Extending gains into the fourth consecutive session, equity benchmarks --Sensex and Nifty -- ended with healthy gains on June 1. Positive global cues, expectations of economic activity coming back to normal and forecast of a normal monsoon lifted investor sentiment.

The Sensex ended 879 points, or 2.71 percent, higher at 33,303.52. The Nifty closed up 246 points, or 2.57 percent, at 9,826.15. The BSE Midcap and Smallcap indices closed 2.65 percent and 3.03 percent higher, respectively.

Ajit Mishra, VP - Research, Religare Broking is of the view that the recent surge indicates that the market is focusing more on the optimistic side and anticipating a favourable scenario.

"We suggest maintaining a positive yet cautious approach as the Nifty is closer to the resistance zone of 9,950-10,050. Besides, the continuous spike in COVID-19 cases and subdued earnings may cap the upside ahead. On the global front, further deterioration in US-China relations is another important factor that could unsettle global markets. In short, traders should use a further surge to liquidate aggressive longs around the hurdle and wait for any dip to re-enter," Mishra said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for Nifty

According to pivot charts, the key support level for Nifty is placed at 9,711.54, followed by 9,596.92. If the index moves up, key resistance levels to watch out for are 9,936.18 and 10,046.22.

Nifty Bank

The Nifty Bank index closed 3.43 percent higher at 19,959.90. The important pivot level, which will act as crucial support for the index, is placed at 19,653.43, followed by 19,346.97. On the upside, key resistance levels are placed at 20,245.83 and 20,531.77.

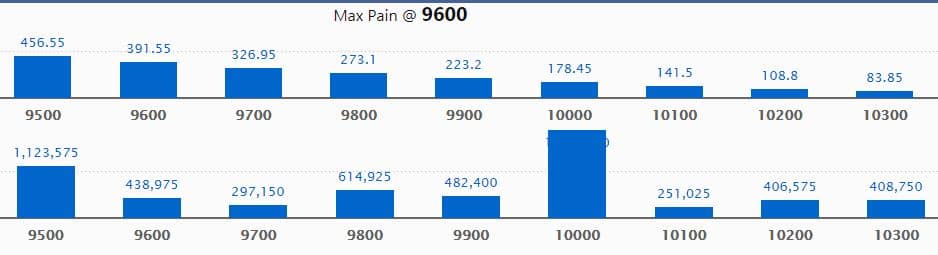

Call option data

Maximum call OI of 18.78 lakh contracts was seen at 10,000 strike, which will act as crucial resistance in the June series.

This is followed by 9,500, which holds 11.24 lakh contracts, and 9,800 strikes, which has accumulated 6.15 lakh contracts.

Significant call writing was seen at the 10,300, which added 1.91 lakh contracts, followed by 9,900 strikes that added 1.72 lakh contracts.

Call unwinding was witnessed at 9,500, which shed 3.31 lakh contracts, followed by 9,400 strike which shed 1.98 lakh contracts.

Source: MyFNO

Source: MyFNO

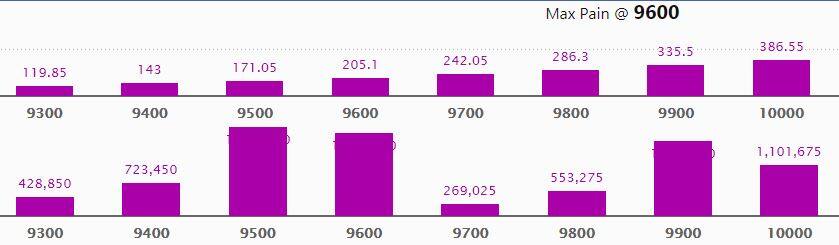

Put option data

Maximum put OI of 18.92 lakh contracts was seen at 9,500 strike, which will act as crucial support in the June series.

This is followed by 9,600, which holds 17.59 lakh contracts, and 9,900 strikes, which has accumulated 16 lakh contracts.

Significant put writing was seen at 9,500, which added 4.89 lakh contracts, followed by 9,800 strikes, which added 4.20 lakh contracts.

Put unwinding was seen at 9,400, which shed 70,650 contracts, followed by 10,000 strikes that shed 17,400 contracts.

Source: MyFNO

Source: MyFNO

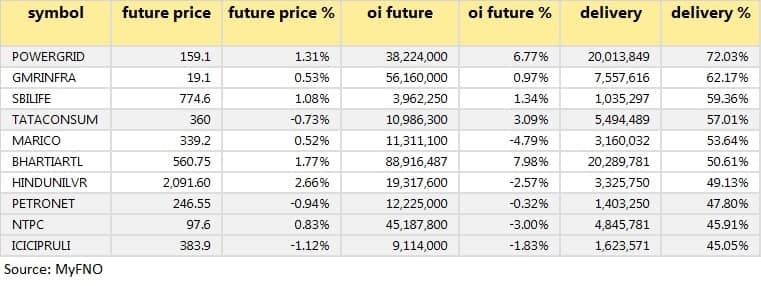

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

54 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

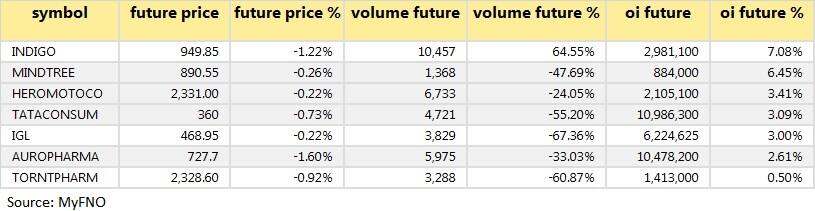

10 stocks saw long unwinding

7 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions.

73 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

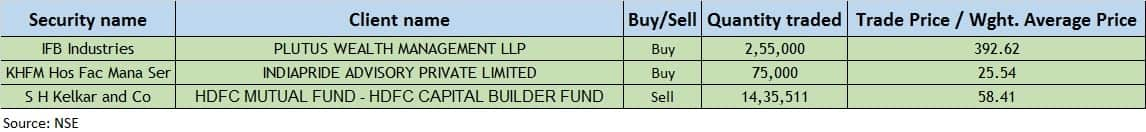

Bulk deals

(For more bulk deals, click here)

Results on June 2

Britannia Industries, InterGlobe Aviation, Spandana Sphoorty Financial, Sun Pharma Advanced Research Company, Motherson Sumi Systems, Dhampur Sugar Mills, Dolat Investments, Granules India, Marksans Pharma, Transport Corporation of India, Tata Teleservices, Vishnu Chemicals and Zydus Wellness.

Stocks in the news

IFB Industries: Plutus Wealth Management bought 255,000 shares at Rs 392.62 per share.

NCC: Aditya Birla Sun Life Insurance Company bought 40,00,000 shares at Rs 25.92 per share.

SREI Infrastructure: Fidelity Investment Trust sold 29,00,000 shares at Rs 4.37 per share.

Supreme Petrochem: Supreme Petrochem bought 5,34,000 shares at Rs 161.65 per share.

TVS Motor Company sold 58,906 units in May. Two and three-wheeler sales came in at 56,218 and 2,688 units, respectively.

Hero MotoCorp: Total sales at 1.12 lakh units in May included domestic sales of 1.08 lakh units.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 1,575.46 crore, while domestic institutional investors (DIIs) sold shares worth Rs 459.25 crore in the Indian equity market on June 1, provisional data available on the NSE showed.

Stock under F&O ban on NSE

No stock is under the F&O ban for June 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!