The Indian market ended in the green on May 19, enduring profit-booking towards the end of the session, amid positive global cues.

The Sensex closed the day with a gain of 167 points, or 0.56 percent, at 30,196.17, and the Nifty settled 56 points, or 0.63 percent, higher at 8,879.10.

Sectorally, the action was seen in telecom, power, utilities, auto, while profit-taking was seen in capital goods, energy, realty and banks.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- months data and not of the current month only.

Key support and resistance level for Nifty

According to pivot charts, the key support level for Nifty is placed at 8,812.82, followed by 8,746.53. If the index moves up, key resistance levels to watch out for are 8,987.87 and 9,096.63.

Nifty Bank

The Nifty Bank closed 0.49 percent lower at 17,486.25. The important pivot level, which will act as crucial support for the index, is placed at 17,192.83, followed by 16,899.46. On the upside, key resistance levels are placed at 17,977.43 and 18,468.67.

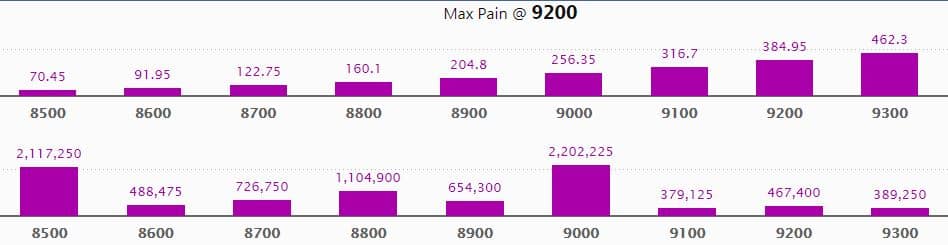

Call option data

Maximum call OI of 14.95 lakh contracts was seen at 9,300 strike, which will act as crucial resistance in the May series.

This is followed by 9,000, which holds 12.89 lakh contracts, and 9,400 strikes, which has accumulated 9.95 lakh contracts.

Significant call writing was seen at the 9,300, which added 6.03 lakh contracts, followed by 9,400 strikes that added 3.07 lakh contracts.

Call unwinding was witnessed at 8,500, which shed 1,425 contracts.

Source: MyFNO

Source: MyFNO

Put option data

Maximum put OI of 22.02 lakh contracts was seen at 9,000 strike, which will act as crucial support in the May series.

This is followed by 8,500, which holds 21.17 lakh contracts, and 8,800 strikes, which has accumulated 11.05 lakh contracts.

Significant put writing was seen at 8,700, which added 1.45 lakh contracts, followed by 8,800 strikes, which added 1.20 lakh contracts.

Put unwinding was seen at 9,300, which shed 84,000 contracts, followed by 9,200 strikes that shed 80,250 contracts.

Source: MyFNO

Source: MyFNO

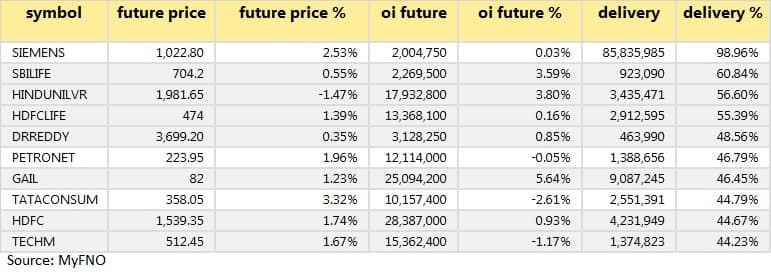

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

60 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

13 stocks saw long unwinding

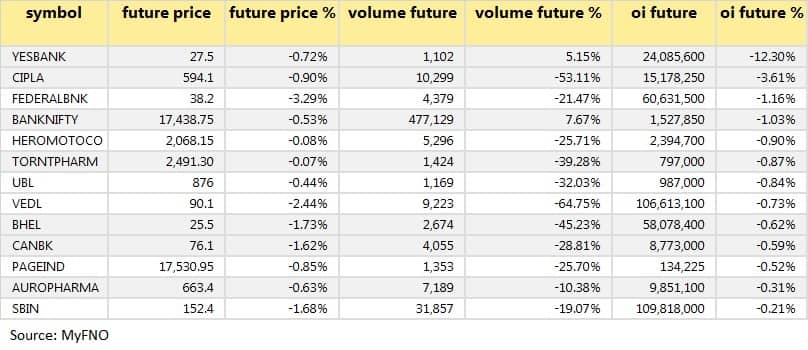

36 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

38 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

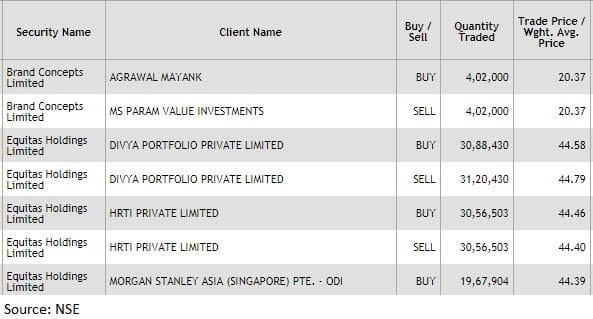

Bulk deals

(For more bulk deals, click here)

Results on May 20

Bajaj Auto, Dr Reddy's Laboratories, UltraTech Cement, Jubilant FoodWorks, Ajanta Pharma, JSW Energy, Kalpataru Power Transmission

Stocks in the news

Bajaj Finance Q4: Profit at Rs 948 crore versus Rs 1,176 crore, net interest income at Rs 4,684 crore versus Rs 3,385 crore YoY.

Tata Power Q4: Profit at Rs 403 crore versus Rs 122 crore, revenue at Rs 6,621 crore versus Rs 7,230 crore YoY.

Ujjivan Small Finance Bank Q4: Profit at Rs 73.15 crore versus Rs 63.78 crore, revenue at Rs 466.64 crore versus Rs 319.71 crore YoY.

Equitas Holdings: Morgan Stanley Asia (Singapore) bought 19,67,904 shares in the company at Rs 44.39 per share.

Healthcare Global Enterprises: Buena Vista Fund bought another 5,15,634 shares in the company at Rs 103.99 per share.

JMC Projects Q4: Loss at Rs 54.76 crore versus profit at Rs 35.24 crore, revenue at Rs 976.3 crore versus Rs 980.5 crore YoY.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 1,328.31 crore, while domestic institutional investors (DIIs) bought shares worth Rs 1,659.74 crore in the Indian equity market on May 19, provisional data available on the NSE showed.

Stock under F&O ban on NSE

Vodafone Idea is under the F&O ban for May 20. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!