It was indeed a manic Monday for D-Street! The S&P BSE Sensex plunged nearly 800-points to register its biggest single-day fall in a year while Nifty50 breached 12,000 levels to post its biggest one-day fall in six months.

Volatility index surged over 16 percent, its biggest single-day gain in a year while the India Gold hit a fresh record high buoyed by risk-off sentiment. India Gold February futures broke above 41,000 to hit a fresh record high 41,096 on January 6.

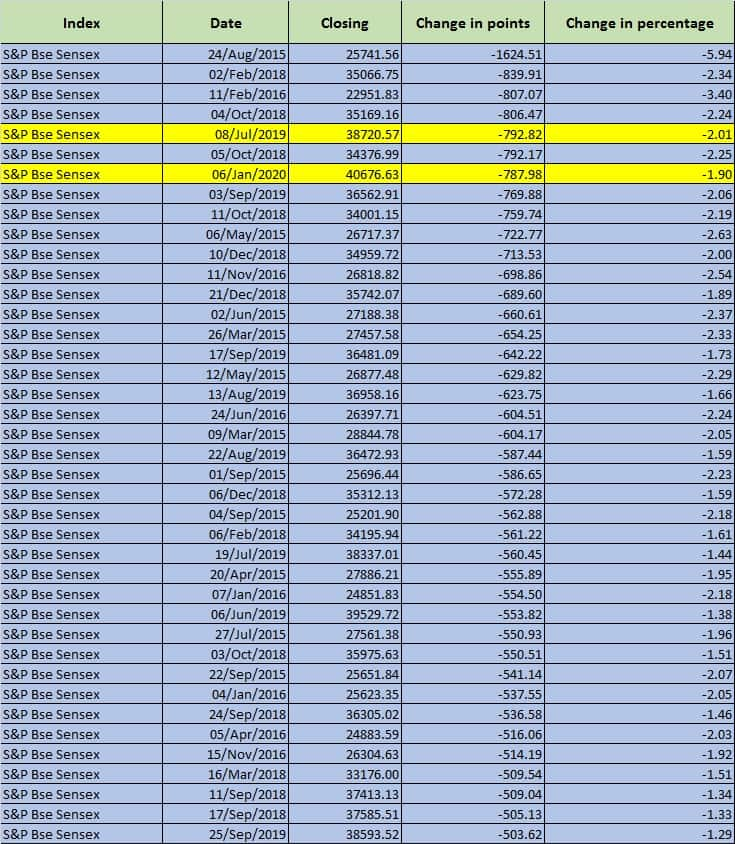

This was the biggest fall in Sensex since July 8, 2019. On August 24, 2015, Sensex took a beating of 1,625 points or 5.94 percent, which was the biggest fall in points in the last five years.

In fact, in the last five years, there have been 40 such sessions (including today) in which Sensex plunged over 500 points, 20 sessions in which Sensex cracked over 600 points, and 11 sessions in which the market benchmark suffered a loss of over 700 points.

Rising Middle East tensions wiped out almost Rs 3 lakh crore in terms of market wealth, pushed crude oil prices towards $70/bbl, and rupee to its lowest level since November 14.

The market capitalisation of BSE-listed companies stood at Rs 153.86 lakh crore, down nearly Rs 3 lakh crore from Friday’s close of Rs 156.87 lakh crore, data showed.

The rupee hit the lowest level since Nov. 14 and was hovering around to Rs 72 against the dollar mark as oil prices surged more than 2 percent towards $70/bbl fueling concerns of large current account deficit.

Let’s look at the final tally on D-Street – the S&P BSE Sensex plunged 787 points to 40,676 while the Nifty50 dropped 233 points to 11,993. Sectorally, profit-taking was seen in sectors like Metals, public sector, realty, banks, Energy, and Oil & Gas.

Looking at the global setup – rise in geopolitical concerns will give markets the excuse to sell at higher levels. On January 2, Nifty was just 4 points away from hitting a fresh record high.

So what should investors do? Historically, correction on account of external factors such as geopolitical concerns is usually regarded as the best time to get into quality stocks which might be available at a discount.

But, it (geopolitical concerns) is unlikely to derail the bull market, suggest experts. Long-term investors should use dips to get into stocks while traders might have to battle the volatility in the short term.

“Geopolitical concerns will certainly not derail the bull market rally but if there is any knee-jerk reaction then this will be a buying opportunity for investors,” Ajit Mishra, VP – Research, Religare Broking Ltd told Moneycontrol.

“Geopolitical concerns are short-term triggers which cause corrections in the market but the broader trend will remain intact. The Indian bull market will take its own sweet time correcting on the way up. In general, 2020 will be far better than 2019,” he said.

The market, which was in bullish momentum, got hit by a geopolitical storm, but experts feel that the halt in momentum is temporary and could see a rebound if the situation stabilised. If not, the texture of the market in the near term may become weak.

“The market is in bullish momentum but geopolitical tension acting as a speed breaker for the market where if this geopolitical tension doesn't escalate further then we can expect the market to resume its uptrend in next week,” Amit Gupta, Co-Founder, TradingBells told Moneycontrol.

“But, if the situation becomes worse than near term texture of the market may become weak,” he said.

Where are markets headed?

Technically, Nifty is consolidating in the range of 12,000-12,300. The crucial support for the market is placed at Monday’s low of 11,974, and a break below this level could take the index towards 11,850-11,500 levels.

After showing a rising wedge or a triangle type pattern within a narrow high low range in the last 5-6 sessions, the Nifty witnessed a sharp weakness today and closed the day lower 233 points.

“Nifty formed a long bear candle on Monday with a gap-down opening. Technically, this pattern indicates a sharp reversal pattern in the market,” Nagaraj Shetti, Technical Research Analyst, HDFC Securities told Moneycontrol.

“The initial support of 12150 (ascending trend line) has been broken on the lower and the Nifty closed below it. The daily 14 period RSI has turned down from near 60 levels,” he said.

Shetty further added that the overall chart pattern of Nifty looking weak and the next lower supports to be watched at 11800 levels. The near term downside targets to be watched for Nifty at 11500, which could be achieved in the next 3-4 weeks.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.