The IPO landscape is showing signs of life again, with hopes of 2025 being as good as 2024, if not better, according to market analysts.

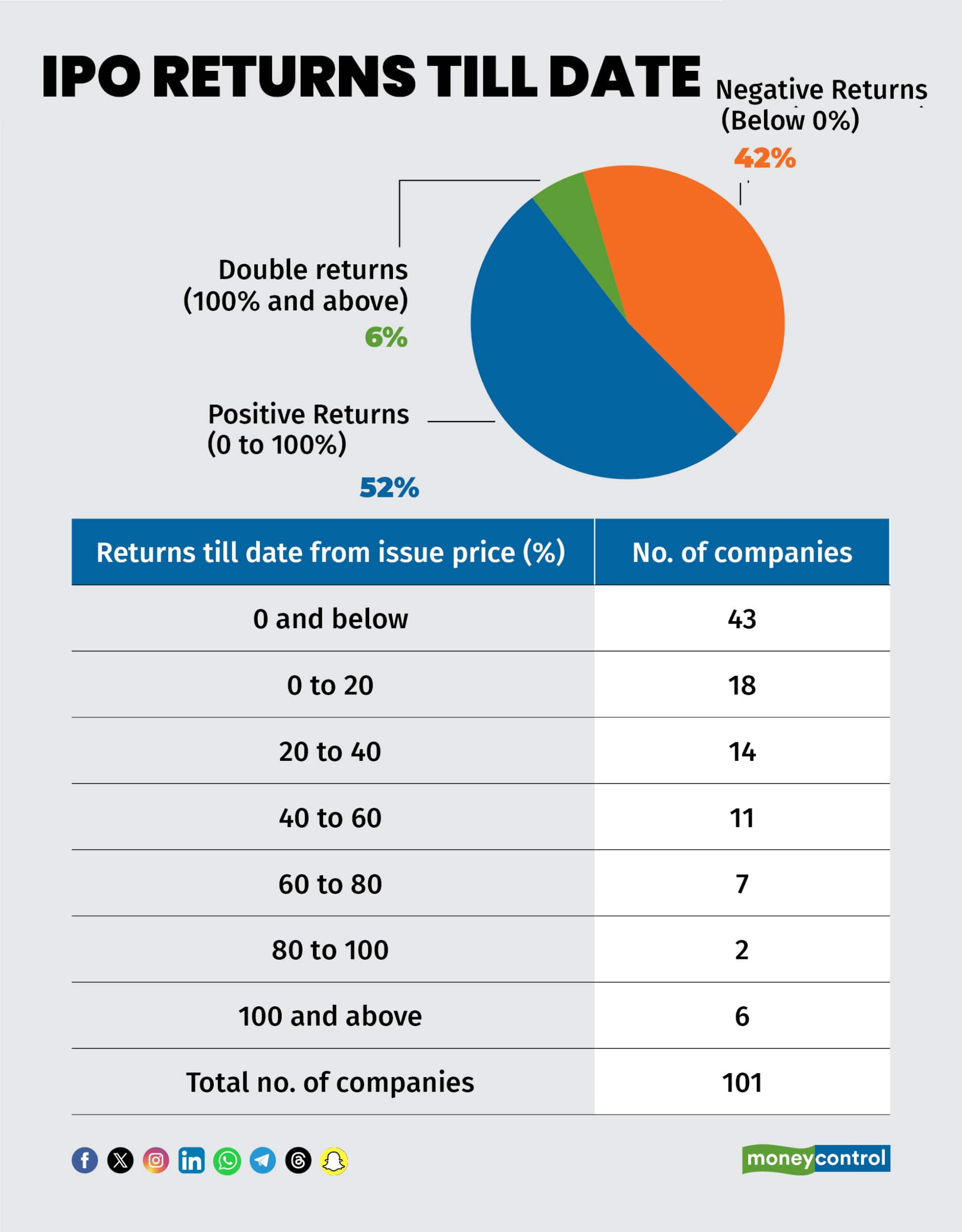

A Moneycontrol analysis of 101 IPOs launched since January 2024 till date, reveals that as a part of the 58 percent with positive returns, hardly 6 percent of the total IPOs managed to double gains relative to their listing price. About 42 percent have negative returns, including top names like Ola Electric (-32.74 percent), Swiggy (-20.14 percent), Hyundai (-7.12 percent), and NTPC (-4.64 percent).

So far, 2025 has been slow, with only nine companies launching IPOs in January and February. March saw only one company launch its IPO while April saw zero activity. May, however, is expected to be better, with seven companies launching IPOs and more expected in June. Although it reflects like investor appetite has reduced and there's less enthusiasm overall in 2025 as compared to 2024, the market remains active. A good line up of IPOs await, say analysts.

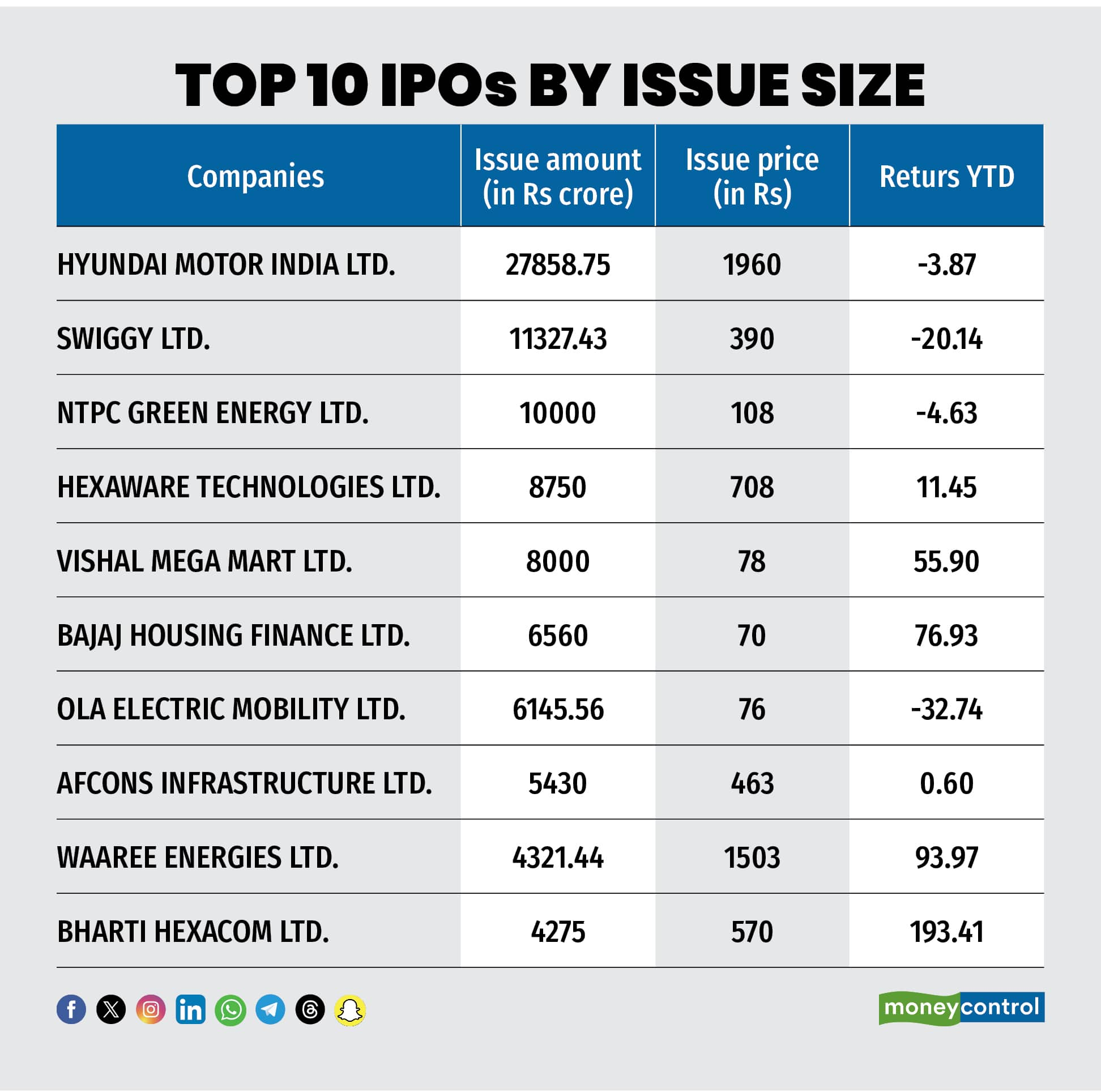

Top 10 IPOs by issue size

Top 10 IPOs by issue size

Through 2024 till date, the top three IPOs by size were Hyundai Motor India (Rs 27,858.75-crore issue at Rs 1,960 issue price), Swiggy (Rs 11,327.43-crore issue at Rs 390 issue price), and NTPC Green Energy (Rs 10,000-crore issue value at Rs 108 issue price).

“Last year ended with a few big IPOs, but many others were shelved,” said Nirav Karkera. “The ones that went live were already in the pipeline and had little choice. Others, especially in the early stages, decided to wait it out — and now, with market conditions improving, many of them are warming up to return,” said Karkera on DRHP filings signalling strong intent, though actual launches remain selective.

“Merchant bankers have a vested interest in securing high valuations — after all, they want the mandate. That sometimes overrides long-term thinking about what happens to investors post-listing,” said Deepak Jasani, a market veteran.

“There are a few, like Swiggy and Hyundai for instance, that had massive pre-IPO hype. But even with strong fundamentals, they’re struggling to move the needle post-listing. This isn’t an outlook on the stocks themselves — just a reflection of how difficult the post-listing environment has been for some high-profile names,” said Karkera.

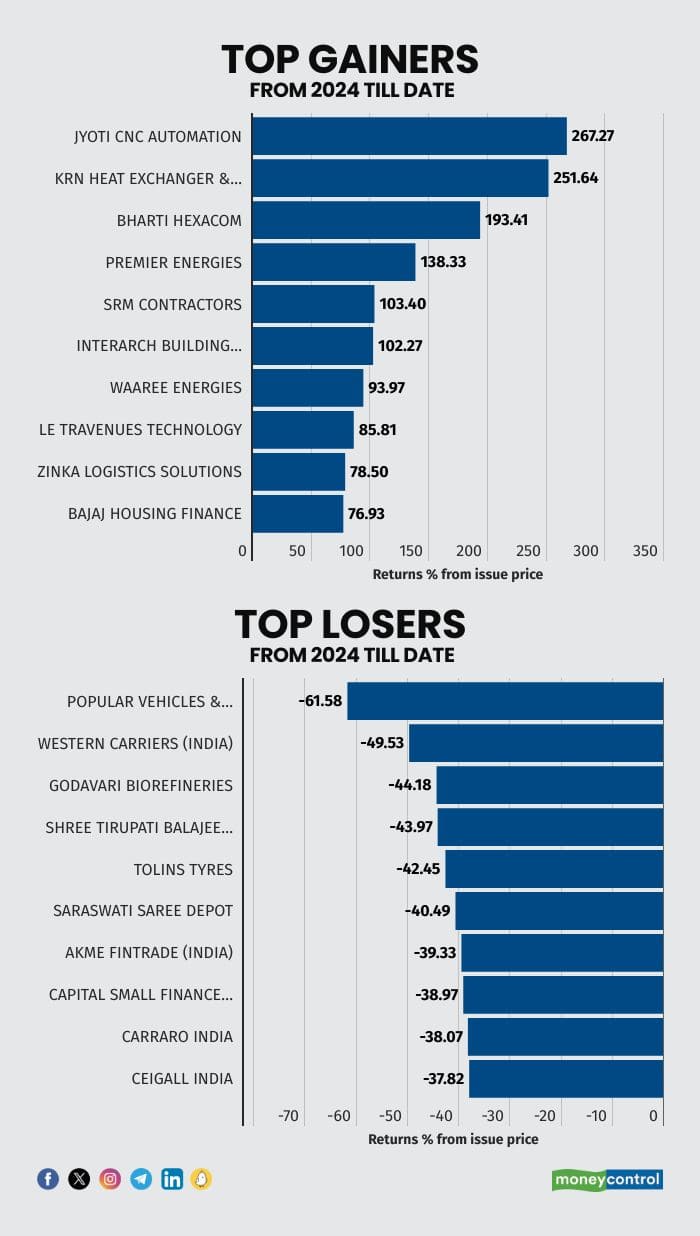

Meanwhile, the standout performers with the highest returns are Jyoti CNC Automation (267.27 percent), KRN Heat Exchanger (251.64 percent), and Bharti Hexacom (193.41 percent), which was one of the big-sized IPOs from 2024.

Current Market Sentiment: Cautious but Active

As of May 22, 2025, the IPO market is cautiously active. Global uncertainties such as the US tariffs and geopolitical tensions remain, although FPIs made a good comeback as expected after some major turbulent market periods. Domestically, DII remains committed but valuation concerns have also not settled completely with only some pockets looking attractive. The S&P BSE IPO index is down over 11 percent for the year till date.

High-profile names like Reliance Jio and LG Electronics are among the big players with fintechs like Groww and PhonePe also being in the process for 2025. Renewable energy and quick commerce remain attractive sectors for investors. As many as 49 companies proposed to raise Rs 84,000 crore, in 2025, with another 67 companies looking to raise about Rs 1,02,000 crore awaiting SEBI approval, as per Prime Database.

Karkera believes that right now, conditions may not be the most favourable but are conducive enough. Firms raising funds to reinvest in their businesses are likely to come forward. Those pursuing offer-for-sale (OFS) exits, however, may stay cautious.

“In many cases, promoters and merchant bankers were a bit greedy on valuations,” said Jasani, adding that they often benchmark their IPO pricing to funded unlisted peers or higher-valued listed companies. “But that rarely considers what happens to retail IPO investors six months or a year down the line. That disconnect is now catching up,” he said.

India’s market trades at a 20.3x P/E multiple (1 year forward), reflecting growth expectations. Unicorns like Zepto target $5 billion–$10 billion valuations, but investors demand profitability or a clear growth path. For instance, Swiggy’s lacklustre debut highlighted the risks of aggressive pricing in tech. Profitable firms like Bajaj Housing Finance command premiums, while speculative tech plays face resistance. Recent corrections have moderated valuations across some pockets, creating opportunities for disciplined investors.

Jasani also pointed at the participants of the IPO run, saying that retail and HNI investors don’t always have the tools to assess valuation deeply. So they rely heavily on grey market signals — especially when the IPO hype is high. If grey market premiums look healthy and recent listings are doing well, demand picks up. But if sentiment dips, they vanish just as quickly.

He further added that institutional investors are generally open to subscribing to mainboard IPOs, even when valuations are slightly stretched. But HNI response is far more sensitive — they’re closely tracking recent IPO returns before committing. Most IPO players still optimize for a successful listing, not long-term investor returns. SEBI now mandates post-listing performance disclosures in the prospectus, but that hasn’t had a major impact yet, as per Jasani.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.