Despite the positive momentum in the American stock markets, this New York-headquartered private investment firm believes that it is time to reduce exposure to it.

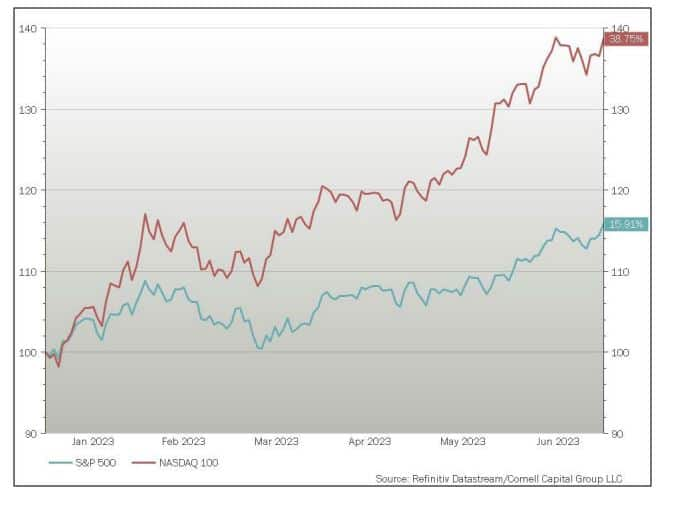

Cornell Capital, which manages more than $6 billion in assets, believes that the extent of run up in US stock prices--without a corresponding improvement in fundamentals--in the first half of 2023 is a cause for concern. During this period, S&P 500 went up 15.9 percent while NASDAQ 100 went up an “astonishing” 38.7 percent “matching half year increases not seen since the 1980s”.

Cornell Capital communicated this through a recent memo to investors, which reviewed the stock market for the first half of this year.

Also read: Stock market has 70% chance of crashing in a few years, says GMO co-founder Jeremy Grantham

Therefore, the firm is looking to reduce exposure to the markets particularly with respect to companies that have seen their stock prices rise to levels are difficult to justify using a reasonable assessment of future cash flows.

The memo stated that they are continuing to look at more valuation-based opportunities, versus momentum-based ones.

“Of course, this means that if the American tech companies continue to charge upward, a valuation-based strategy is likely to underperform, but we believe that is a risk worth taking in order to protect investor capital,” it read.

Cornell Capital’s core investment philosophy remains comparing price with fundamental value determined through discounted-cash flow models, said the note. But they use momentum as a “caution flag”.

“If the valuation analysis implies that a company is overpriced, but the momentum is strong, then it may be wise to wait until momentum has ebbed before selling. The reverse is true on the buy side for stocks that have been falling and for which DCF models indicate they are now underpriced,” the note read.

On the optimism about artificial intelligence, the memo said that there may be a “big market delusion” in play.

Also read: Artificial intelligence gives real boost to U.S. stock market

“Prices of U.S. tech stocks have risen to a level where many sophisticated value investors such as Cliff Asness of AQR Capital Management are beginning to talk about the possibility of a bubble. Whether it represents a bubble or not, there is evidence that AI may be the basis for a big market delusion,” said the note.

It pointed out that even if such technologies do change the world, they do not justify the acceleration in valuation seen in anticipation of them.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!