The market is expected to remain rangebound in the coming sessions too, with the Nifty 50 likely facing hurdle at 22,100-22,200 levels on the higher side, while the immediate support may be at 21,900, followed by 21,800 level, experts said, adding the breaking of the said range on either side can give firm direction to the index.

On March 26, the BSE Sensex was down 362 points at 72,470, while the Nifty 50 fell 92 points to 22,005 and formed bullish candlestick pattern with long upper shadow on the daily charts, which was formed within the body of previous day's candle, indicating a broader rangebound action for the market.

"At the lows, the area of 21,900 is offering strong support for the market and the Nifty is facing stiff resistance at the highs around 22,150-22,200 levels. Hence, a decisive move beyond this range is likely to open sharp movement for the market on either side," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

He feels the overall long-term chart pattern remains positive and that indicates a possibility of upside breakout in the near term.

For an optimistic outlook, Om Mehra, technical analyst at Samco Securities feels the Nifty needs to close above the middle Bollinger band around the 22,180-22,200 zone and until Nifty surpasses these levels, it may be advisable to opt for a sell-on-rise strategy.

However, the broader markets continued to outperform benchmark indices as the Nifty Midcap 100 index rose 1 percent and Smallcap 100 index gained 0.4 percent.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty 50 may face resistance at 22,056 followed by 22,086 and 22,134 levels. On the lower side, the index may take immediate support at 21,961 followed by 21,931 and 21,883.

On March 26, the Bank Nifty was also under pressure, falling 264 points to 46,600 and formed small-bodied bullish candlestick pattern with long upper shadow on the daily charts, but defended 46,500 level throughout session.

"Bank Nifty also consolidated within a narrow range around the key daily moving averages. On the downside, 46,500 is acting as a crucial support while 46,900 is acting as an immediate hurdle," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

Overall, he expects the Bank Nifty to resume its retracement towards 47,000 – 47,200 over the next few trading sessions.

According to the pivot point calculator, the Bank Nifty index may see resistance at 46,738 followed by 46,799 and 46,899. On the lower side, it is expected to take support at 46,540 followed by 46,479 and 46,380.

As per the monthly options data, the maximum Call open interest was seen at 22,500 strike with 1.02 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 23,000 strike, which had 87.8 lakh contracts, while the 22,100 strike had 72.77 lakh contracts.

Meaningful Call writing was seen at the 22,500 strike, which added 32.37 lakh contracts followed by 22,100 strike and 22,200 strike, which added 26.72 lakh and 25.87 lakh contracts, respectively.

The maximum Call unwinding was at the 22,700 strike, which shed 7.57 lakh contracts followed by 22,900 and 23,300 strikes, which shed 3.32 lakh contracts and 3.04 lakh contracts, respectively.

On the Put side, the 22,000 strike owned the maximum open interest, which can act as a key support level for the Nifty with 1.1 crore contracts. It was followed by the 21,000 strike comprising 78.85 lakh contracts and then the 22,100 strike with 67.84 lakh contracts.

Meaningful Put writing was at the 21,700 strike, which added 22.77 lakh contracts followed by the 21,900 strike and 21,500 strike adding 10.8 lakh and 9.49 lakh contracts, respectively.

Put unwinding was seen at 20,800 strike, which shed 5.73 lakh contracts followed by 21,000 and 21,200 strikes, which shed 5.42 lakh and 3.44 lakh contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Bharti Airtel, IndusInd Bank, Hindustan Unilever, Mahindra & Mahindra, and ICICI Lombard General Insurance Company saw the highest delivery among the F&O stocks.

A long build-up was seen in 50 stocks, which included MCX India, Metropolis Healthcare, Ambuja Cements, Nestle India, and Polycab India. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 26 stocks saw long unwinding, which included Coromandel International, Sun TV Network, Dabur India, Bata India, and Bharti Airtel. A decline in OI and price indicates long unwinding.

41 stocks see a short build-up

A short build-up was seen in 41 stocks, including ICICI Lombard General Insurance Company, JK Cement, Hero MotoCorp, Canara Bank, and Wipro. An increase in OI along with a fall in price points to a build-up of short positions.

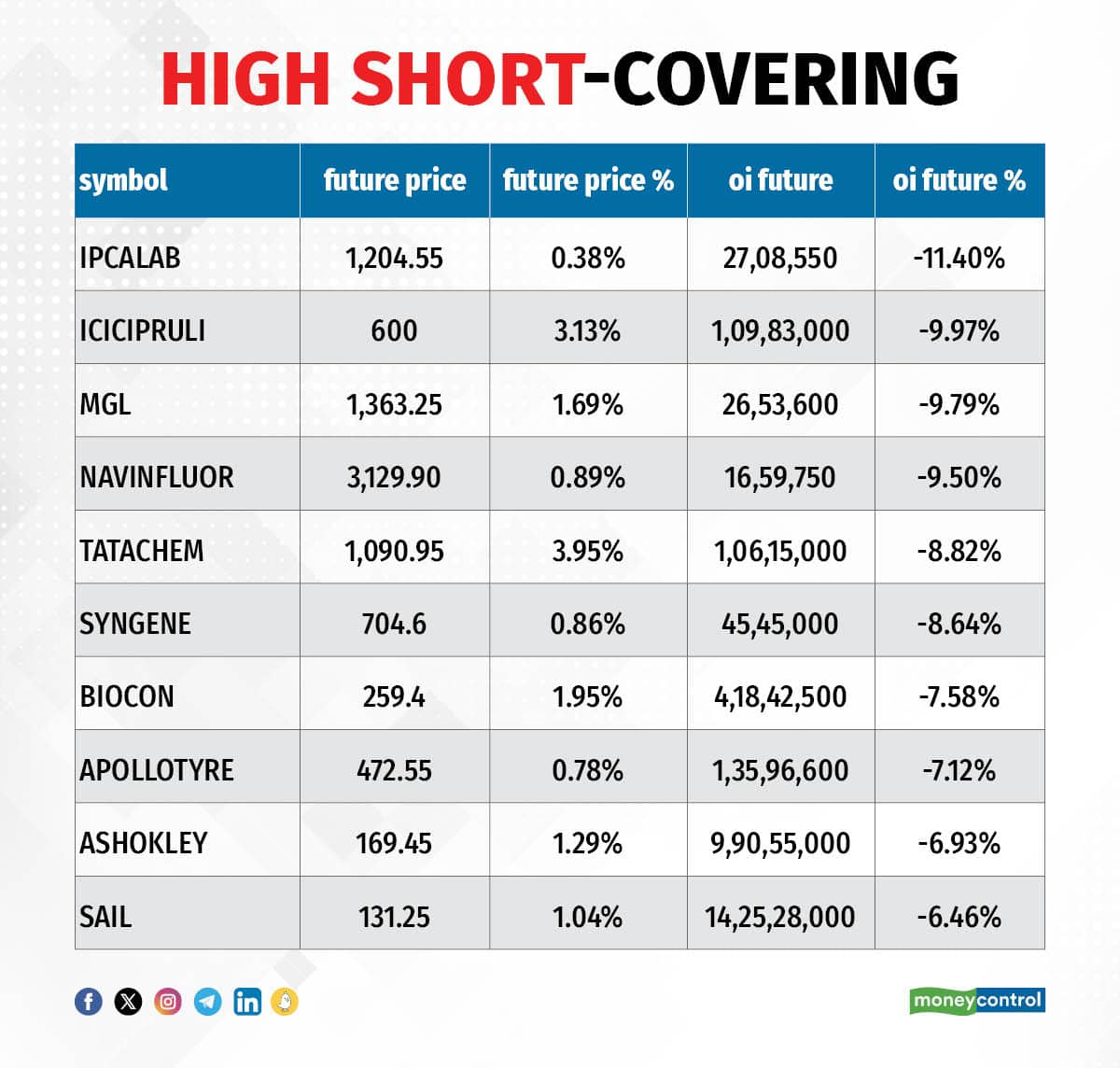

67 stocks see a short covering

Based on the OI percentage, a total of 67 stocks were on the short-covering list. These included Ipca Laboratories, ICICI Prudential Life Insurance Company, Mahanagar Gas, Navin Fluorine International, and Tata Chemicals. A decrease in OI along with a price increase is an indication of short-covering.

Analysts and Investors Meeting

For more bulk deals, click here

Stocks in the news

Aster DM Healthcare: Private equity firm Olympus Capital Asia Investments is likely to sell up to 9.8 percent equity stake in the private healthcare services provider through a block deal, multiple industry sources in the know told Moneycontrol. The block deal size is around $235 million and the floor price has been fixed at Rs 400 per share.

Central Depository Services (India): Public shareholder Standard Chartered Bank - Corporate Banking is likely to sell entire 7.18 percent stake (75 lakh equity shares) in CDSL for $151 million through a block deal, sources told CNBC-TV18.

Cipla: Sanofi India and Sanofi Healthcare India have announced an exclusive partnership with Cipla for distribution and promotion of Sanofi India’s 6 central nervous system (CNS) products in India including Frisium, a leading brand in the anti-epileptic medication category.

Shyam Metalics and Energy: Shyam Metalics in joint venture with Natural Resources Energy (NREPL) has received the Letter of Intent from the Industry, Energy, Labour, and Mining Department, Government of Maharashtra, for composite license for iron ore block with area of 1,526 hectares in Maharashtra.

Prism Johnson: The building materials company said the Board of Directors will be meeting on March 29 to consider the raising of funds via issue of non-convertible debentures on a private placement basis.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net bought shares worth Rs 10.13 crore, while domestic institutional investors (DIIs) purchased Rs 5,024.36 crore worth of stocks on March 26, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has retained SAIL to the F&O ban list for March 27. Biocon, Tata Chemicals and Zee Entertainment Enterprises were removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.