The benchmark indices maintained their upward journey for another session, rising 0.2 percent amid range-bound trading on January 23, with positive market breadth. About 1,411 shares saw buying interest compared to 1,113 shares that declined on the NSE. The market may remain in positive terrain amid elevated volatility. Below are some trading ideas for the near term:

Chandan Taparia, Head - Equity Derivatives & Technicals, Broking & Distribution at Motilal Oswal Financial ServicesBajaj Finserv | CMP: Rs 1,746.15

Bajaj Finserv has broken out of a Flag and Pole pattern on the daily chart and has given a golden crossover confirming the uptrend. The RSI (Relative Strength Index) indicator is rising, which confirms the bullish momentum.

Strategy: Buy

Target: Rs 1,850

Stop-Loss: Rs 1,700

Eicher Motors | CMP: Rs 5,116.2

Eicher Motors is retesting its breakout from a consolidation zone on the daily chart with a large-bodied bullish candle. It has also taken support at its 200 DEMA. The Stochastic indicator has bounced up from the oversold zone, confirming the price move.

Strategy: Buy

Target: Rs 5,400

Stop-Loss: Rs 5,000

LTIMindtree | CMP: Rs 6,002

LTIMindtree is forming a double bottom pattern on the daily chart and has crossed above its 100 DEMA. Buying was visible across the IT space, which may support the up move. The MACD (Moving Average Convergence Divergence) indicator has given a bullish crossover and is heading up to support the price move.

Strategy: Buy

Target: Rs 6,370

Stop-Loss: Rs 5,825

Mandar Bhojane, Equity Research Analyst at Choice BrokingMahindra & Mahindra Financial Services | CMP: Rs 275.5

M&M Financial Services has recently formed a symmetrical triangle pattern on the daily chart, signaling a potential breakout and a shift in market sentiment. The price is consolidating just below the breakout level, indicating strong bullish momentum. A notable increase in trading volume further supports the possibility of an upward move. The RSI is trending upwards at 55, reflecting strengthening bullish momentum, while the Stochastic RSI has shown a positive crossover, adding to the bullish outlook.

These technical indicators suggest that the stock is gaining momentum for a potential rally. A decisive close above Rs 280 could pave the way for short-term targets of Rs 300 and Rs 310. On the downside, immediate support is at Rs 270, providing an attractive buying opportunity on dips.

Strategy: Buy

Target: Rs 300, Rs 310

Stop-Loss: Rs 264

Britannia Industries | CMP: Rs 5,012.6

Britannia is on the verge of completing an Inverted Head-and-Shoulders pattern on the daily chart. This pattern, coupled with a notable increase in trading volume, suggests strong buying interest and the potential for a breakout, which could lead to sustained upward momentum.

Technical indicators further reinforce the bullish outlook. The RSI is trending upwards at 62.8, indicating strengthening momentum, while the Stochastic RSI has confirmed a positive crossover, signaling additional upside potential. If the price sustains above Rs 5,040, it could open the door for short-term targets of Rs 5,300 and Rs 5,400. On the downside, immediate support is at Rs 4,950, offering a potential buying opportunity on dips.

Strategy: Buy

Target: Rs 5,300, Rs 5,400

Stop-Loss: Rs 4,800

Cipla | CMP: Rs 1,451.15

Cipla has formed a triple bottom pattern on the daily chart, suggesting a potential bullish reversal. The stock has been consolidating near its key support level, indicating accumulation by buyers. Increased trading volume highlights growing buying interest and supports the possibility of continued bullish momentum.

The technical indicators also align with this outlook. The RSI is trending upwards at 43.59, signaling improving strength, while the Stochastic RSI has shown a positive crossover, further confirming the potential for an upward move. A breakout above Rs 1,460 could trigger a rally toward the immediate targets of Rs 1,550 and Rs 1,580. On the downside, the support at Rs 1,430 provides a favourable buying opportunity for investors.

Strategy: Buy

Target: Rs 1,550, Rs 1,580

Stop-Loss: Rs 1,400

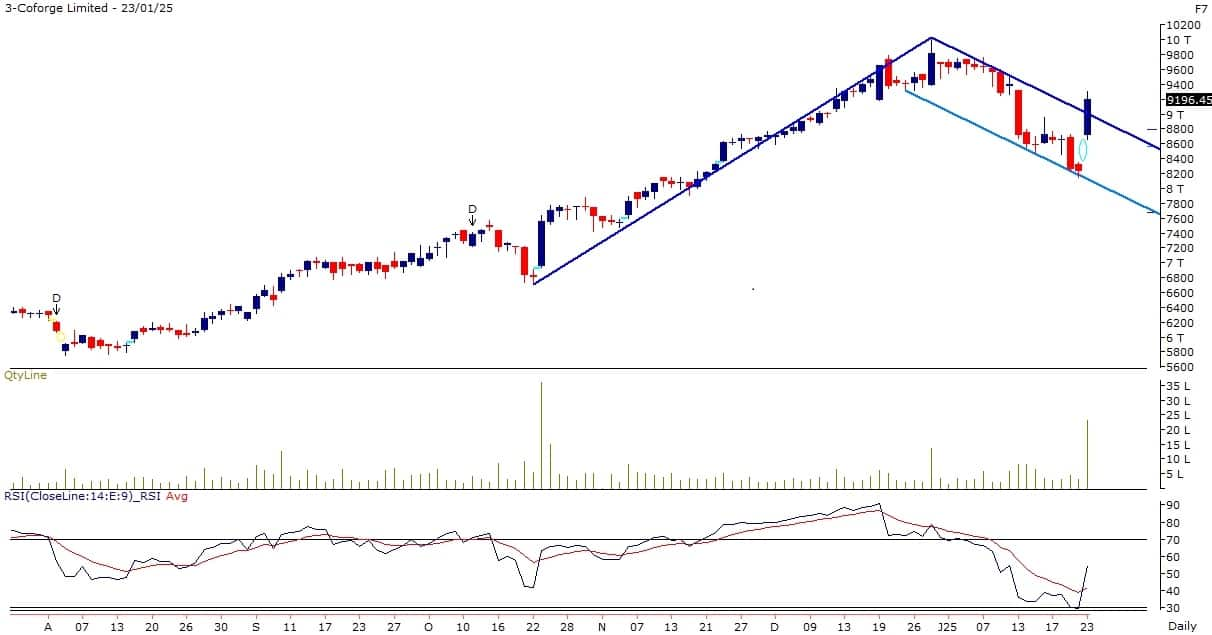

Virat Jagad, Technical Research Analyst at BonanzaCoforge | CMP: Rs 9,196.5

Coforge has recently broken out from a Flag and Pole pattern on the daily chart, a strong bullish indicator suggesting the potential for a sustained uptrend. The breakout is supported by a surge in trading volume, reflecting increased buying interest and reinforcing the stock's positive outlook. Additionally, the stock is trading above key EMAs, aligning with the ongoing bullish trend. The DMI+ (Directional Movement Index) is higher than the DMI-, and the ADX (Average Directional Index) is above 25, suggesting strong upward momentum. Overall, these technical signals point to a bullish scenario, with potential for further price appreciation in the near term.

Strategy: Buy

Target: Rs 10,000

Stop-Loss: Rs 8,800

UPL | CMP: Rs 557.85

The daily chart of UPL shows a confirmed breakout from a symmetric triangle pattern, a strong bullish signal. This breakout is supported by a rise in trading volume, indicating strong buying interest and positive market sentiment. The stock is trading near its recent highs, with both the Fast and Slow EMAs trending upward, reinforcing the bullish outlook. Additionally, the RSI has crossed above its average line, emphasizing the strength and sustainability of the ongoing uptrend. These technical indicators collectively suggest a bullish outlook, with potential for continued price gains in the near term.

Strategy: Buy

Target: Rs 600

Stop-Loss: Rs 535

AAVAS Financiers | CMP: Rs 1,727.85

AAVAS Financiers has recently broken out from a rectangle pattern on the daily chart, signaling a potential uptrend. This bullish formation suggests the likelihood of further price appreciation. A significant surge in volume during the last session highlights increased buying interest, reinforcing the positive outlook. The stock is also trading above key EMAs, confirming sustained upward momentum. Additionally, the RSI has broken out in a bullish direction, underscoring the strength of the ongoing uptrend. Together, these technical signals suggest a strong bullish outlook for AAVAS Financiers.

Strategy: Buy

Target: Rs 1,825

Stop-Loss: Rs 1,675

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.