Anubhav Sahu

Moneycontrol Research

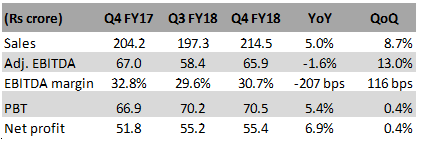

Bajaj Corp’s Q4 FY18 result underlined improving offtake in rural areas, turnaround in Canteen Stores Department trade channel and challenges of rising raw material cost.

Healthy like-for-like growth

The company's Q4 sales grew 10.12 percent year-on-year (YoY) at Rs 204 crore. The stated net sales figures are not comparable as the quarter under review witnessed an 18 percent deduction on account of the Goods & Service Tax while the same for the corresponding quarter of last year witnessed a deduction of around 14 percent on account of value added tax (VAT).

Result snapshot

Source: Company, Moneycontrol Research

EBITDA margins remained healthy at 30.7 percent despite a steep rise in employee (31 percent YoY) and raw material cost (eight percent) on account of operational efficiency. While a 40 percent YoY increase in crude oil impacted a large part of the operational cost (freight, Light Liquid Paraffin, plastic packaging), the management's purchase policy for LLP and value engineering initiatives (lost cost glass bottles) helped it cushion the cost inflation impact.

Sequentially, net profit growth was subdued. However, investors need to bear in mind that in Q3 the management gained from a GST refund of Rs 10.25 crore.

Volume growth picks up but on a low base

Overall topline growth was driven by a 6.9 percent YoY volume growth in flagship Almond Drop Fair Oil and traction in rural demand. Volume growth in FY18 moderated two percent YoY.

Source: Company, Moneycontrol research

Source: Company, Moneycontrol research

In the light hair oil segment, the company witnessed market share gain of 120 bps (62.2 percent YoY ) in Almond Drop Hair Oil in the quarter gone by.

Industry shift towards amla based value added hair oil

The management said that unlike earlier years when the shift to premium segment was from coconut based oils to light hair oil, the same now is due to a value proposition shift towards Amla based hair oil.

In fact, the company’s own value-added variant of amla oil - Brahmi Amla, witnessed a volume increase of 38 percent YoY, though sequentially it declined 18 percent.

Raw material prices are the key concern

Sharp increase in raw material prices, mainly that of LLP, remains a concern. Adjusted for input tax credit, LLP prices have risen by 17 percent YoY. The company did increase prices in higher stock keeping units (SKUs) of Almond Hair Oil in April but guided for largely maintaining the price levels throughout the year.

Moves towards diversification; Nomarks cream fares well

The company's move to diversify and gain better traction for the skin care product - Nomarks - is commendable. There has been 42 percent YoY increase in sales in the quarter gone by. Value growth of 30.1 percent QoQ has been much ahead of the anti-marks category growth.

Robust performance across trade channels

Growth has been positive for all trade channels led by modern trade (24 percent YoY). CSD has also seen a turnaround with a 5.6 percent YoY growth. However, its international business remains a laggard (down 33 percent YoY). The management expects this to continue for a quarter or so before witnessing some stabilisation.

Positives for the company from the earnings result includes growth revival in rural areas, improved market share in its flagship product and improving distribution reach. The company faces challenges from changing hair oil industry dynamics which includes competition from low cost manufacturers and shift towards amla hair oil. In this context, the management’s Mission 2020 plan to become a complete FMCG company by launching a new product every quarter becomes even more critical.

Similarly, the company’s search for an inorganic opportunity is also equally important. A strategic fit in that case, aiding portfolio expansion while lowering business risk, could trigger a re-rating.

Bajaj Corp is currently trading at 30.4 times FY19e earnings which is towards the lower end of the FMCG sector valuation range. However, moderate scope for growth in the current business model keeps us neutral on the stock.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.