The market showed nice recovery from the day's low (which was on expected lines, given the oversold conditions), though ended lower on January 18. Hence, in case of further recovery, the Nifty 50 may find immediate resistance at the 21,550 mark, followed by 21,700-21,800 levels, while the immediate support may be at 21,400, experts said, adding that overall, the trade is likely to be rangebound in the Nifty 50 in coming days.

Even HDFC Bank ADR, which got beaten down badly in last two sessions, also climbed 2 percent on the NYSE, indicating the possibility of a rebound in its India shares.

On January 18, the BSE Sensex dropped 314 points to 71,187, while the Nifty 50 was down 110 points at 21,462 and formed bullish candlestick pattern with long upper shadow on the daily charts.

The broader markets also witnessed volatility and ended moderately lower. The Nifty Midcap 100 and Smallcap 100 indices declined 0.1 percent and 0.2 percent.

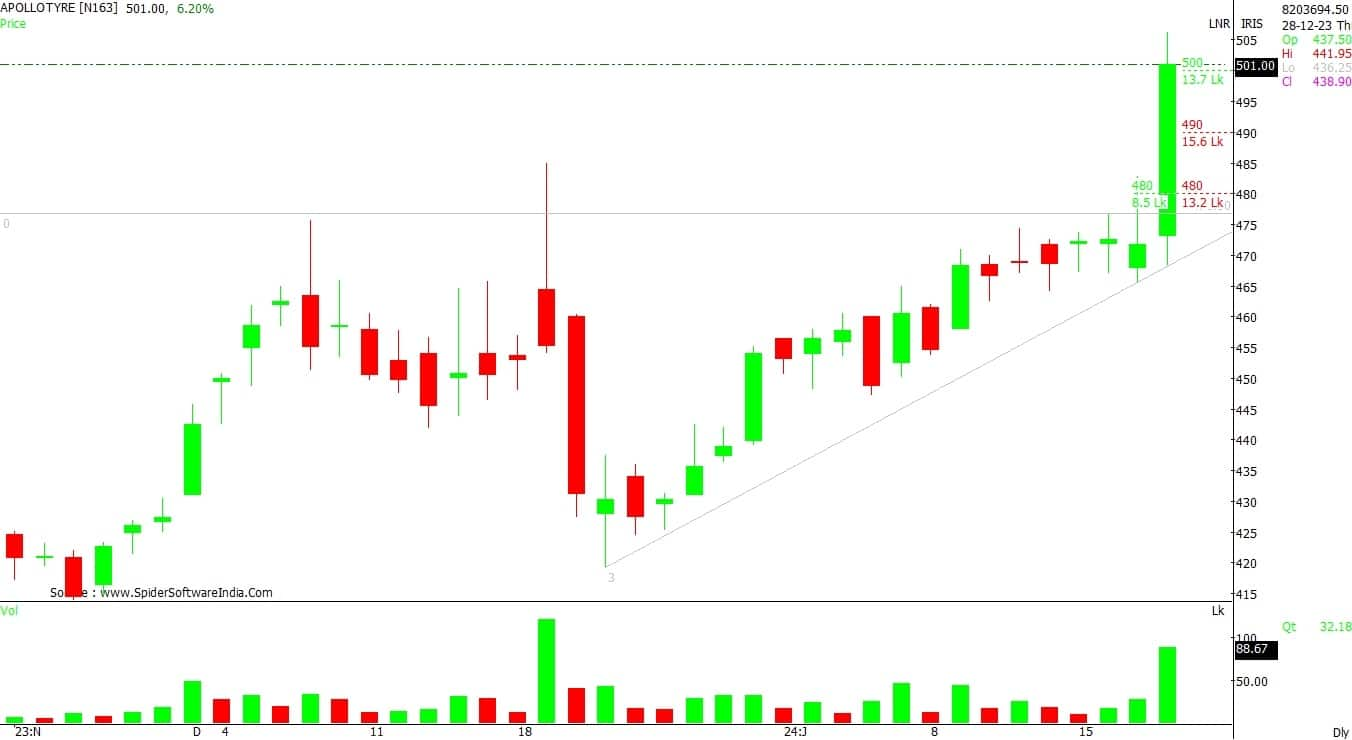

Stocks that outperformed benchmarks as well as broader markets included Apollo Tyres, Sun Pharmaceutical Industries, and Petronet LNG. Apollo Tyres has taken out its previous new high and hit a new high on Thursday. The tyre stock jumped 6 percent to end at new closing high of Rs 500.05 on the NSE, and formed strong bullish candlestick pattern on the daily charts with healthy volumes, while it was trading above all key moving averages.

Sun Pharmaceutical Industries gained nearly 3 percent and it too ended at record closing high of Rs 1,336. The stock has formed healthy bullish candlestick pattern on the daily timeframe with above average volumes and traded above all key moving averages.

Petronet LNG has been in a strong uptrend since November last year from the low of Rs 191.30, barring intermittent consolidation, and on January 18, it rallied 3.2 percent to Rs 240 with above average volumes. The stock remained above all key moving averages.

Here's what Shrikant Chouhan of Kotak Securities recommends investors should do with these stocks when the market resumes trading today:

The stock has given a breakout of its Ascending Triangle chart pattern on the daily scale. Additionally, it has formed a higher bottom formation along with incremental volume activity, hence the structure of the stock indicates the beginning of a new up move from the current levels.

For positional traders, Rs 480 would be the trend decider level. Trading above the same uptrend formation will continue till Rs 540. However, if it closes below Rs 480, traders may prefer to exit from trading long positions.

After the strong upward rally, the stock went into the consolidation mode on the daily scale. The recent breakout in the stock is representing a bullish continuation pattern, which is signifying a new leg of up move from the current levels.

As long as the stock is trading above Rs 1,290 the uptrend formation is likely to continue. Above which, the counter could move up to Rs 1,440. On the flip side, fresh sell off possible only after dismissal of Rs 1,290.

On the weekly scale, the counter is into a rising channel chart formation with higher high and higher low series pattern. The technical indicators like ADX (average directional index) is also indicating further up trend from current levels, which could boost the bullish momentum in coming horizon.

For the traders, Rs 230 would be the key support level to watch out. Above which the uptrend structure should continue until Rs 260.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.