Considering the sharp recovery from day's low and consistently holding 21,500 mark on closing basis along with taking support at upward sloping support trendline, the Nifty 50 may see northward journey towards the hurdle of 21,700-21,850 area in coming sessions, but overall, the index still has been in the range of 300-400 points since the starting of the current month, experts said.

On January 10, the BSE Sensex jumped 272 points to 71,658, while the Nifty 50 was up 74 points at 21,619 and formed bullish candlestick pattern with long lower shadow on the daily timeframe, indicating buying interest at lower levels.

"Technically, this pattern indicates false downside breakout of the immediate support of 21,500 levels by an emergence of renewed buying from the lows," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

After closing below the immediate support of 10-day EMA (exponential moving average) at 21,550 in the last couple of sessions, Nifty failed to show any sharp follow-through weakness/decisive downside breakout and has bounced back smartly from the lower levels. This is positive indication, he feels.

Hence, he further feels the short-term trend of Nifty seems to have reversed up after a minor decline of the last two sessions. "The Nifty is now expected to retest the upper trajectory around 21,750-21,850 levels in the next few sessions. Immediate support is placed at 21,450 levels," Nagaraj said.

According to Kunal Shah, senior technical & derivative analyst at LKP Securities, if the index manages to close above 21,700-21,750 levels, then the index might see the Nifty reaching 22,000.

The fear index India VIX dropped further, down by 2.2 percent to 12.97 levels, giving the comfort for bulls.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty and Bank Nifty

The pivot point calculator indicates that the Nifty is likely to see immediate resistance at 21,636 followed by 21,689 and 21,763 levels, while on the lower side, it can take support at 21,496 followed by 21,450 and 21,377 levels.

On January 10, the Bank Nifty also rebounded sharply from day's low and closed with 118 points gains at 47,361. The banking index has formed bullish candlestick pattern on the daily timeframe and held on to its support of 47,000 mark, which is a positive sign, though there has been lower highs, lower lows formation for three days in a row.

"We expect the Bank Nifty to continue with the positive momentum going ahead. Initial hurdle is placed at 47,550 – 47,680 while support zone is placed at 47,100 – 47,000," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

As per the pivot point calculator, the Bank Nifty is expected to see resistance at the 47,399 level followed by 47,520 and 47,678 levels, while on the lower side, it may take support at 47,107 followed by 47,010 and 46,852 levels.

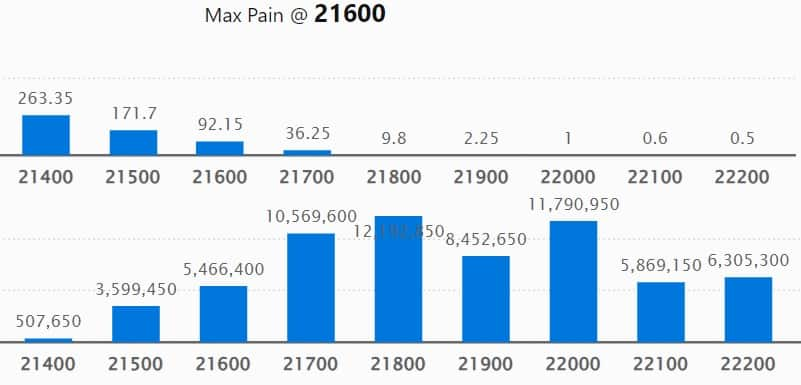

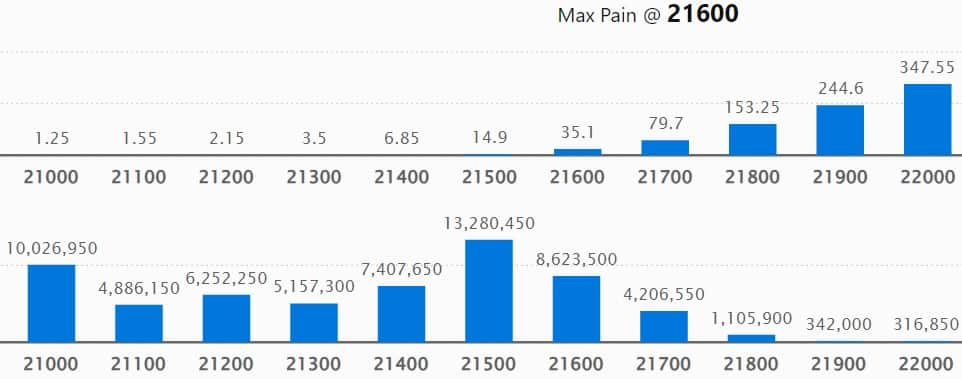

As per the weekly options data, the maximum Call open interest was seen at 21,800 strike, with 1.22 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,000 strike, which had 1.18 crore contracts, while the 21,700 strike had 1.06 crore contracts.

Meaningful Call writing was seen at the 21,800 strike, which added 46.77 lakh contracts followed by 22,000 and 21,900 strikes adding 45.13 lakh and 31.25 lakh contracts, respectively.

The maximum Call unwinding was at the 21,600 strike, which shed 20.67 lakh contracts followed by 22,100 and 22,400 strikes that shed 10.56 lakh and 4.83 lakh contracts.

On the Put front, the maximum open interest was seen at 21,500 strike, which can act as a key support area for the Nifty with 1.33 crore contracts. It was followed by 21,000 strike comprising 1 crore contracts and then 21,600 strike with 86.23 lakh contracts.

Meaningful Put writing was at 21,500 strike, which added 76.89 lakh contracts followed by 21,600 strike and 21,000 strike adding 52.24 lakh contracts and 40.39 lakh contracts, respectively.

The Put unwinding was seen at 22,000 strike, which shed 33,150 contracts followed by 21,800 strike and 21,900 strike, which shed 26,600 contracts and 26,400 contracts, respectively.

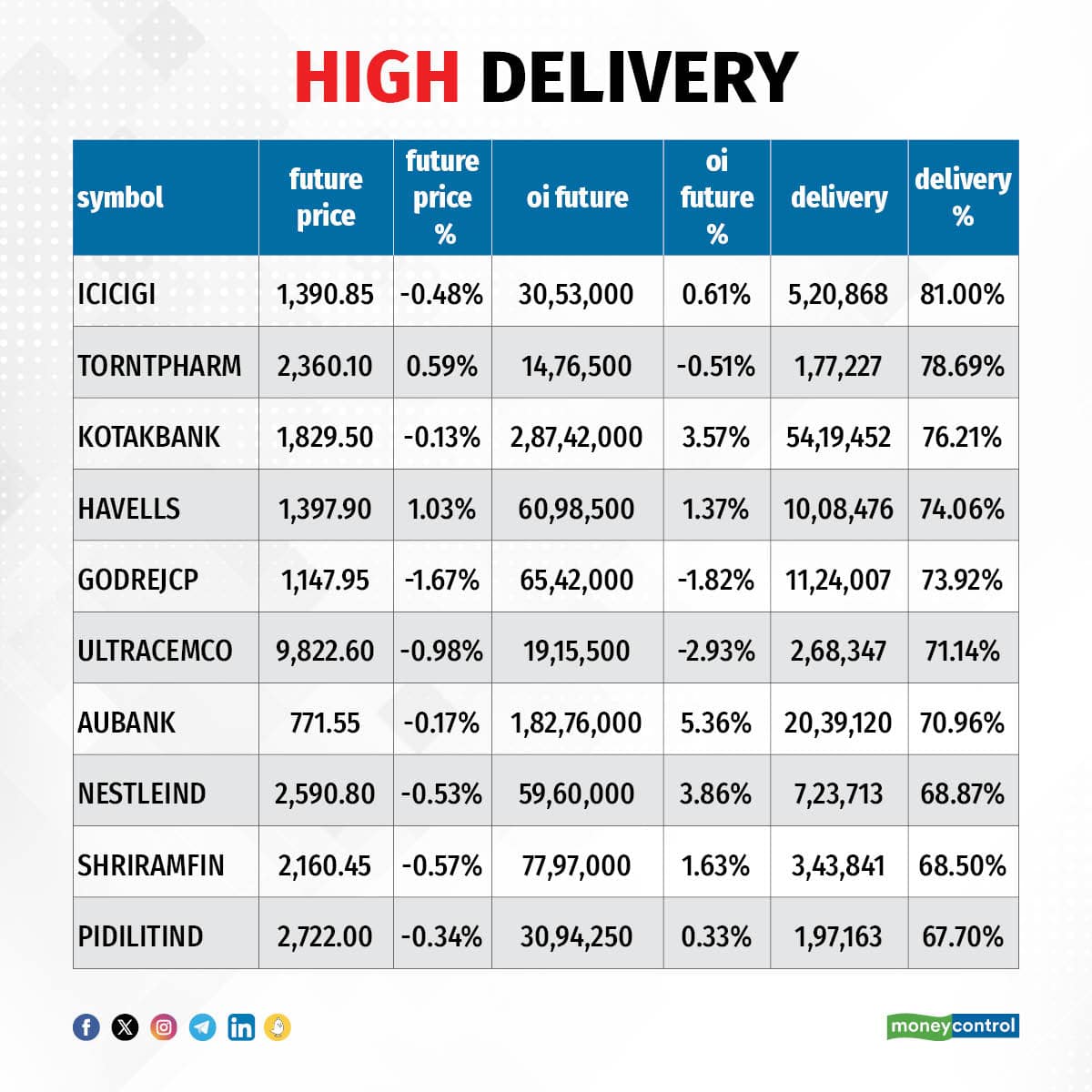

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. ICICI Lombard General Insurance Company, Torrent Pharmaceuticals, Kotak Mahindra Bank, Havells India, and Godrej Consumer Products saw the highest delivery among the F&O stocks.

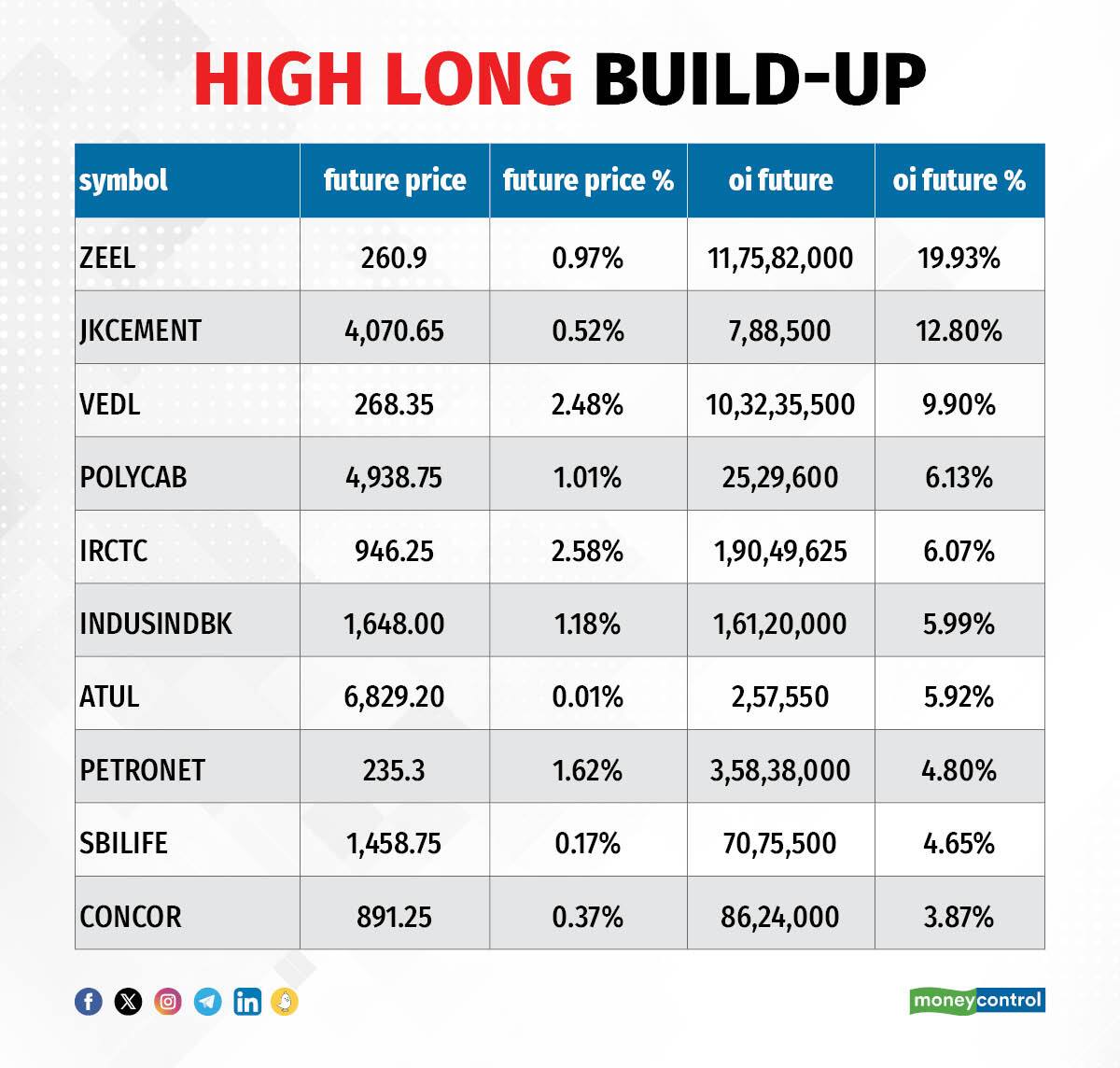

A long build-up was seen in 60 stocks, which included Zee Entertainment Enterprises, JK Cement, Vedanta, Polycab India, and IRCTC. An increase in open interest (OI) and price indicates a build-up of long positions.

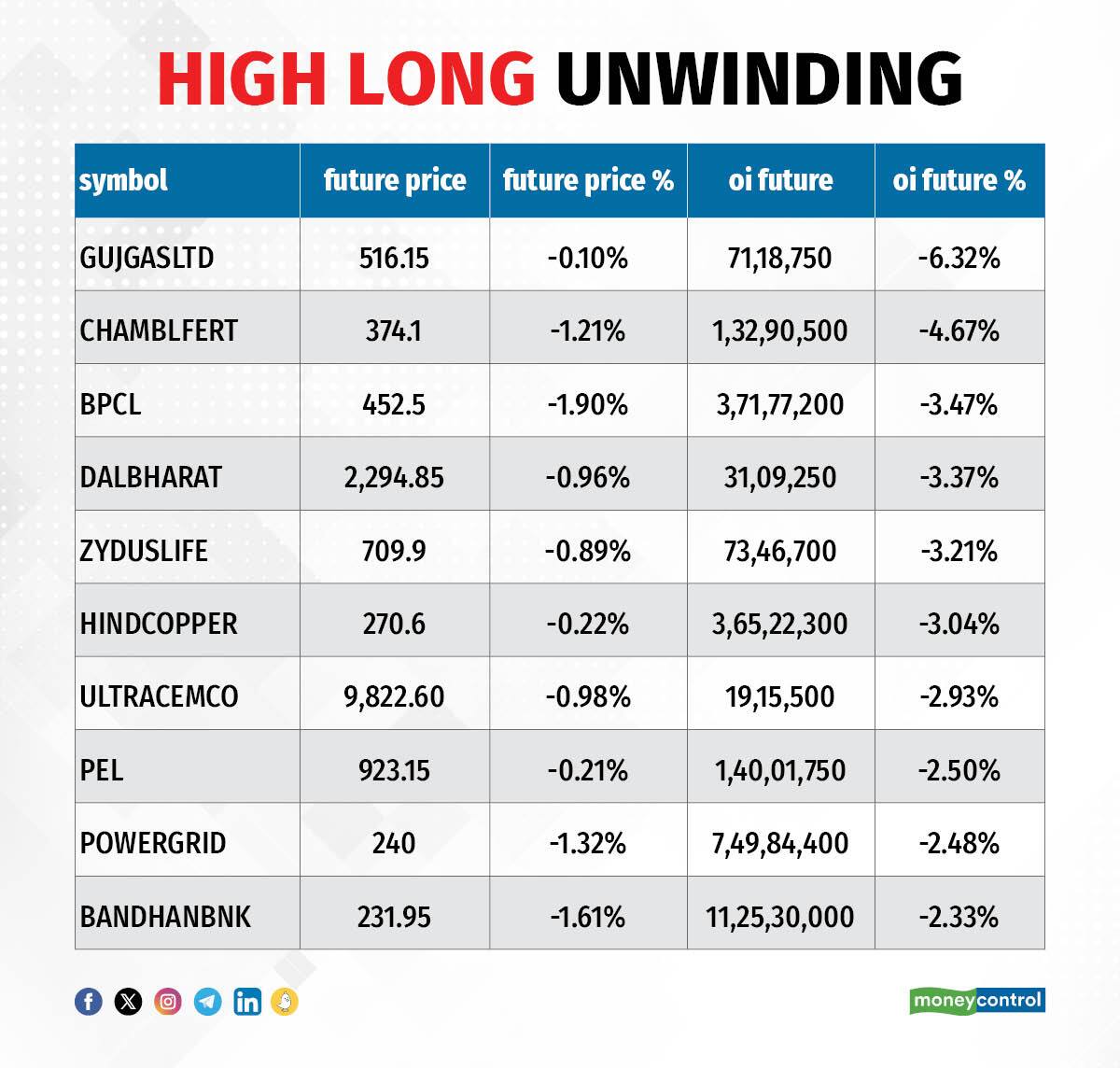

Based on the OI percentage, 38 stocks saw long unwinding, including Gujarat Gas, Chambal Fertilisers and Chemicals, BPCL, Dalmia Bharat, and Zydus Lifesciences. A decline in OI and price indicates long unwinding.

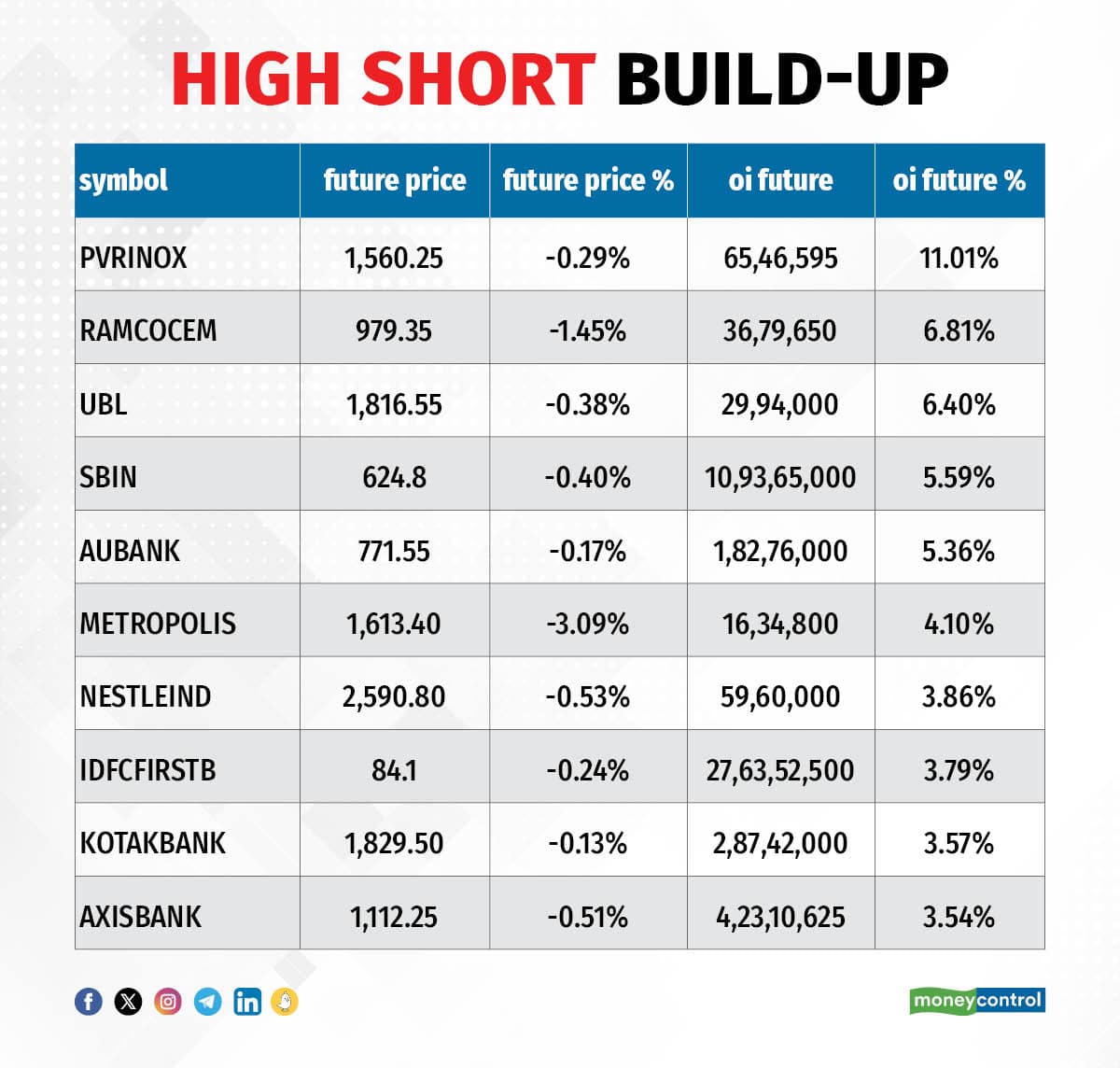

49 stocks see a short build-up

A short build-up was seen in 49 stocks including PVR INOX, Ramco Cements, United Breweries, State Bank of India, and AU Small Finance Bank. An increase in OI along with a fall in price points to a build-up of short positions.

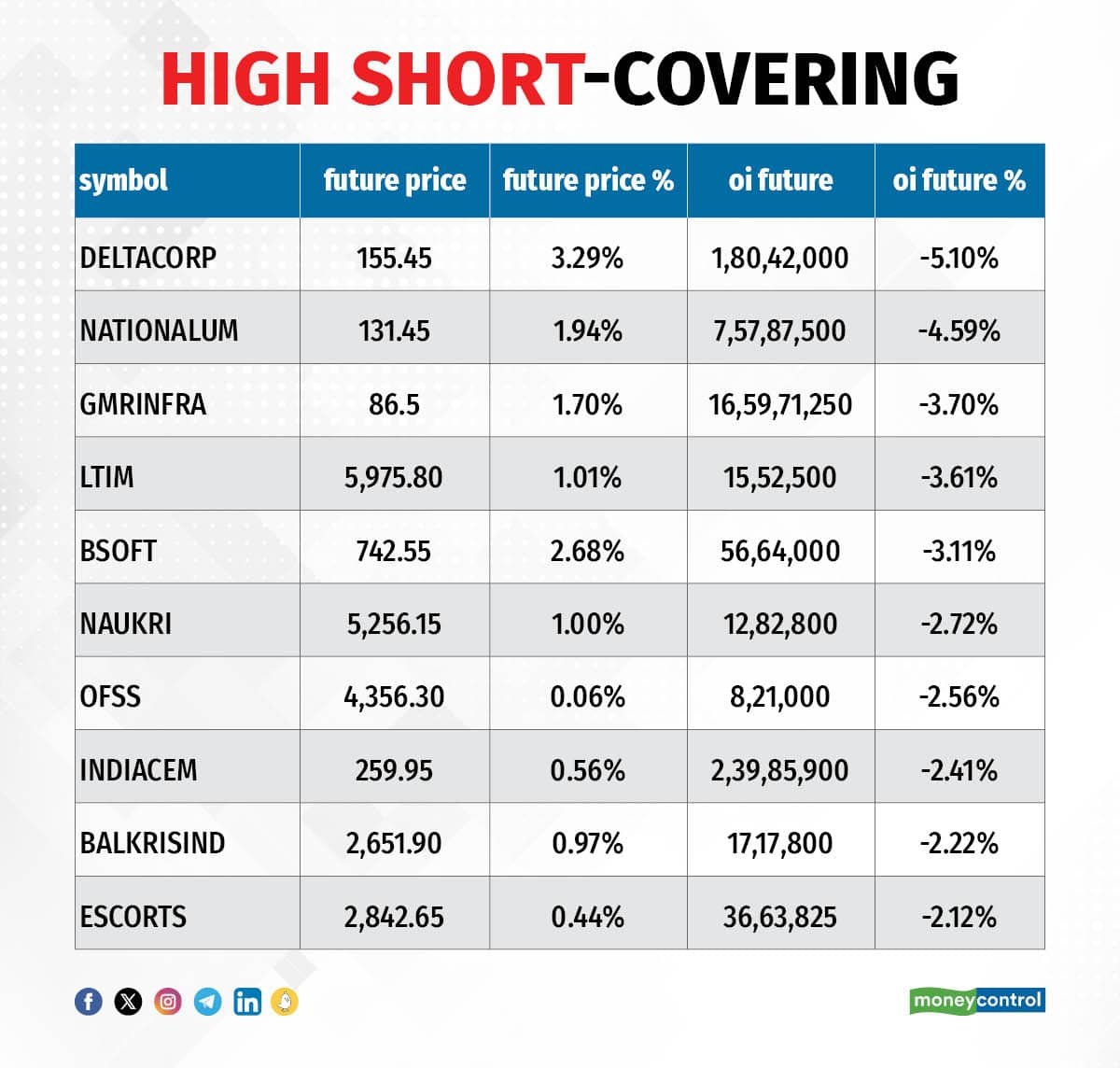

Based on the OI percentage, 38 stocks were on the short-covering list. This included Delta Corp, National Aluminium Company, GMR Airports Infrastructure, LTIMindtree and Birlasoft. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, climbed to 1.06 on January 10, from 0.88 levels in the previous session. The above 1 PCR indicates that the traders are buying more Puts options than Calls, which generally indicates an increase in bearish sentiment.

For more bulk deals, click here

Tata Consultancy Services, Infosys, HDFC Asset Management Company, 5paisa Capital, AGI Infra, Fundviser Capital (India), GTPL Hathway, Gujarat Hotels, Kenvi Jewels, Longview Tea Company, Mercury Trade Links, Plastiblends India, Pro Fin Capital Services, Quasar India, Rajoo Engineers, Sonalis Consumer Products, Shekhawati Poly-Yarn, and Vijay Textiles will be in focus ahead of quarterly earnings on January 11.

Stocks in the news

Phoenix Mills: Total consumption for the quarter ended December FY24 stood at Rs 3,287 crore, increasing 24 percent over a year-ago period. On a like-to-like basis, the consumption in Q3 FY24 grew by 4 percent over Q3 FY23. Gross retail collections at Rs 700 crore during the quarter increased 30 percent YoY.

Bank of India: The public sector lender registered a 9.9 percent on-year growth in total business at Rs 12.76 lakh crore in the quarter ended December FY24, with deposits increasing 8.66 percent to Rs 7.10 lakh crore and gross advances rising 11.49 percent to Rs 5.66 lakh crore.

Angel One: The board of directors of the brokerage company will be meeting on January 15 to consider a proposal for raising funds through issuance of non-convertible securities on private placement basis.

Safari Industries (India): The company's board of directors will meet on January 15 to consider the raising funds through issue of securities to one or more persons, on preferential basis.

Metro Brands: Deepika Deepti has resigned as Senior Vice President- Marketing of the company with effect from March 26, due to personal reasons. She was a part of the senior management of the company. Meanwhile, Alisha Malik, the President, who previously handled the marketing function, will oversee it on an interim basis until a successor is appointed.

Nuvama Wealth Management: Nuvama Asset Management, and Cushman & Wakefield announced the joint venture company namely Nuvama and Cushman & Wakefield Management (NCW) with equal share. NCW is planning to launch its first real estate fund – PRIME Offices Fund (PRIME) and aims to raise Rs 3,000 crore to invest in prime commercial offices across India’s high-growth markets.

Funds Flow (Rs crore)

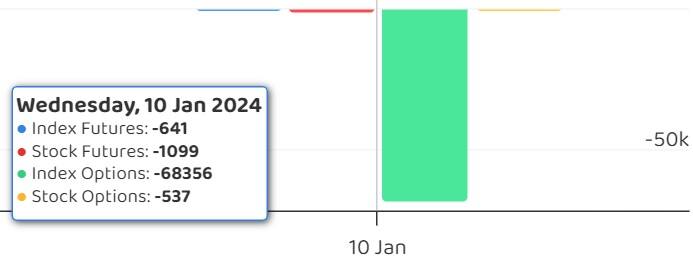

Foreign institutional investors (FIIs) sold shares worth Rs 1,721.35 crore, while domestic institutional investors (DIIs) purchased Rs 2,080.01 crore worth of stocks on January 10, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added Indus Towers, PVR INOX, and Zee Entertainment Enterprises to its F&O ban list for January 11, while retaining Balrampur Chini Mills, Bandhan Bank, Chambal Fertilisers & Chemicals, Escorts Kubota, Hindustan Copper, Indian Energy Exchange, India Cements, National Aluminium Company, Piramal Enterprises, and SAIL to the said list. Delta Corp, and GNFC (Gujarat Narmada Valley Fertilisers & Chemicals) removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!