The market is largely expected to consolidate in the coming session before heading back to its record high of 22,249, with immediate support at the 22,000 mark and key support at the 21,750 level. In case the market gains strength after consolidation, then 22,300 is the next level to watch out for, followed by 22,500, the key resistance area, experts said.

On February 21, the market snapped its six-day winning streak with the BSE Sensex falling more than 400 points to 72,623, while the Nifty 50 dropped 142 points to 22,055 and formed a bearish engulfing candlestick pattern on the daily charts, which is a bearish trend reversal pattern formed at the top, but the index still continued with its higher-high, higher-low formation.

The broader markets fell more than the benchmarks as the Nifty Midcap 100 and Smallcap 100 indices corrected more than 1 percent each.

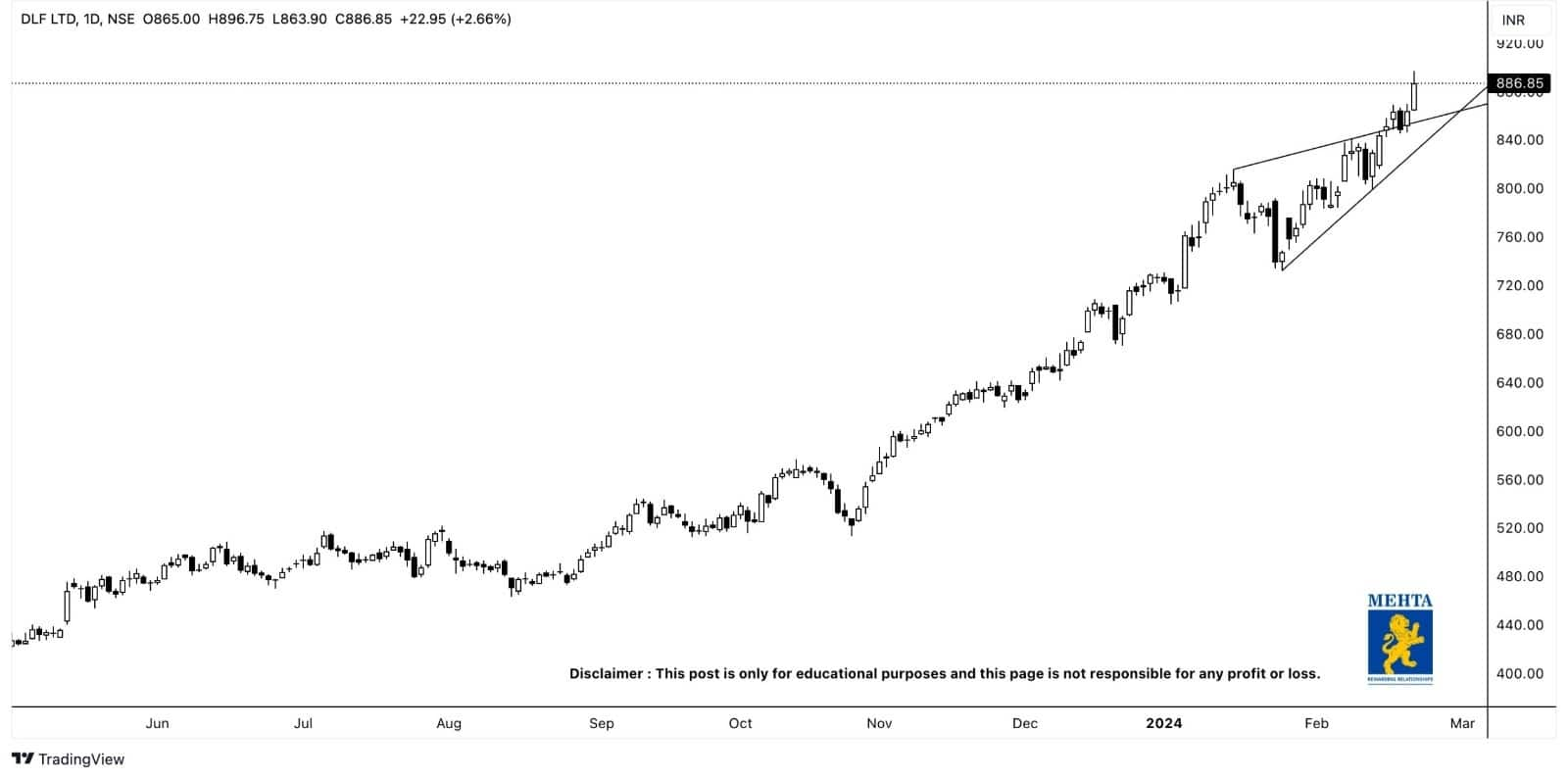

Stocks that outperformed the market included DLF, State Bank of India, and Raymond. DLF continued its higher highs, higher lows formation since October 2023, on the daily charts, and rallied 2.66 percent to end at record closing high of Rs 887. The stock has formed bullish candlestick pattern on the daily charts with healthy volumes and traded above all key moving averages.

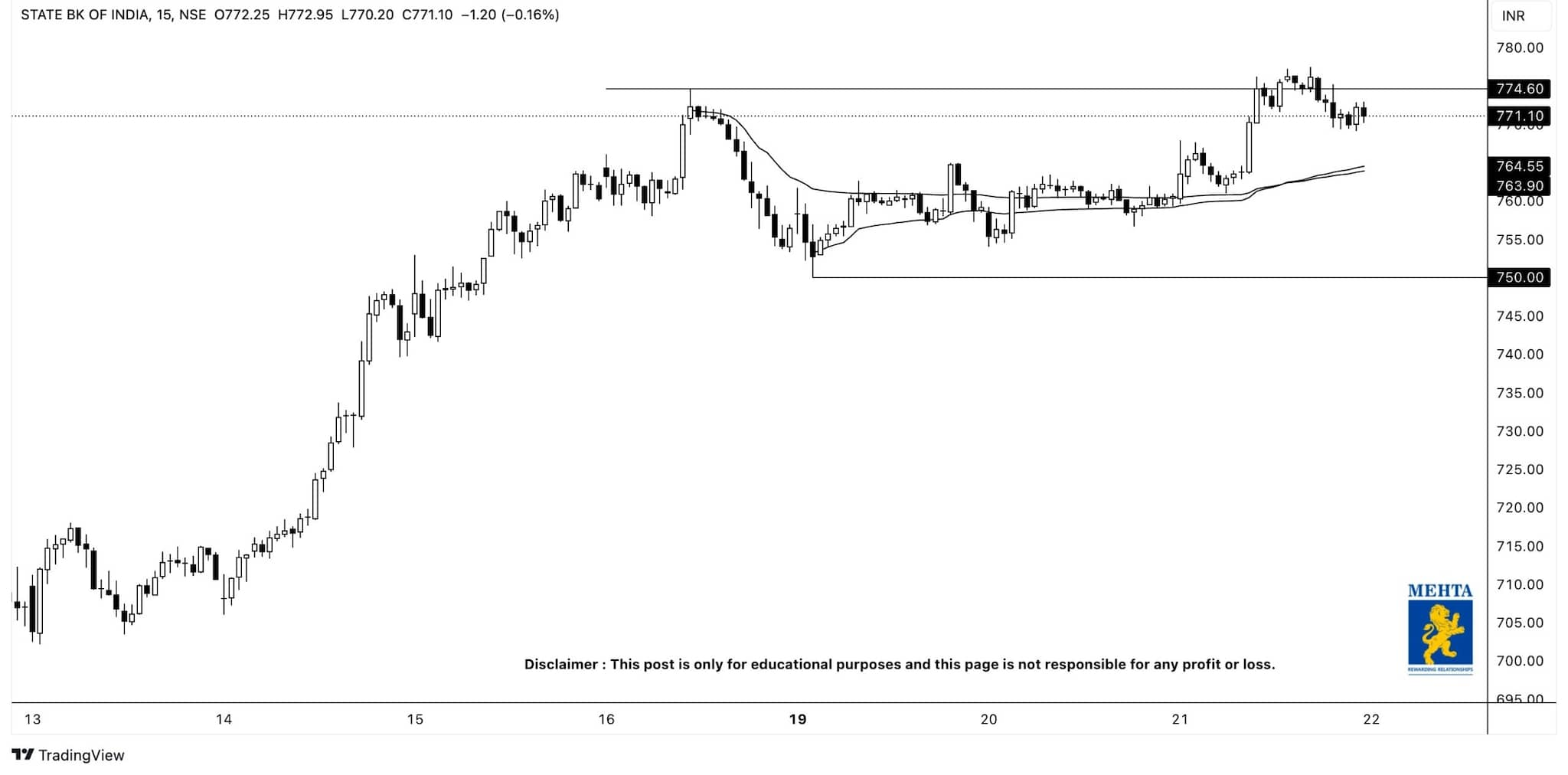

State Bank of India, too, ended at new closing high of Rs 771.5, and formed bullish candlestick pattern on the daily timeframe, though the volume was below average. The stock traded way above all key moving averages and maintained higher highs, higher lows formation since October 2023.

Raymond has seen a breakout of downward sloping resistance trendline adjoining highs of November 12, 2023 and January 16, 2024, and formed long bullish candlestick pattern on the daily scale with robust volumes. The stock gained 5.8 percent at Rs 1,874 and traded above all key moving averages.

Here's what Riyank Arora of Mehta Equities recommends investors should do with these stocks when the market resumes trading today:

The stock has made a good move above its previous high of Rs 775 and is currently pulling back to its anchor VWAP (volume-weighted average price) support zone.

The anchor VWAP support zone is placed at Rs 760-765 levels, below which the next support is near Rs 750 mark. Overall, the trend continues to be bullish, and the stock looks poised to reach Rs 825 and above.

The stock is moving in an uptrend, with the rally continuously pushing the stock price up. The immediate support for the stock is at Rs 840 mark, below which the next support is near Rs 800 level. Overall, the stock looks poised for an upside move towards Rs 950 and Rs 1,000.

The stock is moving in an uptrend, with its major support placed at Rs 1,490 mark. The immediate resistance is at Rs 1,925 mark, above which the move can extend towards Rs 2,150 and beyond.

Immediate support is placed at Rs 1,650 mark, and it is expected that the stock should move above Rs 1,925 in a short span of time and head higher further.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!