The Sensex and Nifty ended in the green for the third consecutive session on May 21 supported by gains in heavyweights such as ITC, Tata Consultancy Services (TCS), Asian Paints, Maruti Suzuki and Reliance Industries (RIL).

The market witnessed mild bouts of volatility due to weekly F&O expiry. Eventually, Sensex closed the day 114 points, or 0.37 percent, higher at 30,932.90 and the Nifty finished with a gain of 40 points, or 0.44 percent, at 9,106.25.

Market participants told Moneycontrol that if the Nifty manages to sustain above 9,150 levels, then we may see a bounce towards 9,300-9,350 zone.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for Nifty

According to pivot charts, the key support level for Nifty is placed at 9,048.72, followed by 8,991.18. If the index moves up, key resistance levels to watch out for are 9,171.17 and 9,236.08.

Nifty Bank

The Nifty Bank closed 0.59 percent lower at 17,735.10. The important pivot level, which will act as crucial support for the index, is placed at 17,528.9, followed by 17,322.7. On the upside, key resistance levels are placed at 18,071 and 18,406.9.

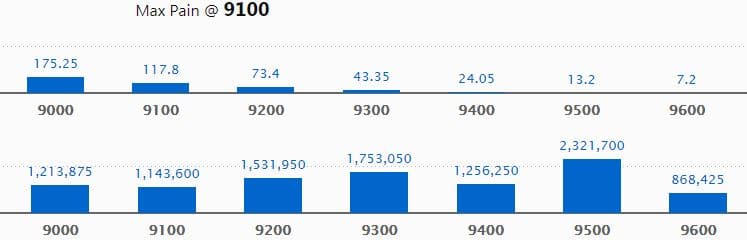

Call option data

Maximum call OI of 23.22 lakh contracts was seen at 9,500 strike, which will act as crucial resistance in the May series.

This is followed by 9,300, which holds 17.53 lakh contracts, and 9,200 strikes, which has accumulated 15.32 lakh contracts.

Significant call writing was seen at the 9,100, which added 5.18 lakh contracts, followed by 9,500 strikes that added 5.15 lakh contracts.

Call unwinding was witnessed at 9,000, which shed 92,625 contracts, followed by 8,800 strike, which shed 49,575 contracts.

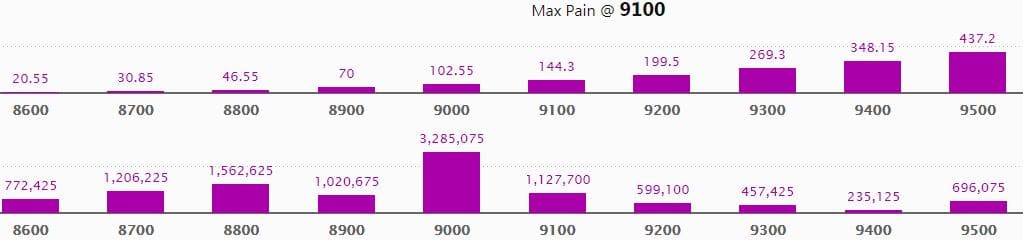

Put option data

Maximum put OI of 32.85 lakh contracts was seen at 9,000 strike, which will act as crucial support in the May series.

This is followed by 8,800, which holds 15.63 lakh contracts, and 8,700 strikes, which has accumulated 12.06 lakh contracts.

Significant put writing was seen at 9,000, which added 7.24 lakh contracts, followed by 9,100 strikes, which added 6.77 lakh contracts.

Put unwinding was seen at 9,500, which shed 24,150 contracts.

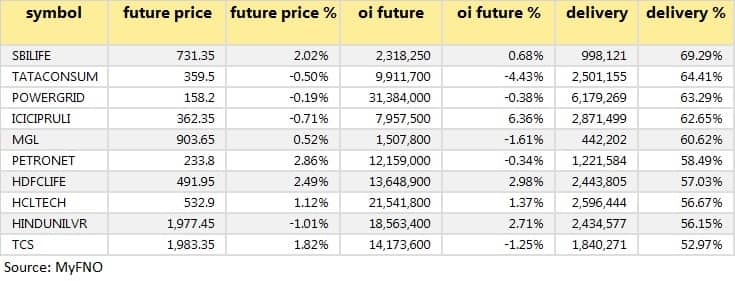

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

46 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

23 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

45 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

31 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

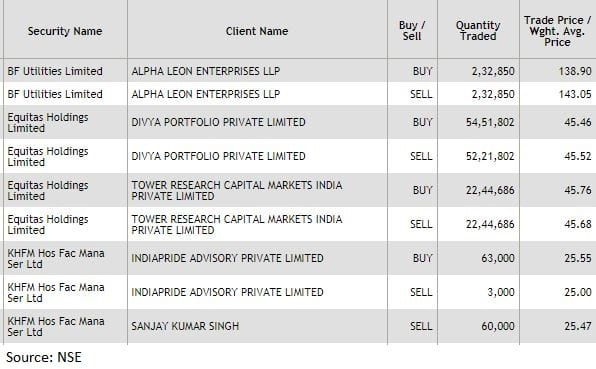

Bulk deals

(For more bulk deals, click here)

Results on May 22

Alembic Pharmaceuticals, IDFC First Bank, UPL, 3i Infotech, BASF India, Bayer Cropscience, Bosch, Essel Propack, Godrej Industries, Honeywell Automation, JSW Steel, Neuland Laboratories, Orient Cement, Supreme Industries, Trent, Vesuvius India, Wabco India, and Xchanging Solutions.

Stocks in the news

Quick Heal Technologies Q4: Profit at Rs 8 crore versus Rs 27.7 crore, revenue at Rs 64.25 crore versus Rs 86 crore YoY.

VST Industries Q4: Profit at Rs 70.61 crore versus Rs 53.03 crore, revenue at Rs 350 crore versus Rs 294 crore YoY.

Nahar Spinning: Company's manufacturing facilities in Punjab and Madhya Pradesh have partially resumed operations.

Automotive Axles: Offices and manufacturing have resumed at Jamshedpur and Hosur.

JCT: Textile division order has been reduced from 10 lakh pieces to 5.10 lakh pieces.

Bajaj Holdings Q4: Profit at Rs 361 crore versus Rs 791 crore, revenue at Rs 110 crore versus Rs 83 crore YoY.

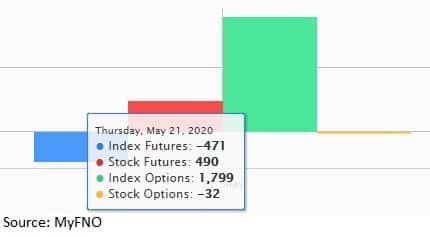

Fund flow

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 258.73 crore, while domestic institutional investors (DIIs) bought shares worth Rs 401.78 crore in the Indian equity market on May 21, provisional data available on the NSE showed.

Stock under F&O ban on NSE

No stock is under the F&O ban for May 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!