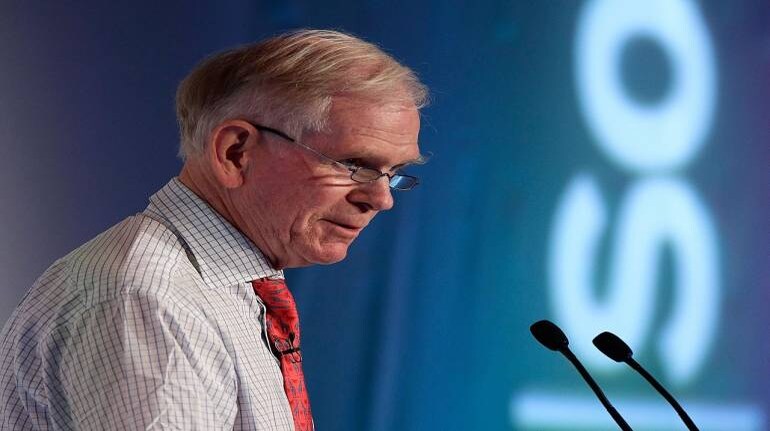

The stock market has a 70 percent chance of crashing in a few years, says GMO LLC's co-founder Jeremy Grantham.

In an interview with WealthTrack on July 1, the British investor said stocks face a 70 percent risk of crashing in a few years, as there's a bubble forming in asset prices on the verge of implosion.

"As you know, I'm only interested in the really great bubbles, like 1929, 2000, and 2021 (these) are the three senior bubbles in the US stock market. We have checked off pretty well every one of the boxes," he said.

Grantham also spoke about parallels between the current stock market and previous crashes, with stocks gaining from an almost perfect economic environment for nearly a decade, before seeing a sharp slide downward.

He originally priced in an 85 percent chance the market was in another bubble on the verge of bursting, but revised that to a 70 percent chance, thanks to the recent tech rally fuelled by investors' excitement for AI, he said in the interview.

"I'm a little bit disturbed by the emergence of the kind of mini bubble in artificial intelligence," Grantham said, adding that he was still unsure if the excitement for generative AI was strong enough to alter the final stage of the stock market's bubble. "I suspect it already has elongated this process somewhat. There is some fairly small chance I think it will mitigate it to such an extent that we only have a modest decline," Grantham added.

Over the longer term, he acknowledged that advances in artificial intelligence could pose risks to humanity and agreed with the notion to regulate artificial intelligence.

"We have a year or two here to have a fairly traditional bubble losing air, a fairly traditional recession, and fairly traditional decline in profit margins and some grief in the stock market. And we can do that before the real effects of AI kick in," Grantham warned.

In April, Grantham had warned that the US banking crisis is far from over and the world’s largest economy is on the verge of a deeper recession than anticipated.

The S&P 500, the index of 500 leading publicly traded companies in the US, will drop at least 25 to 27 percent to around 3,100 points and may only bottom out next year, he had said.

Also read | US banking crisis far from over, stocks can sink another 27%: Jeremy Grantham

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.