Taking Stock | Sensex rises 346 points, Nifty around 17,100; mid, smallcaps outshine

Among sectors, auto, FMCG, PSU Bank, capital goods, realty and metal indices up 1-3 percent.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 83,216.28 | -94.73 | -0.11% |

| Nifty 50 | 25,492.30 | -17.40 | -0.07% |

| Nifty Bank | 57,876.80 | 322.55 | +0.56% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Shriram Finance | 816.35 | 23.85 | +3.01% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Bharti Airtel | 2,001.20 | -93.70 | -4.47% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10426.80 | 144.90 | +1.41% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Infra | 9393.60 | -95.20 | -1.00% |

Despite some hiccups, markets staged a smart rebound as investors placed bullish bets on the day of current month derivative expiry. Although there is no major change in global market sentiment, foreign investors turning net buyers of domestic equities in recent sessions has helped improve the overall mood.

Technically, after the breakout of the 17,050 range, the positive momentum intensified. A promising reversal formation and long bullish candle on daily charts is indicating further uptrend from the current levels.

For the bulls, 17,000 would act as a trend decider level and above the same, the index could move up to 17,200-17,250. On the flip side, below 17,000 the uptrend would be vulnerable.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Nifty medium setup remains positive with buying on dips advisable. For the short term as well, we are currently seeing weekly support placed at 16,800 levels - on the higher side 17,500/17,700 is expected.

Expect some further consolidation before the index witnesses a direction move. Energy and Banking stocks look attractive while underperformance is seen in the auto and BFSI space.

Nifty witnessed a trending day of trade today. It opened on a positive note and continued to inch higher throughout the day to close the day on a strong note up ~130 points. On the daily charts, we can observe that the narrow range of the previous couple of trading sessions has been broken on the upside. Indicating resumption of up move after a brief pause.

The daily and hourly momentum indicator has a positive crossover which is a buy signal. Thus, both price and momentum indicator is suggesting continuation of the positive momentum over the next few trading sessions.

On the upside initial resistance is placed at 17,207 and beyond that it can stretch higher till 17,500 levels. The crucial support zone is placed at 16,940 - 16,910.

JSW Energy shares ended at Rs 237.10, up Rs 14.90, or 6.71 percent on the BSE.

The home market is being impelled to stay non-sticky in both directions by the continuous instability in the international market. The domestic market's favourable ending was supported by a significant upswing in both the US and European markets.

This volatility is expected to continue until the global banking system gets fully recovered from the turmoil, along with a confirmation of the Fed's decision to pause rate hikes.

Indian rupee ended 16 paise lower at 82.35 per dollar against previous close of 82.19.

Benchmark indices ended higher on March 29 with Nifty around 17,100.

At close, the Sensex was up 346.37 points or 0.60% at 57,960.09, and the Nifty was up 129 points or 0.76% at 17,080.70. About 2139 shares advanced, 1288 shares declined, and 110 shares unchanged.

Adani Enterprises, Adani Ports, JSW Steel, Eicher Motors and HCL Technologies were among the biggest gainers on the Nifty, while losers were UPL, Bharti Airtel, Reliance Industries, ICICI Bank and Asian Paints.

Among sectors, auto, FMCG, PSU Bank, capital goods, realty and metal indices up 1-3 percent.

The BSE midcap and the smallcap indices added 1.5 percent each.

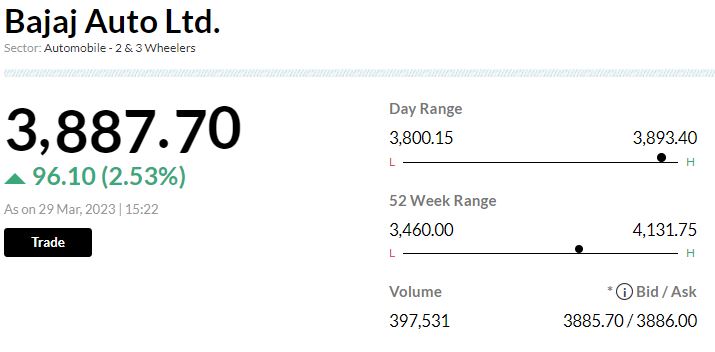

-Overweight call, target Rs 4,400 per share

-Bull Case: 41 percent upside; bear case: 12 percent downside

-See likely bottoming of exports & potential recovery from Q2FY24

-See EV volume ramp up in both 2-W & 3-W

-Expect margin to improve due to better overall mix

-Investors see concerns around timing of these catalysts, especially exports recovery

-Overweight call, target Rs 415 per share

-See suggestions of a Rs 0.5/stick(3 percent hike) price hike in gold flake KSFT segment

-Observe some price interventions in Bristol brand of a similar nature

-Current hike implies a 1 percent price hike on a weighted average portfolio level

-Hikes are still getting implemented in various markets

ITC was quoting at Rs 382.95, up Rs 3.35, or 0.88 percent.

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| NCC | 107.90 | 107.90 | 107.05 |

| Gujarat Pipavav | 116.40 | 116.40 | 115.95 |

| UltraTechCement | 7598.95 | 7598.95 | 7,596.10 |

| Bosch | 18990.80 | 18990.80 | 18,990.80 |

| Zydus Life | 492.80 | 492.80 | 492.50 |

| Godrej Consumer | 968.70 | 968.70 | 967.50 |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Astec Life | 1,295.55 | 20 | 10.00k |

| Syncom Formula | 5.98 | 19.84 | 955.82k |

| Cybertech | 98.00 | 13.56 | 39.62k |

| Shalby | 130.95 | 11.92 | 40.08k |

| Suzlon Energy | 7.88 | 11.3 | 34.45m |

| Apcotex Ind | 474.00 | 9.94 | 8.31k |

| NBCC (India) | 34.19 | 9.83 | 3.01m |

| Faze Three | 315.50 | 9.53 | 8.31k |

| UCO Bank | 24.65 | 9.36 | 4.28m |

| Hind Constr | 13.95 | 9.24 | 4.27m |

DB Corp has appointed Lalit Jain as Chief Financial Officer with effect from April 1, 2023 after Pradyumna Mishra retired as the Group Chief Financial Officer on March 31, 2023.

DB Corp was quoting at Rs 96.76, up Rs 1.06, or 1.11 percent on the BSE.