The benchmark indices ended the session on May 15 in the red, with about 1,338 shares advancing and 915 shares declining on the NSE. The market seems to be in a consolidation phase for now. Here are some trading ideas for the near term.

Rupak De, Senior Technical Analyst, LKP SecuritiesAngel One | CMP: Rs 2,700

The stock has risen after two days of consolidation on the daily chart, indicating increased bullishness. Furthermore, it has surpassed the critical 21EMA on the daily timeframe, indicating a positive price trend for the short term. Additionally, the RSI is showing a bullish crossover.

Strategy: Buy

Target: Rs 2,900

Stoploss: Rs 2,600

Bharti Airtel | CMP: Rs 1,316

The stock has experienced a consolidation breakout on the daily chart, suggesting a rise in optimism. It has been sustaining above the critical 21EMA for the last few days, indicating a positive price trend for the short term. Additionally, the RSI is showing a bullish crossover.

Strategy: Buy

Target: Rs 1,350 - 1,385

Stoploss: Rs 1,274

BPCL | CMP: Rs 625

The stock is poised for a breakout from a consolidation phase, accompanied by volume-based buying. It has found support at its 20DMA, situated at the level of 608, serving as a cushion against declines. Furthermore, the positive crossover on the momentum indicator RSI validates the buy signal, indicating potential upward movement.

Strategy: Buy

Target: Rs 650 - 670

Stoploss: Rs 600

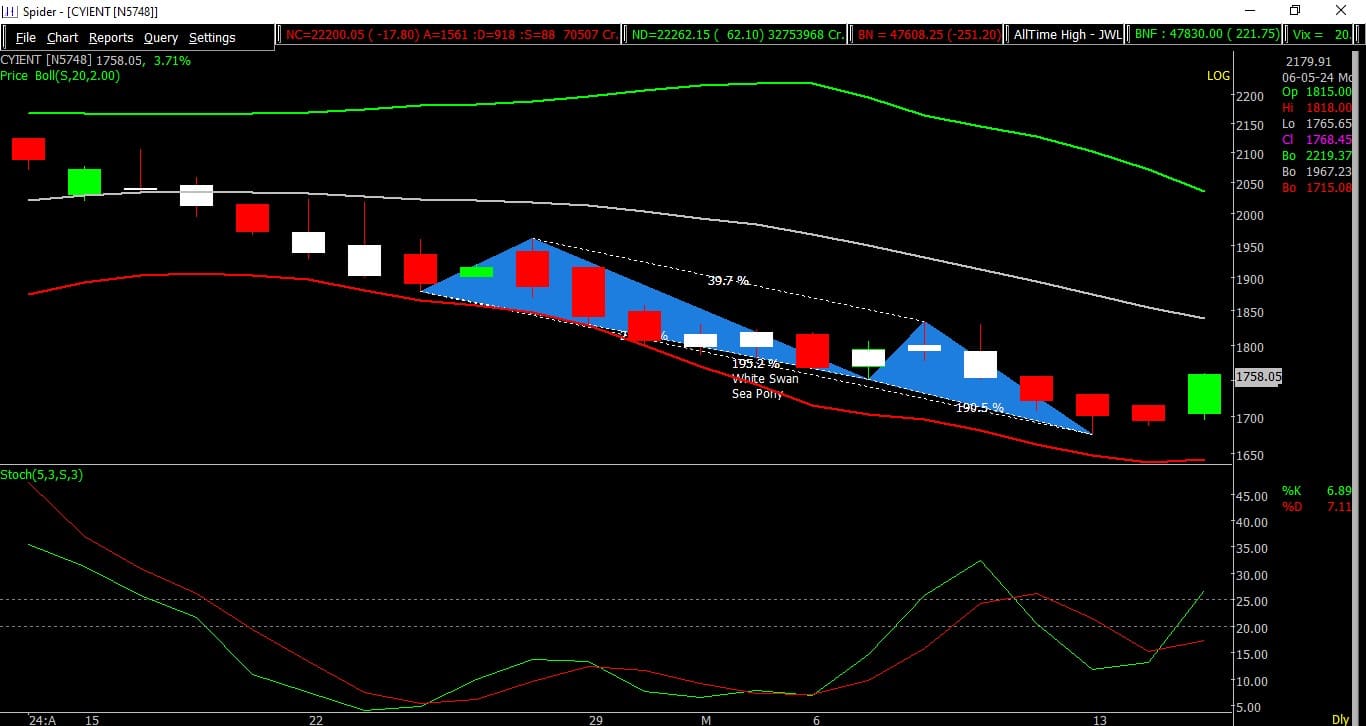

Jigar S Patel, Senior Manager, Equity Research, Anand RathiCyient | CMP: Rs 1,756

After experiencing a correction of approximately 500 points, translating to a significant 24 percent decline, Cyient has now reversed its trajectory from the previous support level of 1700. Notably, this support level aligns with the lower Bollinger band, suggesting a potential bounce back, especially considering the bullish crossover observed on the stochastic indicator at the daily scale, indicating an attractive opportunity.

Strategy: Consider buying within the range of Rs 1735 - 1765

Target: Rs 1,900

Stoploss: Rs 1,675

Aether | CMP: Rs 830

Following a correction of roughly 60 points, equating to a notable 7 percent downturn, Aether has shifted its course away from the prior support mark of 800. This support level notably coincides with the lower Bollinger band, implying a potential rebound, particularly given the bullish crossover on the stochastic indicator at the daily scale, signifying an appealing opportunity.

Also Read: Trade setup for Thursday: 15 things to know before opening bellStrategy: consider buying within the range of Rs 830 - 840

Target: Rs 900

Stoploss: Rs 803

Clean Science and Technology | CMP: Rs 1,324.9

Currently, Clean Science has formed a double bottom pattern on the daily scale, indicating a potential reversal in its price trend. Alongside this pattern, there is a bullish divergence observed on the RSI at the daily scale. This divergence occurs when the price makes new lows while the RSI indicator shows higher lows, suggesting a weakening downward momentum and a potential impending upward movement in the price. Moreover, Clean Science has successfully held onto its historical support zone ranging between 1,280 to 1,300, further bolstering the bullish sentiment surrounding the stock.

Strategy: Consider initiating long positions within the range of Rs 1,300 - 1,320

Target: Rs 1,400

Stoploss: Rs 1,265

Vidnyan Sawant, HOD - Research, GEPL CapitalCG Power and Industrial Solutions | CMP: Rs 637

The stock has consistently adhered to its 34-week moving average, indicating a positive market structure. Additionally, the Relative Strength Index (RSI) has remained above 60 across various timeframes, underscoring a trend supported by momentum. We anticipate further upward movement in prices, targeting a level of around 762. However, it's essential to monitor the 584 level closely; sustained price action below this point could invalidate the bullish outlook.

Target: Rs 762

Stoploss: Rs 584

Max Healthcare Institute | CMP: Rs 835

The company has demonstrated a robust price structure across various timeframes, with recent price action suggesting it's on the cusp of breaking out from a triangular pattern. A similar pattern observed in November 2023 led to an impressive period of price stability post-breakout. Weekly analysis reveals that Max Healthcare comfortably maintains positions above critical averages like the 20-week and 50-week EMA, indicating a positive trend. The stochastic analysis further supports this, with an uptrend indicated by a bullish crossover, signaling increasing momentum. Moreover, the ratio chart illustrates the stock's high relative strength, hinting at its potential for continued outperformance compared to the broader market.

Target: Rs 985

Stoploss: Rs 768

Riyank Arora, Technical Analyst at Mehta EquitiesLIC | CMP: Rs 990

The stock has experienced a notable breakout from its triangular consolidation pattern on its daily charts. With the RSI (14) witnessing a significant uptick and crossing the 55 mark, the overall momentum appears strong. Additionally, Wednesday's trading session volumes were nearly 2.6 times its average traded volume over the past 30 days, indicating strong buying interest and suggesting the stock is poised for an up-move towards 1,150 and above.

Strategy: Buy

Target: Rs 1,150

Stoploss: Rs 940

Sona Blw Precision Forgings | CMP: Rs 604.55

The stock has touched the lower end of its parallel channel support and formed a bullish candlestick on its daily timeframe charts. With volumes nearly 1.8 times its average (30 days) volume, and the %K line crossing above the %D line in an oversold region, it indicates a strong buy signal on the charts. Limited downside risk at current levels makes the stock an attractive buy.

Strategy: Buy

Target: Rs 760

Stoploss: Rs 560

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.