The market is likely to trade in a range in the upcoming sessions with immediate support at 21,600 and crucial support at 21,500, while the upside for the Nifty 50 seems to have capped at 21,800-21,850. These are critical levels to watch out for as the decisive breach on either side can decide the next course of action, experts said.

On February 13, the benchmark indices rebounded with the Nifty 50 rising 127 points to 21,743 and formed a bullish candlestick pattern with lower shadow on the daily timeframe. The index has taken support at the upward sloping support trendline on a closing basis.

The BSE Sensex was up 483 points to 71,555, while the broader markets like the Nifty Midcap 100 and the Smallcap 100 indices ended moderately higher.

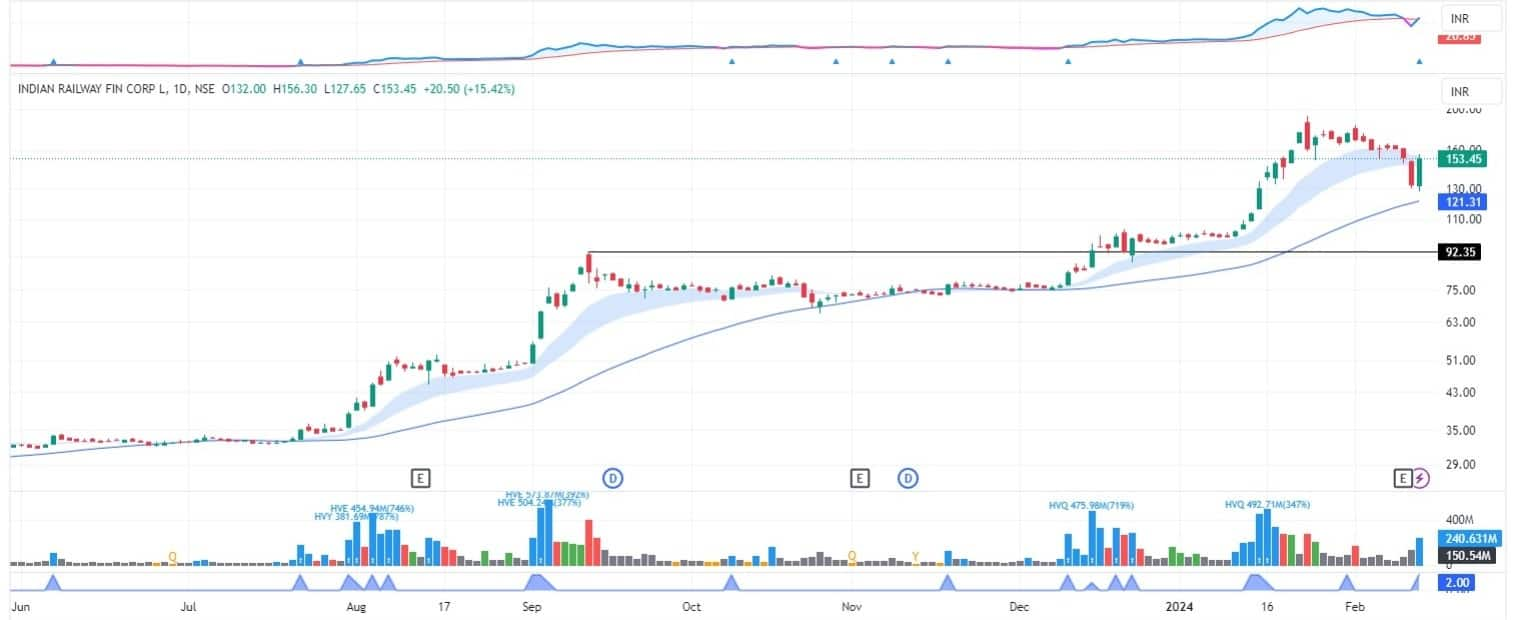

Stocks that performed better than the broader markets included Indian Railway Finance Corporation, Redington India, and Aegis Logistics. Indian Railway Finance Corporation took a support at 50-day EMA (exponential moving average) after correction for around three weeks and recorded 15.4 percent rally to end at Rs 153.5 on the NSE. In fact, it was the top gainer in the Nifty 500 index. The stock has formed robust bullish candlestick pattern, which resembles Bullish Engulfing kind of pattern on the daily charts with healthy volumes, which is a positive sign.

Redington India also rebounded after four days of correction and jumped 9 percent to Rs 199, forming robust bullish candlestick pattern on the daily timeframe with significantly higher volumes. The 50-day EMA seems to be acting as a support for the stock which traded above all key moving averages.

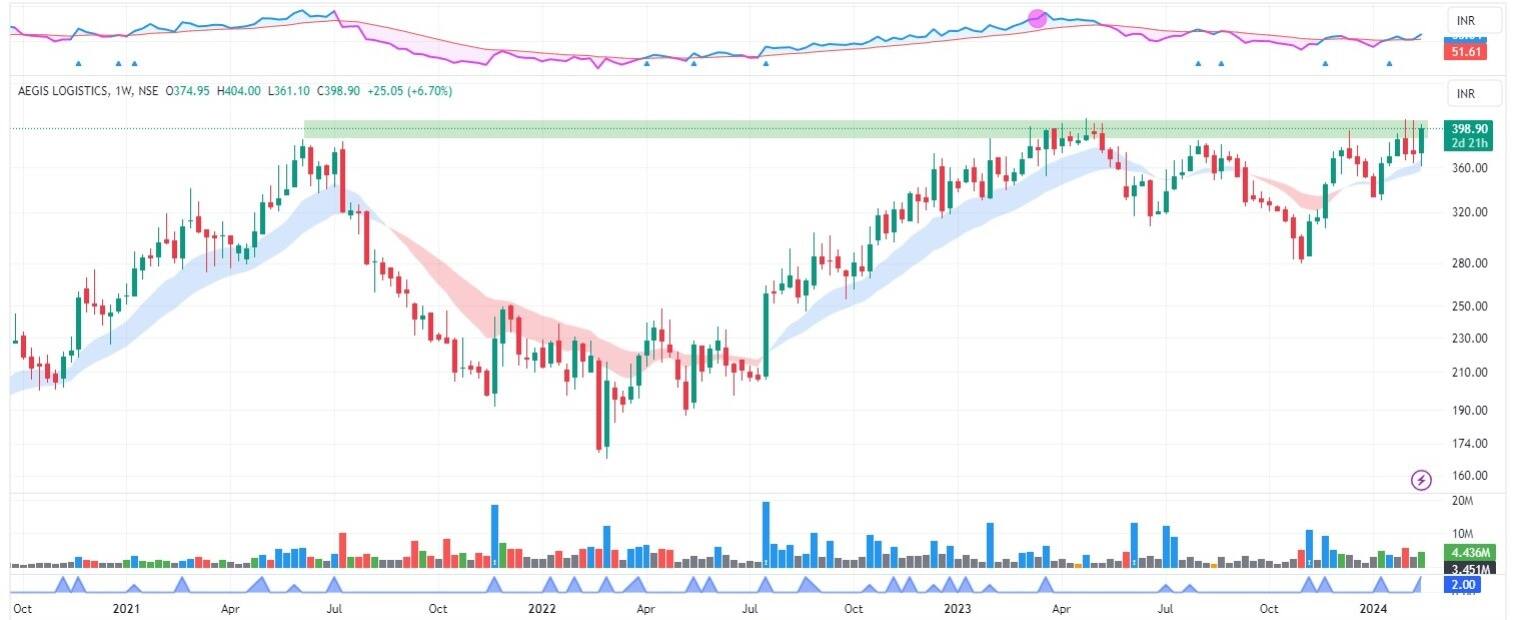

Aegis Logistics ended at record closing high of Rs 399, rising 9 percent and formed strong Bullish Engulfing candlestick pattern on the daily charts, which is a bullish reversal pattern forming at the downtrend. The stock traded above all key moving averages, with strong volumes.

Here's what Kushal Gandhi of Stoxbox recommends investors should do with these stocks when the market resumes trading today:

The price action recently plummeted over 15 percent as a profit-taking stint from the life highs of Rs 212. It retraced to its 20DMA (days moving average) and bolstered a sharp technical pullback on Tuesday. This potential shakeout indicates smart hands continuing to hold their grip which is a positive sign.

We reckon a buy on Redington for a target of Rs 222 against a protective stop-loss at Rs 188.

The pattern analysis on the weekly chart shows that the price action has been trading in a potential Cup and Handle pattern, close to its life highs. The shorter-term moving average offers immediate support as the price consolidates ahead of a major breakout along with improving EPS strength and buyers’ demand which is a positive sign.

We recommend a buy on Aegis for a target of Rs 453, with a stop-loss at Rs 371.

Indian Railway Finance Corporation (IRFC)

The price action corrected over 13 percent following its Q3 earnings and continued its profit-taking rally. The price action saw a tepid recovery in the previous trading session from the support of 61.8 percent retracement level and managed to close above the previous day’s high on a relatively stronger volume.

It shows a healthy price strength, improving buyers’ demand and IRFC’s industry group finance investment management shows a strong price performance.

We reiterate a buy on IRFC for a target of Rs 183 and a protective stop-loss at Rs 138.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.