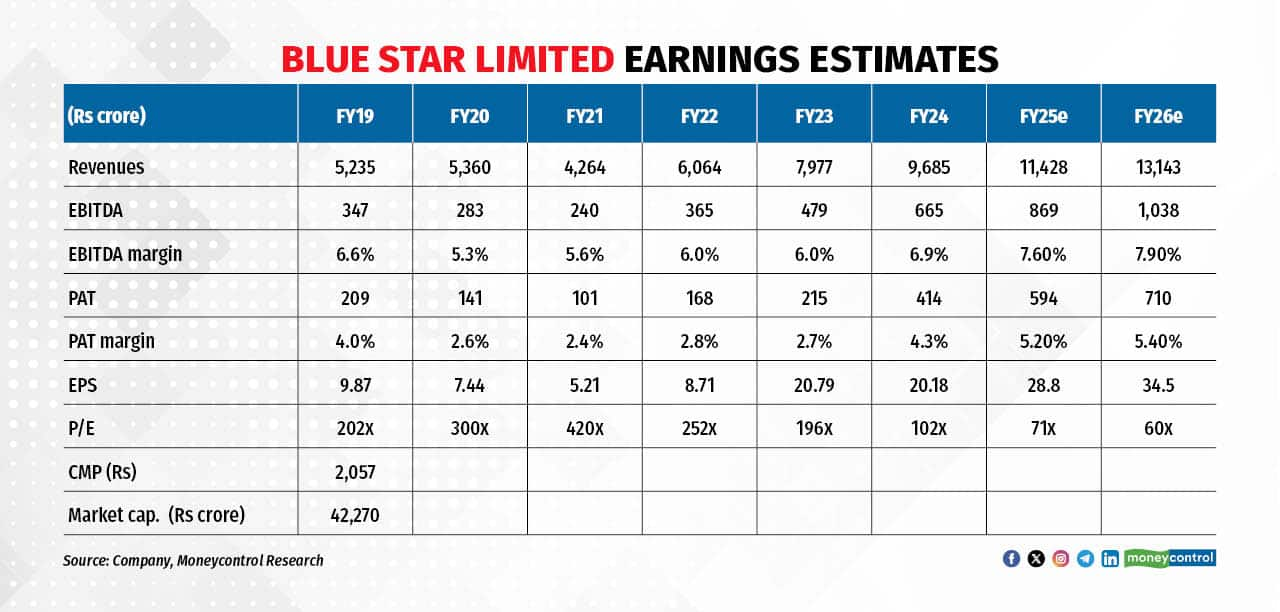

Outlook & Valuation

The upcoming quarter is expected to benefit from several key drivers, including the onset of the summer season, a potential revival in government spending, and accelerated capex by the private sector. We anticipate robust performances in the EMP and UCP segments, supported by the ongoing cost optimisation efforts and improved operating leverage, which should enhance profitability. However, it is important to note that the current valuation multiple of 60 times the estimated earnings for FY26 already incorporates many of these positive factors. As a result, prospective investors may want to consider waiting for a price correction before initiating new positions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.