In the current market scenario, Sujit Modi, CIO at Share.Market, feels the upcoming elections are expected to be a significant driver of market sentiment in the coming months. Hence, any stock or sector-specific events may be overshadowed by the broader impact of the elections, he says in an interview with Moneycontrol.

With more than 18 years of experience in the capital markets, Sujit believes pockets of opportunities are available across multiple sectors. "PSU stocks around power, mining and energy continue to dominate," he says.

Edited excerpts:

Do you see any factors that can create panic in the equity markets in the coming days?

In the current market scenario, the upcoming elections are expected to be a significant driver of market sentiment in the coming months. Any stock or sector-specific events may be overshadowed by the broader impact of the elections. However, it's worth noting that elections themselves are less likely to substantially impact investors' portfolios if they adhere to their established stock-picking and asset-allocation processes.

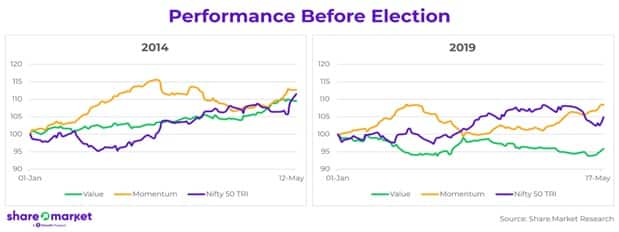

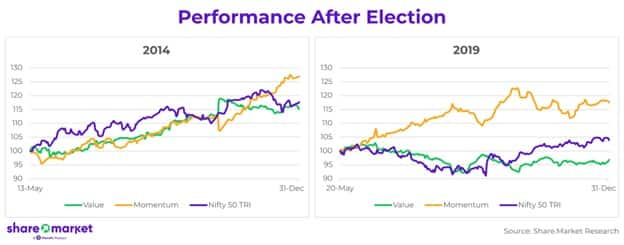

At Share.Market, we bring a Systematic Factor view to equity investing. Therefore, in the current scenario analysing the performance of individual factors such as Momentum and Value against Nifty 50 during the last two election years (2014 & 2019), we can provide valuable insights for investors seeking to position themselves effectively in the coming months.

(Note: Past performance does not guarantee future performance)

Once the election sentiments are over, we can see that momentum continues to be the primary driver of excess returns in line with historical performance.

Also read: Why this investment veteran sees better risk-reward in largecaps, stays bullish on industrials

However, it is essential to note that in 2014, Nifty 50 led the pack until momentum secured solid gains in the last few months. Conversely, in 2019, momentum maintained its dominance, ending the year with significant gains.

Setting aside the election-related market volatility, quality, value, and momentum factors have stood the test of time by generating excess returns over multiple business cycles, and we expect this to continue going forward.

Sectors/stocks that look attractive after recent turmoil?

Our processes are designed to be sector and market cap agnostic. There is no one sector that is standing out currently in our framework. Pockets of opportunities are available across multiple sectors. PSU stocks around power, mining and energy continue to dominate.

In terms of market cap, the recent sell off has increased our allocation to largecap, though specific pockets of small and midcap continue to be part of our recommendation list to our clients.

Also read: SRM Contractors IPO: 10 things to know before subscribing to Rs 130 crore issue

After recent steep fall in midcaps/small caps/micro caps, do you think most of froth has been taken out from these segments as well as overall equity markets?

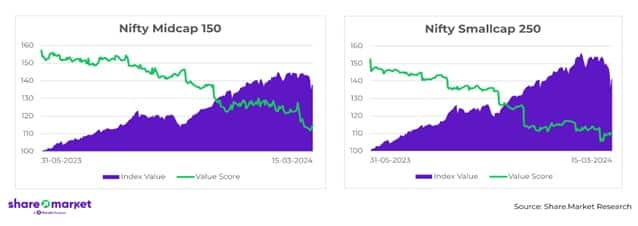

To answer this question, we turn to our Value factor score.

As the respective indices embarked on their upward trajectory over the past 12 months, our models have consistently observed a deterioration in their Value scores. This can be logically explained by the fact that the Value factor is negatively correlated to the markets and that whenever markets show sharp rally, Value scores fall.

As the respective indices embarked on their upward trajectory over the past 12 months, our models have consistently observed a deterioration in their Value scores. This can be logically explained by the fact that the Value factor is negatively correlated to the markets and that whenever markets show sharp rally, Value scores fall.

While there are indications of a reversal in the Value score as the indices dropped in the past couple of weeks, they are still far from their levels from last year.

Fundamentally and technically speaking, here is what we are seeing at the index level.

The trailing 12-month PE ratio of Nifty Midcap 150 now stands at 26.1, nearly aligning with its 5-year average of 25.6. Chart analysis suggests that the next support level for Nifty Midcap 150 is approximately 6-7 percent below the current levels.

Conversely, the current PE of Nifty Smallcap 250 at 26.8 is significantly higher than its 5-year average of 21.7. While the recent sell-off has taken out some froth from smallcaps, we see that technically, the current index levels are now at their support. However, a further break below this level could potentially lead to further declines, with the next support level approximately 15 percent away from current levels.

Do you see any possibility of redemption pressure for mutual funds in near future?

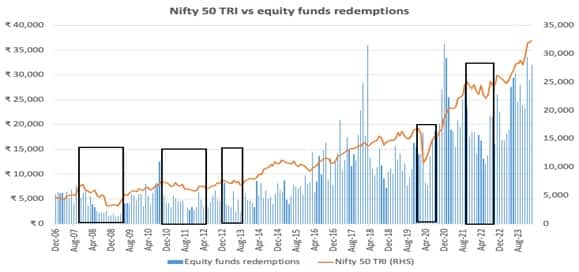

Historically, it has been observed that after any reasonable correction in the market, the redemptions have actually reduced, as most investors are typically averse to redeeming their investments during such times, given the lower valuations. However, as and when the market recovers from such corrections, redemptions tend to gain momentum, at least temporarily.

So over the next few months, if the small and midcap stocks continue to go through the correction phase or move sideways, redemptions are unlikely to increase substantially, especially in the mid and smallcap funds. Having said that, a significant drop in fresh inflows in equity funds due to market correction can also impact mutual funds as that could potentially result in net outflows.

Source: AMFI

Source: AMFI

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.