The market recouped more than half of its previous day's losses on September 29, the first day of the October F&O series. The Nifty50 closed within the previous day's range and formed a bullish candlestick pattern on the daily charts, known commonly as bullish harami pattern, at the downtrend, indicating the possibility of a rise in the coming sessions.

The index consistently faced resistance at the 19,750 levels, which is expected to be crucial for further upside going forward, but failure to do the same can drag it towards 19,500 again, experts said.

The BSE Sensex climbed 320 points to 65,828, and the Nifty50 gained 115 points to 19,638, after a day of steep fall.

"The Nifty has formed a bullish harami candle on the daily chart. The index took support from the 50-day exponential moving average (DEMA) of 19,562 and moved up steadily," Ashwin Ramani, derivatives and technical analyst at SAMCO Securities, said.

He further said that strong Put writing was observed at the 19,500 and 19,600 strikes that led to an up-move in the Nifty. The 19,500 level on the downside and the 19,800 level on the upside are the two key levels to track in the Nifty, and a decisive break on either side will provide cues about the future direction in the index, he feels.

The broader markets rebounded sharply with the Nifty Midcap 100 and Smallcap 100 indices rising a percent each on positive breadth, which was in the 2:1 ratio, while the India VIX, which measures the expected volatility for next 30 days in the Nifty50, fell 10.68 percent to 11.45 levels from 12.82 levels, supporting the bullish sentiment.

The market was shut on October 2 for Mahatma Gandhi Jayanti.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 19,572, followed by 19,530 and 19,463. On the higher side, 19,705 can be an immediate resistance, followed by 19,747 and 19,814.

On September 29, the Bank Nifty recovered almost all its previous day's losses and closed with 284 points gains at 44,585, forming a bullish candlestick pattern with a long upper shadow and minor lower shadow on the daily timeframe.

Further, the bulls defended the key support level at 44,200. However, challenges persist as the 20-day moving average (20DMA) at 45,000 continues to act as a strong resistance. The index appears to be consolidating within a range, with levels of 44,200 on the downside and 45,000 on the upside defining this range, Kunal Shah, senior technical and derivative analyst at LKP Securities, said.

He feels a decisive break on either side of this range will likely trigger fresh trending moves.

As per the pivot point calculator, the banking index is expected to take support at 44,405, followed by 44,308 and 44,151. On the upside, the initial resistance is at 44,718, then at 44,815 and at 44,972.

The weekly options data suggested that the maximum Call open interest (OI) was seen at 19,800 strike with 86.67 lakh contracts, which can act as a key resistance for the Nifty. It was followed by the 19,700 strike, which had 67.25 lakh contracts, while 20,200 strike had 61.36 lakh contracts.

Meaningful Call writing was seen at 19,800 strike, which added 31.86 lakh contracts followed by 20,200 and 20,100 strikes, which added 27.85 lakh and 11.28 lakh contracts.

The maximum Call unwinding was at 19,500 strike, which shed 4.72 lakh contracts followed by 19,600 strike and 19,400 strike, which shed 4.46 lakh contracts and 1.25 lakh contracts.

On the Put side, the maximum open interest was at 19,600 strike with 71.38 lakh contracts. This can be an important support for the Nifty in the coming sessions.

It was followed by 19,500 strike, comprising 64.70 lakh contracts and 19,000 strike with 45.38 lakh contracts.

The meaningful Put writing was at 19,600 strike, which added 37.97 lakh contracts, followed by 19,500 strike and 19,400 strike, which added 17.27 lakh and 15.61 lakh contracts.

Put unwinding was at 19,200 strike, which shed 6.05 lakh contracts, followed by 20,100 strike and 20,200 strike, which shed 40,450 and 16,000 contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. ICICI Lombard General Insurance Company , Godrej Consumer Products, Samvardhana Motherson International, Bharti Airtel, and Grasim Industries have seen the highest delivery among the F&O stocks.

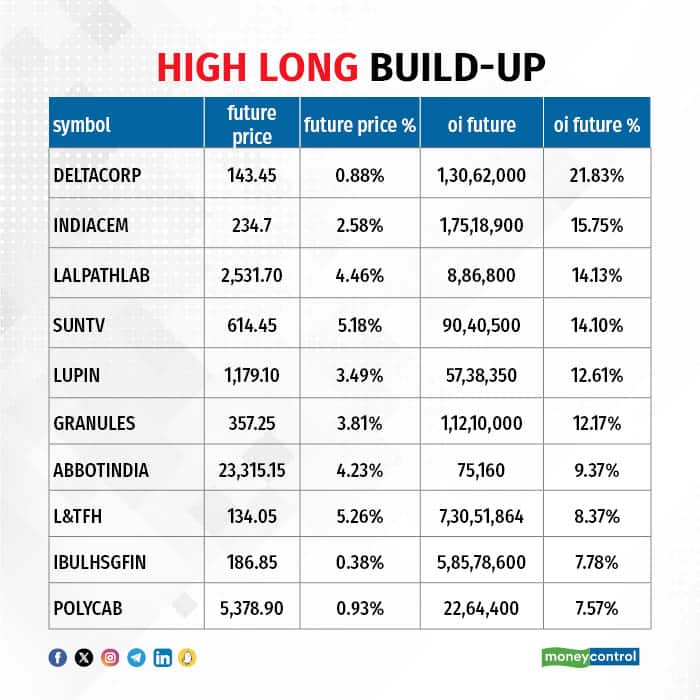

A long build-up was seen in 81 stocks namely, Delta Corp, India Cements, Dr Lal PathLabs, Sun TV Network, and Lupin. An increase in open interest (OI) and price indicates a build-up of long positions.

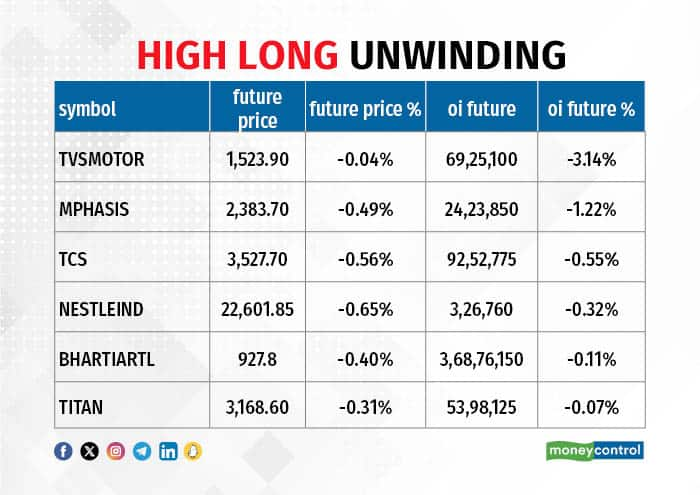

Based on the OI percentage, a total of six stocks, including TVS Motor Company, Mphasis, TCS, Nestle India, and Bharti Airtel saw long unwinding. A decline in OI and price indicates long unwinding.

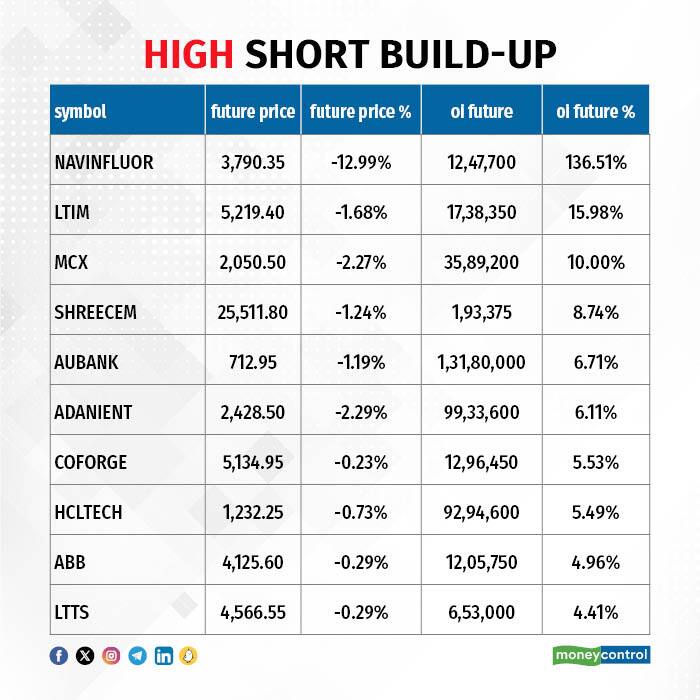

23 stocks see a short build-up

A short build-up was seen in 23 stocks, including Navin Fluorine International, LTIMindtree, MCX India, Shree Cements, and AU Small Finance Bank. An increase in OI along with a fall in price points to a build-up of short positions.

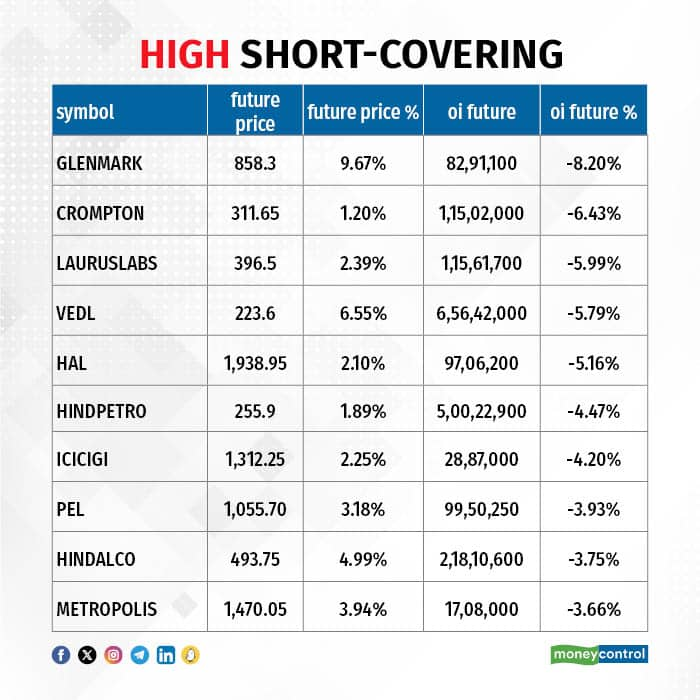

Based on the OI percentage, 77 stocks were on the short-covering list. These included Glenmark Pharma, Crompton Greaves Consumer Electricals, Laurus Labs, Vedanta, and Hindustan Aeronautics. A decrease in OI along with a price increase is an indication of short-covering.

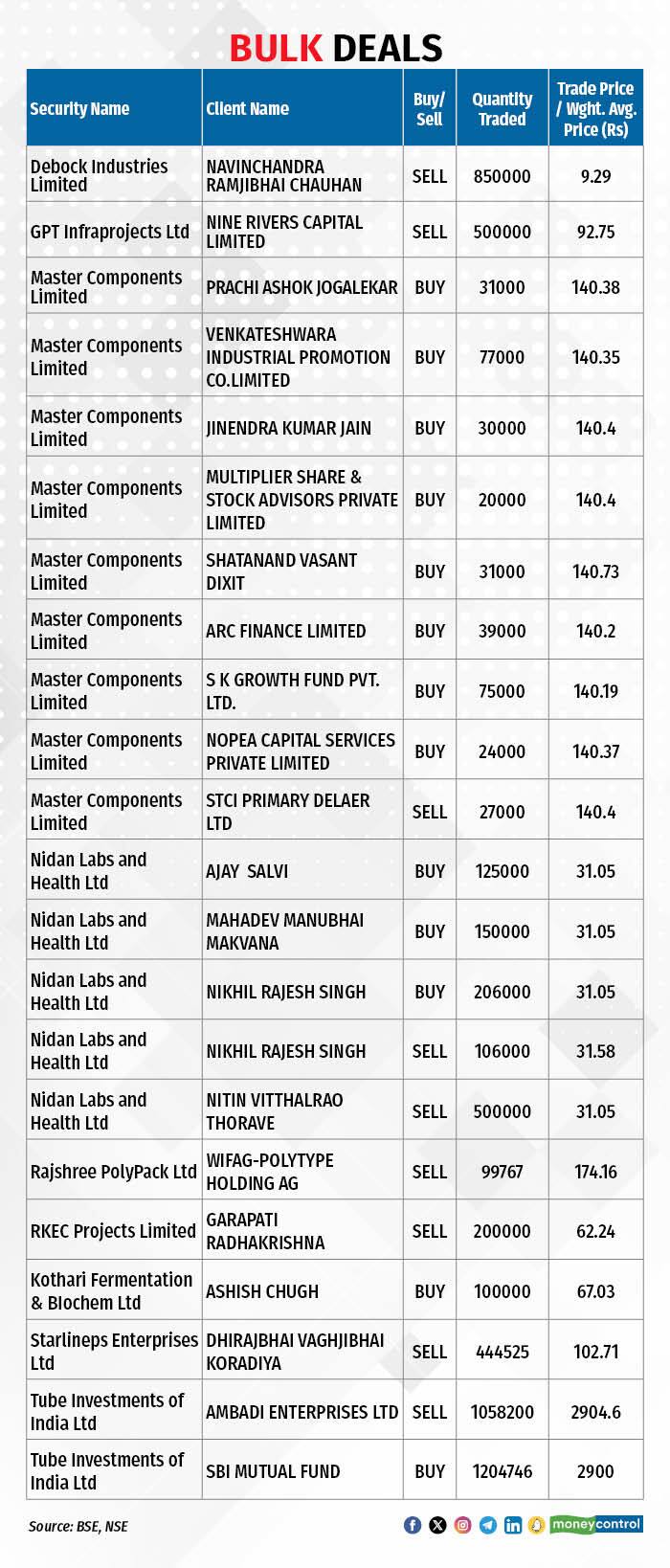

For more bulk deals, click here

Investors meeting on October 3

Stocks in the news

Stocks in the news

Vedanta: India's largest diversified natural resources company announced a plan to demerge its business units into independent pure play companies to unlock value and attract big-ticket investment into the expansion and growth of each of the businesses. It has received the board approval for a pure-play, asset-owner business model that will result in six separate listed companies namely, Vedanta Aluminium, Vedanta Oil & Gas, Vedanta Power, Vedanta Steel and Ferrous Materials, Vedanta Base Metals, and Vedanta. The de-merger is planned to be a simple vertical split, for every share of Vedanta, the shareholders will additionally receive one share each of the five newly listed companies.

JSW Infrastructure: India's second largest commercial port operator will make its debut on the bourses in the T+3 timeline on October 3. The final issue price has been fixed at Rs 119 per share, while the date of allotment of IPO shares was September 28. It was supposed to list on October 6.

Vaibhav Jewellers: The Andhra Pradesh-based jewellery retailer has preponed its listing date to October 3, from October 6 earlier, making the debut in T+3 timeline. The issue price has been finalised at Rs 215 per share, while the date of allotment of IPO shares was September 28.

Hero MotoCorp: The world's largest two-wheeler maker has decided to make a marginal revision in the ex-showroom prices of select motorcycles and scooters, effective from October 3, 2023. The price increase will be around 1 percent and the exact quantum of increase will vary by specific models and markets.

Kalpataru Projects International: The EPC company and its international subsidiaries have secured new orders amounting to Rs 1,016 crore including orders in the transmission & distribution business of Rs 552 crore.

Rail Vikas Nigam: RVNL emerged as the lowest bidder for the development of distribution infrastructure at South Zone of Himachal Pradesh under the Revamped Reforms based and Results-linked, Distribution Sector Scheme (loss reduction works). The said project worth Rs 1,098 crore will be executed within 24 months.

Indus Towers: Indus Towers has signed an agreement with IOC Phinergy (IOP) for deployment of 300 zero-emission energy systems based on aluminium-air technology, to optimize diesel consumption at Indus’ telecom tower sites. This development accelerates Indus Towers’ progress towards its sustainability priorities. IOC Phinergy will supply 300 energy systems which will be deployed in the next few quarters as a pilot project.

Fund Flow (Rs Crore)

Foreign institutional investors (FII) sold shares worth Rs 1,685.70 crore, while domestic institutional investors (DII) bought Rs 2,751.49 crore worth of stocks on September 29, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has not added any stock to its F&O ban list for October 3. Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.