After a day of robust pullback rally, the market traded volatile throughout the session amid lack of follow-through buying activity and ended moderately lower on September 22. Select banking and financials and FMCG weighed down on the market, whereas the buying in IT, and Metals capped the downside.

The BSE Sensex fell 77.94 points to 58,927.33, while the Nifty50 declined 15.30 points to 17,546.70 and formed a bearish candle on the daily charts as the closing was lower than opening levels.

"Post muted opening the Nifty hovered in the range of 17,525-17,610 levels. It made a couple of attempts to clear the resistance of 17,600 but failed to clear the hurdle due to tepid global cues and lack of follow-through buying activity. The intraday trading setup suggests 17,600-17,625 levels would act as a key resistance level for the day traders and below the same, a quick intraday correction till 17,500-17,450 is not ruled out," said Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities.

He further said on the flip side, 17,625 could be the range breakout level for the day traders and above the same, the breakout continuation formation is likely to continue up to 17,665-17,700-17,725 levels.

However, the Nifty Midcap 100 and Smallcap 100 indices outperformed frontliners, rising 1.67 percent and 1.44 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,510.33, followed by 17,473.96. If the index moves up, the key resistance levels to watch out for are 17,596.73 and 17,646.77.

Nifty Bank

The Nifty Bank dipped 291.15 points to close at 36,944.70 on September 22. The important pivot level, which will act as crucial support for the index, is placed at 36,777.27, followed by 36,609.93. On the upside, key resistance levels are placed at 37,220.27 and 37,495.93 levels.

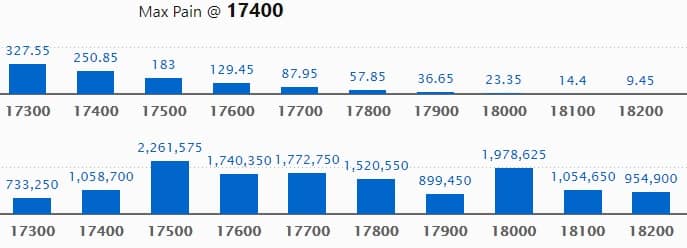

Call option data

Maximum Call open interest of 22.61 lakh contracts was seen at 17500 strike. This is followed by 18000 strike, which holds 19.78 lakh contracts, and 17700 strike, which has accumulated 17.72 lakh contracts.

Call writing was seen at 17500 strike, which added 3.53 lakh contracts, followed by 18100 strike, which added 3.09 lakh contracts and 17600 strike which added 2.93 lakh contracts.

Call unwinding was seen at 17400 strike, which shed 1.15 lakh contracts, followed by 17300 strike, which shed 58,850 contracts, and 17000 strike which shed 22,050 contracts.

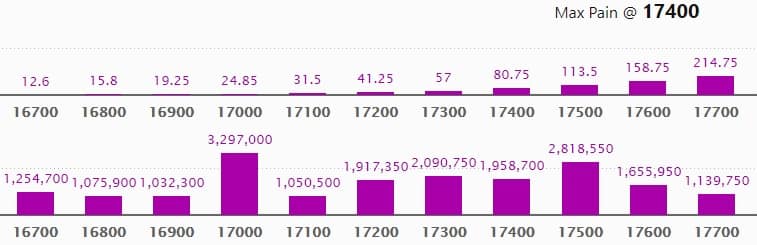

Put option data

Maximum Put open interest of 32.97 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the September series.

This is followed by 17500 strike, which holds 28.18 lakh contracts, and 17300 strike, which has accumulated 20.90 lakh contracts.

Put writing was seen at 17300 strike, which added 4.65 lakh contracts, followed by 17500 strike which added 3.54 lakh contracts, and 17600 strike which added 2.8 lakh contracts.

Put unwinding was seen at 18000 strike, which shed 14,500 contracts, followed by 17900 strike which shed 4,800 contracts and 18200 strike which shed 1,800 contracts.

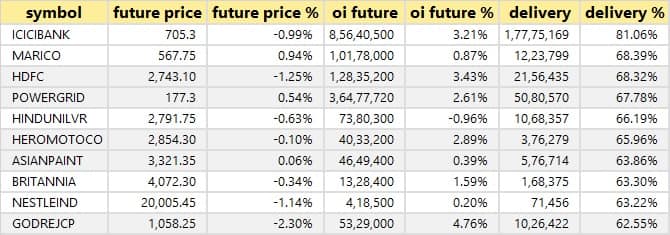

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

67 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

14 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

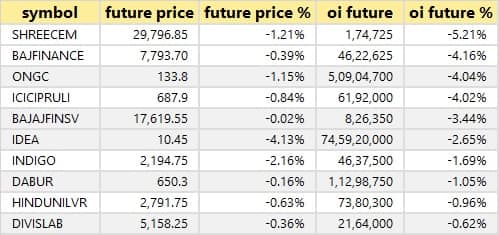

40 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

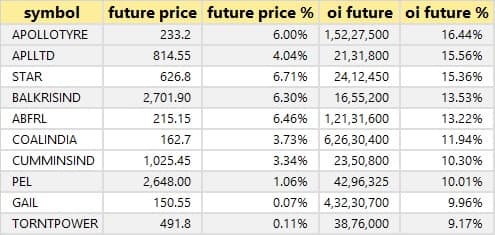

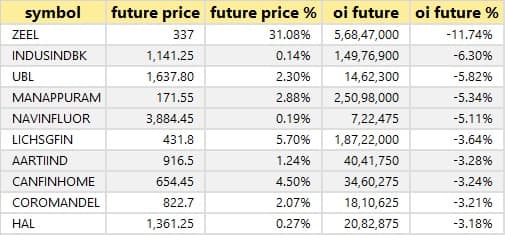

52 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen. The maximum short covering was seen in Zee Entertainment, followed by IndusInd Bank and United Breweries.

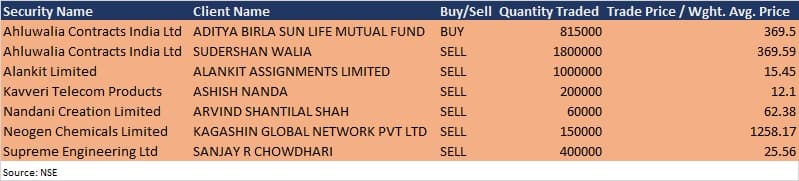

Bulk deals

Ahluwalia Contracts India: Aditya Birla Sun Life Mutual Fund acquired 8.15 lakh equity shares in the company at Rs 369.5 per share, whereas promoter Sudershan Walia sold 18 lakh shares in the company at Rs 369.59 per share on the NSE, the bulk deals data showed.

Alankit: Promoter Alankit Assignments sold 10 lakh shares in the company at Rs 15.45 per share on the NSE, the bulk deals data showed.

Kavveri Telecom Products: Investor Ashish Nanda sold 2 lakh equity shares in the company at Rs 12.1 per share on the NSE, the bulk deals data showed.

Neogen Chemicals: Investor Kagashin Global Network sold 1.5 lakh equity shares in the company at Rs 1,258.17 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Themis Medicare: The company's officials will meet Kotak PMS on September 23.

Gujarat Themis Biosyn: The company's officials will meet Kotak PMS on September 23.

GE Power India: The company's officials will meet Nippon Life India Trustee on September 23.

Timex Group India: The company's officials will meet Consortium Securities, Astute Investment Management, and Artha Ventures on September 23.

HPL Electric & Power: The company's officials will meet River Valley Asset Management, Singapore on September 23.

Yasho Industries: The company's officials will interact with investors and analysts on September 23.

Gulshan Polyols: The company's officials will meet Abakkus Asset Managers on September 23.

Indian Energy Exchange: The company's officials will meet Dhando Funds on September 23, and Perpetuity Ventures on September 27.

Shoppers Stop: The company's officials will meet analysts and investors in Phillip Capital (India) - Resurgent India Virtual Conference on September 23.

Godrej Consumer Products: The company's officials will meet analysts and investors on September 27 to discuss Indonesia business performance and strategy.

Stocks in News

Adani Ports and Special Economic Zone: The company has completed the acquisition of a 10.4 percent stake of Gangavaram Port from the government of Andhra Pradesh.

Varun Beverages: Varun Jaipuria, a part of the promoter group, sold 18 lakh shares in the company via an open market transaction on September 21.

Sarda Energy & Minerals: The company has approved a provisional tariff for the 113 MW hydropower project of subsidiary Madhya Bharat Power Corporation, considering 85 percent of the cost of the project incurred as of March 2021 with return on equity of 15.5 percent per annum.

Amtek Auto: BSE and National Stock Exchange of India approved the delisting of equity shares of the company pursuant to the resolution plan approved by NCLT. The company will delist from the exchanges w.e.f. September 27, 2021. Insolvency Professional of the company has appointed Ram Singh Poswal as Chief Executive Officer of the company.

Karda Constructions: Promoter Naresh Jagumal Karda sold 32.5 lakh shares in the company via open market transactions during September 20-21.

Jubilant Ingrevia: Subsidiary Jubilant Life Sciences International Pte. Limited, Singapore has divested its entire 10 percent stake held in Safe Foods Corporation for $18.2 million.

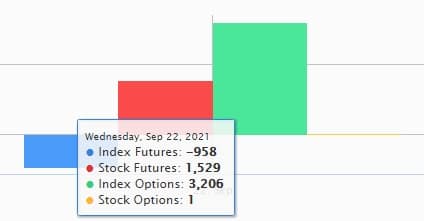

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,943.26 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,850.02 crore in the Indian equity market on September 22, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - Escorts, Indiabulls Housing Finance, Vodafone Idea, IRCTC, Punjab National Bank, and Sun TV Network - are under the F&O ban for September 23. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!