Thaw in US-Iran tensions, softening of crude oil prices and reports of government's intent to use the upcoming Budget to revitalise economic sentiment helped Indian equity benchmarks log strong gains on January 9.

Sensex ended 635 points, or 1.55 percent, higher at 41,452.35, while Nifty50 closed 191 points, or 1.58 percent, up at 12,215.90. The rally was broad-based as the BSE Midcap (up 1.51 percent) and Smallcap (up 1.55 percent) indices rose in sync with the benchmarks.

Nifty formed a bullish candle on the daily chart. After showing a promising upside bounce from the lows in the last session, Nifty formed a long bull candle with a gap up opening and closed near the highs.

"The opening upside gap remains unfilled. Technically, this action indicates a strong comeback of bulls and this pattern seems to have nullified the negative status created by the panic selling of January 6," said Nagaraj Shetti – Technical & Derivative Analyst at HDFC Securities.

The short-term trend of Nifty is positive and there is a possibility of further upside in the next session. Nifty may encounter the upside resistance of 12,290-300 levels in the next 1-2 sessions, said Shetti.

The Indian rupee appreciated by 48 paise to close at 71.21 against the US dollar.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for Nifty is placed at 12,157.6, followed by 12,099.3. If the index continues moving up, key resistance levels to watch out for are 12,249.1 and 12,282.3.

Nifty Bank

Nifty Bank closed 2.29 percent up at 32,092.40. The important pivot level, which will act as crucial support for the index, is placed at 31,782.16, followed by 31,471.93. On the upside, key resistance levels are placed at 32,287.66 and 32,482.93.

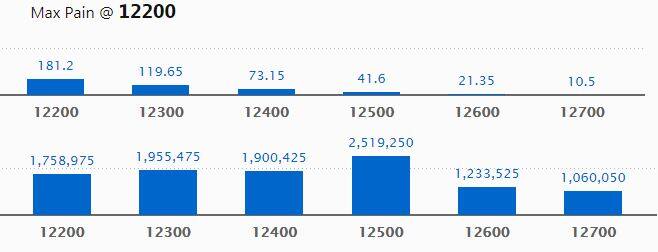

Call options data

Maximum call open interest (OI) of 25.19 lakh contracts was seen at the 12,500 strike price. It will act as a crucial resistance level in the January series.

This is followed by 12,300 strike price, which holds 19.55 lakh contracts in open interest, and 12,400, which has accumulated 19 lakh contracts in open interest.

Significant call writing was seen at the 12,600 strike price, which added 1.74 lakh contracts, followed by 12,200 strike price that added 1.24 lakh contracts.

Call unwinding was witnessed at 12,000 strike price, which shed 2.31 lakh contracts, followed by 12,100 which shed 2.26 lakh contracts.

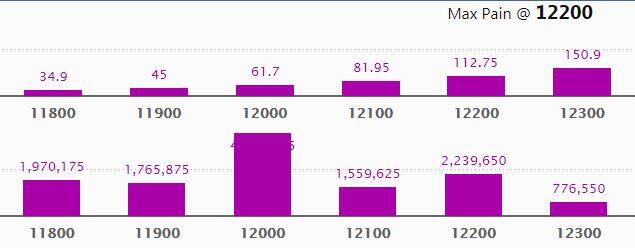

Put options data

Maximum put open interest of 24.06 lakh contracts was seen at 12,000 strike price, which will act as crucial support in the January series.

This is followed by 12,200 strike price, which holds 22.4 lakh contracts in open interest, and 11,800 strike price, which has accumulated 19.70 lakh contracts in open interest.

Put writing was seen at the 12,200 strike price, which added 7 lakh contracts, followed by 12,000 strike, which added 4.6 lakh contracts.

Put unwinding was seen at 11,700 strike price, which shed 1.77 lakh contracts, followed by 11,800 strike which shed 1.44 lakh contracts.

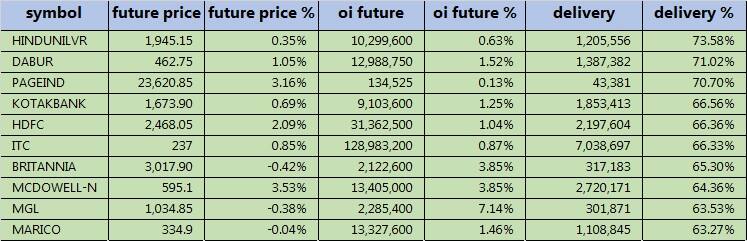

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

81 stocks saw long buildup

Based on open interest (OI) future percentage, here are the top 10 stocks in which long buildup was seen.

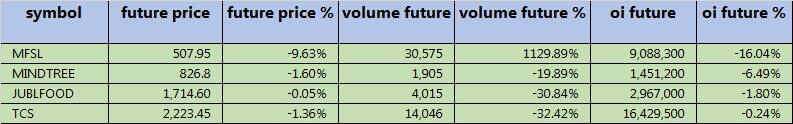

4 stocks saw long unwinding

13 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions.

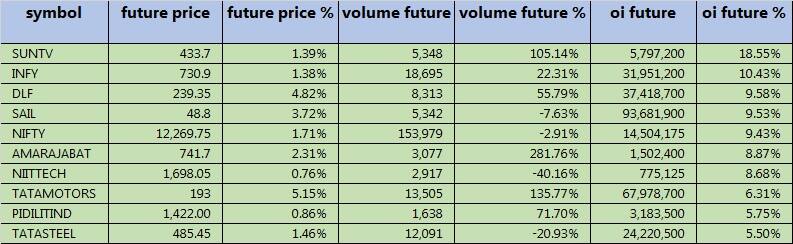

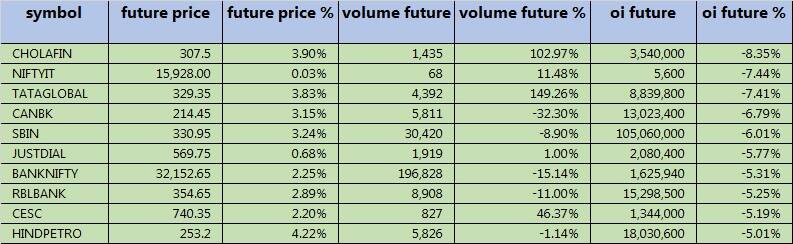

48 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on open interest (OI) future percentage, here are the top 10 stocks in which short-covering was seen.

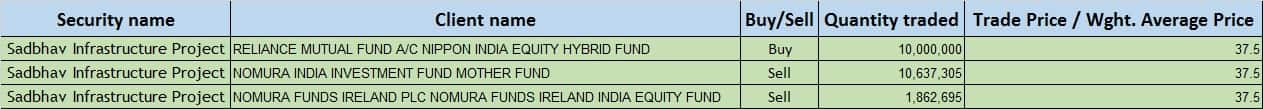

Bulk deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

Yes Bank: The board of the bank will meet on January 10 to consider and approve the right issue of equity shares, issue of warrants and the preferential issue of shares.

Infosys: The board of the company will meet on January 10 to consider and approve quarterly results.

Uttam Galva Steels: The board of the company will meet on January 10 to consider and approve quarterly results.

Supreme Infrastructure India: The board of the company will meet to consider the scheme of arrangement.

Indian Acrylics: The board of the company will meet on January 10 to consider and approve quarterly results.

Stocks in the news

GTPL Hathway: Q3 profit jumped 98 percent to Rs 39 crore versus Rs 19.7 crore, revenue doubled to Rs 674 crore against Rs 314.5 crore YoY.

Emami Paper Mills: Q3 profit jumped to Rs 18.5 crore versus Rs 5.7 crore, revenue climbed 7.4 percent to Rs 400.1 crore YoY.

Sterlite Technologies: Subsidiary will buy a 12 percent stake in Israel-based company ASOCS.

GMR Infrastructure: Arm GHAL formed JV with Hong Kong's ESR for logistics park.

Delta Corp: Subsidiary in Nepal has been issued a license for operating a casino in Nepal.

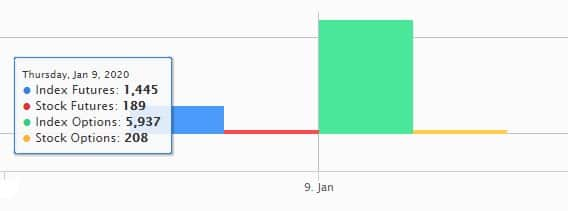

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 431.11 crore, while domestic institutional investors (DIIs) bought shares of worth Rs 419.22 crore in the Indian equity market on January 9, provisional data available on the NSE showed.

Fund flow

Stock under F&O ban on NSE

Yes Bank is under the F&O ban for January 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!