The tide is turning in favour of two-wheelers after three years of lagging passenger vehicle's growth by a significant margin, according to Jefferies.

The brokerage's analysts expect 2W volumes growing at 15 percent over FY24-26E, outpacing 7-8 percent CAGR of passenger vehicles (PVs) and trucks over the same period.

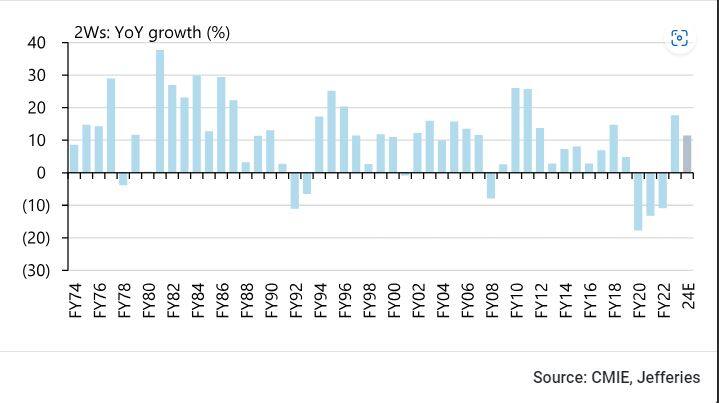

This comes after the 2W segment facing the worst downturn in decades over FY19-22...

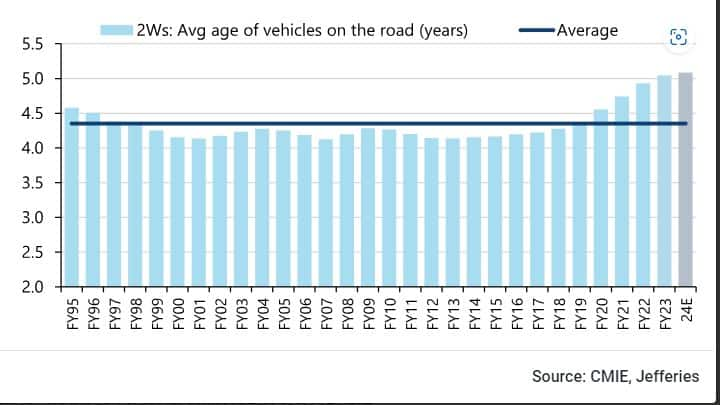

...and 2Ws way entering deep into the replacement cycle.

Jefferies' analysts also expect the demand to continue to shift from smaller motorcycles to scooters (including EVs) and premium motorcycles in the coming years. Their preferred buys are TVS Motors, Eicher, Tata Motors, Bajaj Auto and Hero Motocorp.

Also read: Will traction in 2W sales alleviate concerns of K-shaped recovery?

The analysts wrote, "India's 2W (two-wheeler) demand significantly lagged PVs (passenger vehicles) over the last three years as the combined effect of Covid and regulatory cost push had a more severe impact on vehicle affordability in the less affluent section of society."

From their respective peak volumes in FY19, 2Ws fell 23 percent while PVs rose 15 percent in FY23. But the analyst believe the tide is now turning and expect 2Ws to deliver industry leading 15 percent volume CAGR over FY24-26E, higher than 11 percent volume CAGR estimate for FY24.

Meanwhile, they expect PV and truck volumes growth to moderate to 6 percent and 8 percent respectively in FY24, then to 8 percent and 7 percent respectively over FY24-26.

On PV volume growth, they wrote, "While we believe Indian PV industry has good long-term growth prospects given low penetration and high aspiration, we are concerned on near-term demand. We have cut our FY24-26 industry volume estimates by 2-3% and now expect 6%/7%/10% growth in FY24/FY25/FY26."

Truck volume growth has seen see-sawing trend over the last few years.

It fell sharply by 56 percent over FY19-21 and then revived in FY22. After a 7 percent growth in H1FY24, volume growth softened in the recent months with around 3 percent decline over November-December 2023, noted the analysts.

They wrote that truck upturns in India have historically lasted four-to-five years on average and FY24 is still the third year of the ongoing up-cycle. Also, India is in midst of a resurgence of multi-year capex upcycle, which should continue to drive truck demand.

Also read: Auto index rides on record festive sales to hit all-time high of 39,775

"We, hence, expect the truck up-cycle to continue although growth rates should moderate vs FY21-23," they stated, adding that they expect volume growth to be 8 percent, 10 percent and 5 percent in FY24, FY25 and FY26 respectively.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.