The market closed the last session of the year on a flat note on December 31 with Nifty holding 10,850 levels amid rangebound trade. The benchmark indices also ended flat in December.

The 30-share BSE Sensex was down 8.39 points at 36,068.33 while the 50-share NSE Nifty gained 2.60 points at 10,862.50, forming formed bearish candle on the daily charts as it closed lower than its opening levels.

The Nifty opened higher but remained sideways throughout the trading session amid thin volumes. The index breached above the 78.6 percent retracement level of 10,889 shortly, before closing below this level.

"In the near term, 10,778-10,765 is a crucial support zone on the way down. The bears will gain momentum once the index breaks and sustains below 10,765," Gaurav Ratnaparkhi, Senior Technical Analyst, Sharekhan by BNP Paribas, told Moneycontrol.

He said on the way up, 10,985 will act as strong resistance in the forthcoming trading sessions.

According to him, the charts suggest that the index could correct in the near term if it does not break above 10,985. Overall, he maintained bearish outlook on the index for the short term with a target of 10,005 and a reversal at 11,140.

The broader markets outperformed frontliners as the Nifty Midcap index gained 0.5 percent and Smallcap 0.77 percent. All sectoral indices closed in the green barring FMCG and realty.

The coming few sessions are expected to be volatile amid thin volumes but the year 2019 is expected to be volatile amid elections, earnings and macro factors, experts said.

"We expect low volumes during the week, as worldwide financial markets are closed on Tuesday," said Hemang Jani, Head - Advisory, Sharekhan by BNP Paribas said.

Back home, investors will closely track December auto sales data, to be released on January 1, macro data like Nikkei Manufacturing PMI & services PMI and Q3FY19 earnings starting next week, he added.

For the year 2019, Jani said movement in crude oil & currency, revival of corporate earnings, Union budget and general elections along with trade war & slowdown in global economy are the factors that will decide the trend of the market.

He believes long term investors can use volatility in the market to their advantage and accumulate stocks which have clear earning visibility.

We have collated top 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

The Nifty closed at 10,862.55 on December 31. According to Pivot charts, the key support level is placed at 10,835.97, followed by 10,809.43. If the index starts moving upward, key resistance levels to watch out are 10,906.27 and then 10,950.03.

Nifty Bank

The Nifty Bank index closed at 27,160.20, up 34.95 points on December 31. The important Pivot level, which will act as crucial support for the index, is placed at 27,081.3, followed by 27,002.4. On the upside, key resistance levels are placed at 27,262.8, followed by 27,365.4.

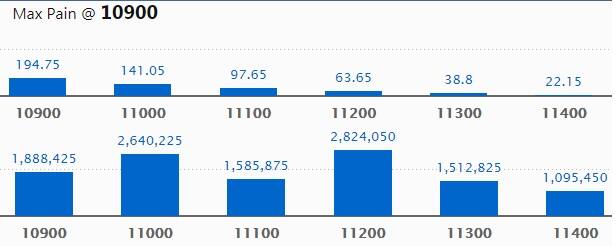

Call Options Data

Maximum Call open interest (OI) of 28.24 lakh contracts was seen at the 11,200 strike price. This will act as a crucial resistance level for the January series.

This was followed by the 11,000 strike price, which now holds 26.40 lakh contracts in open interest, and 10,900, which has accumulated 18.88 lakh contracts in open interest.

Meaningful Call writing was seen at 11,400, which added 3.59 lakh contracts, followed by 11,300 strike which added 3.39 lakh contracts and 10,900 strike which added 2.77 lakh contracts.

Call unwinding was seen at 10,800 strike, which shed 0.74 lakh contracts, followed by 10,600 strike which shed 0.32 lakh contracts.

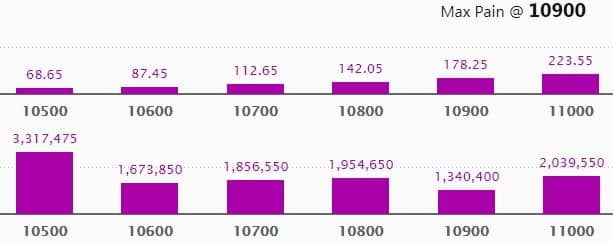

Put Options data

Maximum Put open interest of 33.17 lakh contracts was seen at the 10,500 strike price. This will act as a crucial support level for the January series.

This was followed by the 11,000 strike price, which now holds 20.39 lakh contracts in open interest, and the 10,800 strike price, which has now accumulated 19.54 lakh contracts in open interest.

Significant Put writing was seen at the strike price of 10,700, which added 4.01 lakh contracts, followed by 10,900 strike which added 2.35 lakh contracts and 10,800 strike which added 1.92 lakh contracts.

Put unwinding was seen at the strike of 11,000, which shed 1.82 lakh contracts.

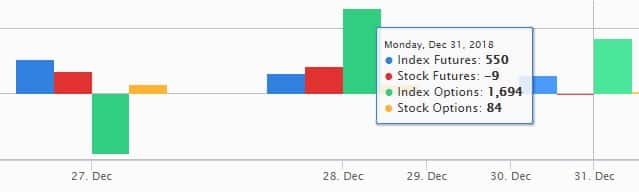

FII & DII data

Foreign Institutional Investors (FIIs) sold shares worth Rs 326.87 crore while Domestic Institutional Investors bought Rs 321.98 crore worth of shares in the Indian equity market on December 31, as per provisional data available on the NSE.

Fund Flow Picture

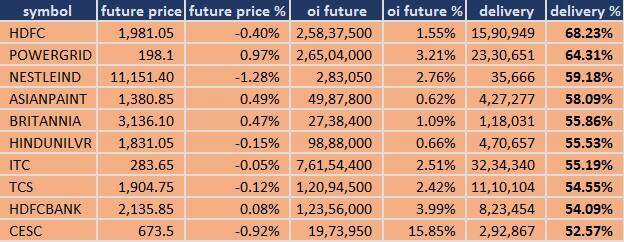

Stocks with high delivery percentage

High delivery percentage suggests that investors are accepting delivery of the stock, which means that investors are bullish on it.

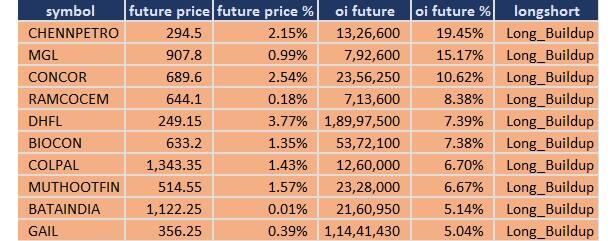

73 stocks saw a long buildup

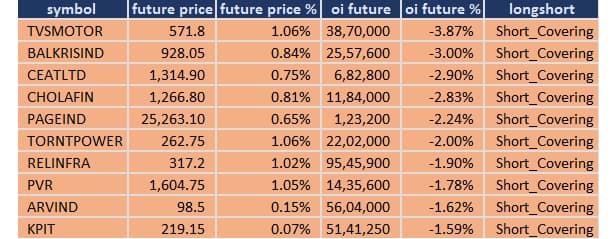

47 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

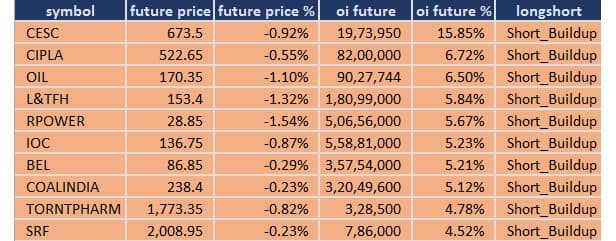

52 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

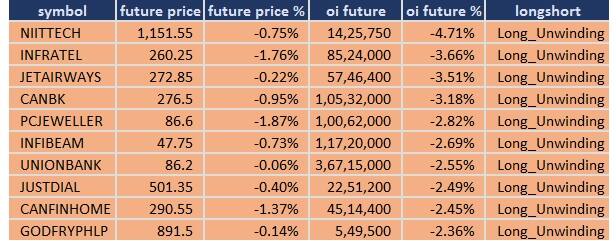

28 stocks saw long unwinding

Bulk Deals on December 31

Agro Phos India: D K Investments sold 1,02,000 shares of the company at Rs 50.82 per share on the NSE.

Hindustan Construction Company: Arya Capital Management Pvt Ltd bought 1,45,73,602 shares of the company at Rs 11.87 per share on the NSE.

Jayashree Tea: Manav Investment and Trading Company sold 1,80,000 shares of the company at Rs 87.78 per share on the NSE.

(For more bulk deals, click here)

Analyst or Board Meet/Briefings

Tata Consultancy Services: Board meeting will be held on January 10 to take on record the audited financial results under Indian Accounting Standards (Ind AS) for the quarter and nine months ending December 2018 (Q3).

Nintec Systems: Board meeting is scheduled on January 10.

Banswara Syntex: Company's officials will be meeting investors/analyst on January 2 and 4.

Godrej Consumer Products: Board meeting is scheduled to be held on January 29 to take on record the unaudited financial results for the quarter ended December 31, 2018 (Q3); and to consider declaration of interim dividend.

Timex Group India: Board meeting is scheduled on February 7 to consider the un-audited financial results of the company for the quarter ending on December 2018.

HDFC Asset Management Company: Board meeting is scheduled on January 21 to consider the unaudited financial results of the company for the third quarter ending December 2018.

GIC Housing Finance: Board meeting is scheduled on February 1 to consider the un-audited (provisional) financial results for the third quarter/nine month ended on December 2018.

Bajaj Corp: Board meeting is scheduled to be held on January 9 to consider the un-audited financial results of the company (Standalone) for the third quarter ending December 2018 (Q3).

Shree Digvijay Cement: Board meeting is scheduled on January 23 to consider the un-audited financial results for the quarter / nine months year ending December 2018.

Rane (Madras): Board meeting has been scheduled to be held on January 22 to consider the unaudited financial results (standalone & consolidated) for the quarter and nine months ending December 2018 and declare dividend, if any.

Cigniti Technologies: Board meeting is scheduled on January 31 to consider the quarter and nine month ended 31.12.2018 results on consolidated and standalone basis.

HDFC Standard Life Insurance Company: Board meeting is scheduled on January 22 to consider the audited standalone financial results of the company for the quarter and nine months ended December 2018.

Rane Holdings: Board meeting is scheduled to be held on February 7 to consider the unaudited financial results (standalone and consolidated) for the quarter and nine months ending December 2018 and declare dividend, if any.

Shriram Transport Finance: The company is considering raising of funds through various options of borrowings including by way of issue of securities in onshore/offshore market by public issue and private placement basis. Based on the market conditions the meeting(s) of Banking and Finance Committee/Debt Issuance Committee - Public NCDs / Bond Issuance Committee will be held during the next month ending January 2019 to consider and approve the terms and conditions of issue of securities.

Dabur India: Board meeting is scheduled on January 31 to consider the unaudited financial results for the quarter/nine months ended on December 2018.

Stocks in news

HDFC: Company increased its retail prime lending rate by 10 basis points.

IL&FS Transportation Networks: Interest due and payable on December 31, 2018 on the NCDs was not paid to the debenture holders due to insufficient funds.

Jindal Steel & Power: Naushad Akhter Ansari, CEO of the company has been designated as the Joint Managing Director.

Aavas Financiers: Members of the company approved the re-appointment of Sushil Kumar Agarwal as Whole Time Director and Chief Executive Officer for five years.

Dynamatic Technologies: Company executed a Business Transfer Agreement with Hi-Tech Arai Private Limited (Purchaser) for divestment of auto division and company will receive Rs 40 crore.

Tirupati Sarjan: Dilipbhai Ganeshbhai Patel resigned as a Chief Financial Officer (CFO) of the company.

Kolte-Patil Developers: CRISIL reaffirmed long term rating to A+ and revised outlook to positive from stable for bank loan facilities.

Kalpataru Power Transmission and JMC Projects: JMC Projects (India) has secured new orders of Rs 596 crore.

Bank of Maharashtra: Bank received the equity capital of Rs 4,498 crore from government.

Central Bank of India: Bank has received Rs 1,678 crore by making preferential allotment of shares to government.

UCO Bank: The bank has received Rs 3,076 crore by making preferential allotment of shares to government.

Centrum Capital: Company's subsidiary, Centrum Financial Services Limited, has successfully acquired the supply chain finance business of L&T Finance Limited (Business), consisting of an asset book of about Rs 650 crore.

Piramal Enterprises: ICRA has assigned credit rating for long term principal protected market linked debentures.

Aarey Drugs & Pharmaceuticals: Board approved the reappointment of Mihir Rajesh Ghatalia as the Managing Director of the company.

Adani Transmission: Company and KEC International mutually agreed to extend the completion date (Long Stop Date) to January 31, 2019 for acquisition of KEC Bikaner Sikar Transmission Private

Limited.

Premier: Company has, with the consent of its secured lenders, entered into a term sheet for the sale of its property at Chinchwad, Pune, with Runwal Realty Pvt.Ltd.

Balrampur Chini Mills: Board has reconstituted the audit committee of the board effective January 1.

Alfa Transformers: Company received a letter of award valuing Rs 3.82 crore from one of reputed customer Odisha Power Transmission Corporation Limited.

HPL Electric & Power: Company issued commercial paper of Rs 80 crore.

Adani Ports: Adani Petroleum Terminal Private Limited, Adani Dhamra LPG Terminal Private Limited and Mundra LPG Terminal Private Limited have ceased to be subsidiaries and Dhamra LNG Terminal Private Ltd has ceased to be step down subsidiary of the company.

Lupin: Company receives FDA approval for Clobazam Oral Suspension, 2.5 mg/mL.

Action Construction Equipment: ICRA assigned a long-term rating of AA- with a stable outlook and a short-term rating of A1+ to the Rs 295 crore bank facilities of the company.

IOC: Company to cut non-subsidised LPG price by Rs 120.5 per cylinder.

Fortis Healthcare: Company appoints BSR & Co as auditor.

1 stock under ban period on NSE

Securities in ban period for the next day's trade under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

For January 1, Adani Power is present in this list.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.