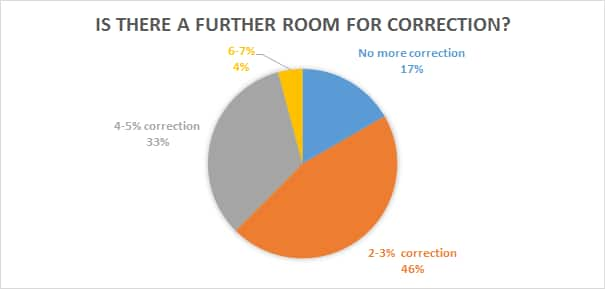

The Nifty50 which witnessed a sharp cut of 3.5 percent earlier in the month of August could see another 2-3 percent cut till December 2017 which long term investors can use as an opportunity to dig into quality stocks, a Moneycontrol Poll showed.

The Nifty could correct by at least 2-3 percent by December, said a majority in an Moneycontrol poll of 25 leading CIO, fund managers as well research heads and brokers conducted over this week.

But, despite high valuations, most analysts polled by Moneycontrol are of the view that it is the right time to pick stocks. Hence, investors should not delay their shopping thinking markets have hit an intermediate top.

The poll showed 84 percent of the participants see now is the best time to dive into quality stocks while the rest, 16 percent feel investors should avoid shopping at current levels.

“Markets are little above fair valuation. But, it is looking at future with hope. There is some amount of euphoria in penny stocks and few other companies but the broad market looks fair,” Nilesh Shah, MD, Kotak AMC told Moneycontrol.

“It doesn’t mean that there will be no correction in near term. It just means that there are opportunities for long term investor in the market with a disciplined stock picking,” he said.

The S&P BSE Sensex which has rallied by about 18 percent s0 far in the year 2017 is well poised to hit fresh record highs in the rest of the year 2017.

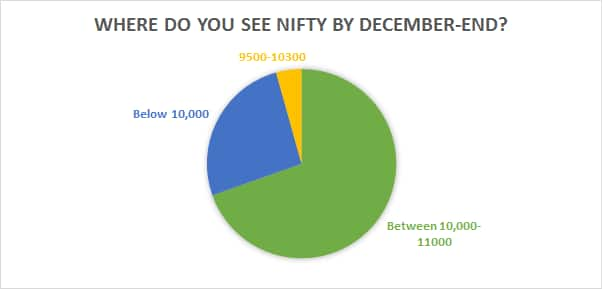

The Nifty50 which hit a record high of 10,137 earlier in the month of August could make an attempt to touch Mount 11K by December-end, showed the poll.

About 70 percent of the poll respondents see Nifty hovering in the range of 10,000-11,000 while 30 percent see it slipping below 10,000.

With respect to Sensex, about 70 percent of the poll respondents see Sensex comfortably trading above 32000 while 25 percent feel that the index could trade between 30,000-31,000. However, only 1 respondent has a slightly bullish outlook which stretched beyond 34000 on Sensex.

“The correction in the near-term is over, and the next course will depend on the performance of the global market. In the last 1 to 2 years developed markets were doing well due to improvement in their economies,” Vinod Nair, Head of Research, Geojit Financial Services Ltd

“Recently, the global market was impacted by US - N. Korea geopolitical issue. But, there is a rational view that this issue is unlikely to be extended. More than that, a point to ponder over the next 2 to 4 quarter will come regarding the exaggerated positive impact of Trump on the US and global market,” he said.

Earnings Revival:

The June quarter earnings have not been exciting but analysts polled by Moneycontrol are of the view that earnings revival could happen by December quarter.

According to data compiled from Capitaline, June quarter net sales growth of 1,671 BSE-listed companies slipped to a three-quarter low of 4.51 percent.

The net profit growth after adjusting for one-time items fell to a six-quarter low. It fell 3.89 percent in June, compared with a year ago, said the report.

Almost 61 percent of the poll respondents see Nifty earnings revival by December quarter while 26 percent feel that it could happen by March quarter while 9 percent of the respondent see it happening as early as September.

“The market may take a breather and consolidate in the 9500-10000 Nifty range and wait for visibility of expected earnings acceleration to flow through in H2 FY18. Euphoria is seen in the primary markets while the secondary markets are governed by fear of correction rather than euphoria,” Shashank Khade, Director, and Co-Founder @ Entrust Family Office Investment Advisors told Moneycontrol.

“Valuations are a concern in secondary markets, but ironically risk to capital in IPO stocks is not being looked at. Given the liquidity in abundance, the markets may choose to correct time wise rather than price wise and disappoint investors seeking to make a quick buck assuming a linear progression. Having said that, we feel markets always tend to present an uncanny surprise,” he said.

Poll Respondents

Nilesh Shah, MD, Kotak AMC

Nitasha Shankar, Senior Vice President and Head of Research, YES Securities (India) Ltd

Sagar Doshi – Technical Analyst, Edelweiss Broking Ltd

Ajay Bodke, CEO & Chief Portfolio Manager (PMS) at Prabhudas Lilladher Pvt. Ltd.

S.Krishna Kumar, CIO-Equity, Sundaram Mutual

Pankaj Tibrewal, Fund Manager- Equity, Kotak Mutual Fund.

A.K.Prabhakar, Head -Research at IDBI Capital

Shashank Khade, Director, and Co-Founder @ Entrust Family Office Investment Advisors.

Mustafa Nadeem, CEO, Epic Research

Vinod Nair, Head of Research, Geojit Financial Services Ltd

Hitesh Agrawal, EVP & Head – Retail Research, Religare Securities

Rahul Shah - Group Advisory Leader - PCG, Motilal Oswal Securities Ltd

Siddhartha Khemka – Head Equity Research (Wealth), Centrum Broking Limited

Arpit Jain, AVP at Arihant Capital Markets.

VK Sharma, Head - PCG(Private Client Group), HDFC Securities

Sanjeev Jain, AVP - Equity Research at Ashika Stock Broking Ltd

Jaikishan Parmar, Sr. Equity Research Analyst, Angel Broking Pvt Ltd

Pankaj Pandey, Head-Research, ICICI Direct

Alok Ranjan, Head of Research, Way2Wealth Brokers Pvt. Ltd.

Pushkaraj Sham Kanitkar, AVP - Technical Research at GEPL Capital

Ritesh Ashar – Chief Strategy Officer, KIFS Trade Capital.

Siddharth Sedani, Vice President - Equity Advisory at Anand Rathi

Vijay Singhania, Founder-Director, Trade Smart Online,

Jimeet Modi, CEO, SAMCO Securities

D K Aggarwal, Chairman, and MD, SMC Investments and Advisors Ltd

Dinesh Rohira, Founder & CEO, 5nance.com

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.