Shabbir Kayyumi

Narnolia Financial Advisors

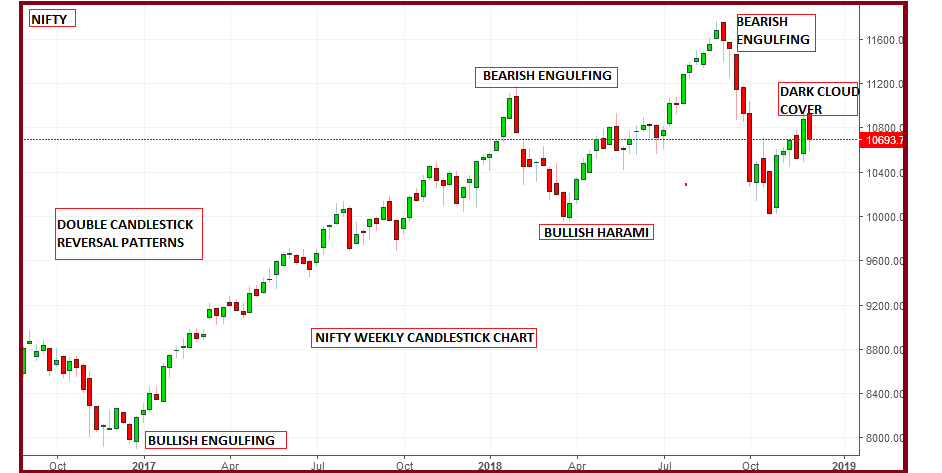

A candlestick depicts the battle between Bulls (buyers) and Bears (sellers) over a given period of time. All known information is reflected in the

price. The relationship between the open and close is considered vital information and forms the essence of candlesticks.

What is ‘Double Candlestick Pattern’?

Candlesticks are so named because the rectangular shape and lines on either end resemble a candle with wicks; and we will be studying most

relevant double candle stick reversal pattern. Each candlestick usually represents one day’s worth of price data about a stock. Double

Candlestick Pattern involves two consecutive candlesticks and these two consecutive candlesticks if interpreted correctly give excellent

trading insight.

Formation of Double Candlestick

The trading signal is generated based on two day’s trading action. The length signifies the range for the trading day; however trades have to

be qualified based on the length of the second day’s candle and formations of two candles as well.

One should avoid trading based on subdued short candles without confirmation candle.

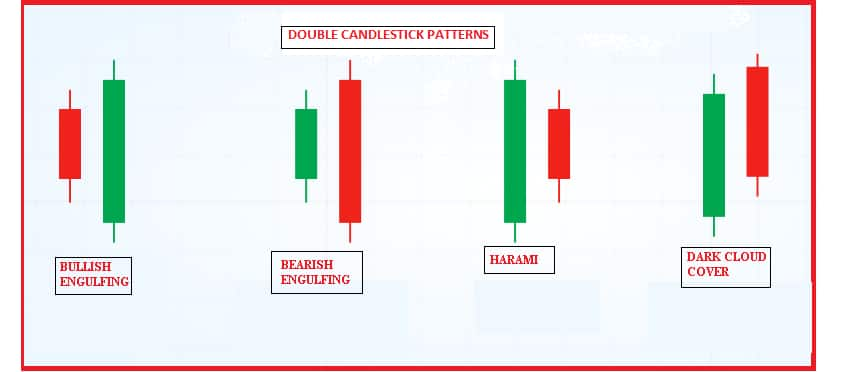

List of Double Candlestick Patterns

Candlestick patterns can be made up of one candle or multiple candlesticks, and can form reversal or continuation patterns. Some of the most

useful & popular double candlestick patterns are mentioned below.

1. Bullish Engulfing

2. Bearish Engulfing

3. Bullish Harami

4. Bearish Harami

5. Tweezer Top

6. Tweezer Bottom

7. Dark Cloud cover

8. Piercing Line

Double Candlestick patterns are depicted in the section above; there are more complex and difficult patterns of more than two candlesticks

which have been identified since the candlestick charting method's inception.

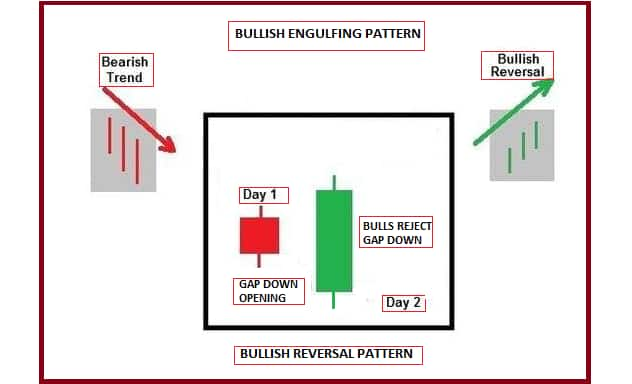

Bullish Engulfing Pattern

Definition

A bullish engulfing pattern occurs in the candlestick chart of a financial instrument when a large green candlestick fully engulfs the smaller

red candlestick. This pattern usually occurs during a down trend and is thought to signal the beginning of a bullish trend in the stock,

commodity or currency.

Identification Criteria

• The market is in an existing downtrend.

• A red solid body is observed on the first day.

• The green body is formed on the second day completely engulfing the red body of the prior day.

Interpretation

The market opens lower with a significant gap down in the direction of the existing downtrend. After the market opening, sentiment changes

rapidly and the market moves in the opposite direction towards upside. This causes fear among traders who have short positions, leading to

the covering of short positions faster, which further adds strength in the rally in the market. However the buying force overcomes the selling

force and in the end markets manages to close above the open of the prior day.

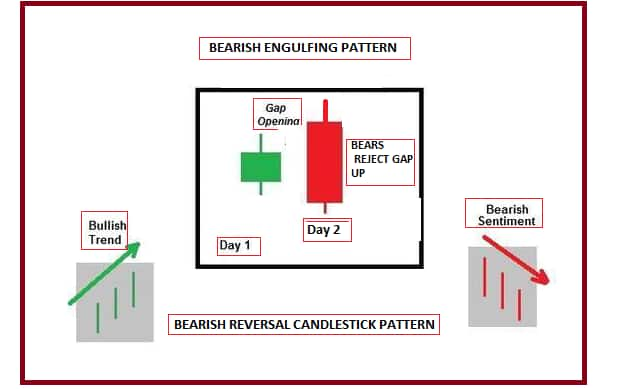

Bearish Engulfing Pattern

Definition

A bearish engulfing pattern is a technical chart pattern that portends a future bearish trend. The pattern consists of a small green candlestick

with short shadows or wicks followed by a large body red candlestick that engulfs the small green candle.

Identification Criteria

• The market is in an existing uptrend.

• A green solid body is observed on the first day.

• The red large body is formed on the second day completely engulfing the green body of the prior day.

Interpretation

The market opens higher with a significant gap up in the direction of the existing uptrend. After the market opening, sentiment changes

rapidly and the market moves in the opposite direction towards downside. This causes fear among traders who have long positions, leading

to the unwinding of long positions faster, which further adds strength in the downfall. However the selling force overcomes the buying force

and in the end markets manages to close lower much below the open of the prior day.

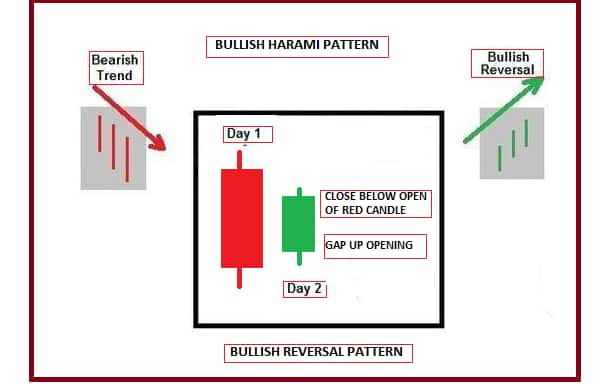

Bullish Harami Pattern

Definition

This pattern consists of a large red body on the first day followed by a small green body the next day that is completely inside the range of

the first day’s red body. It tends to act as a reversal pattern.

Identification Criteria

• The market is in an existing downtrend.

• A large red solid body is observed on the first day.

• The green body is formed on the second day completely engulfed by the red body of the prior day.

Interpretation

The pattern appears in a downtrend and forecasts its bullish reversal. The Bullish Harami pattern needs confirmation on the subsequent

candles. The first red candles indicate a existing downward trend in the asset, and the green candle represents a slightly upward trend on the

second day, which is completely contained by the body of the previous candle. The second day prices open higher or at the close of the

preceding day and steadily rises bringing a sense of fear among the short sellers. This creates a doubt in existing downtrend and leads to the

covering of short positions, causing the price to rise further. Hence, a small green body is formed. Sometime a Bullish Harami candlestick

pattern is referred to as "an inside day".

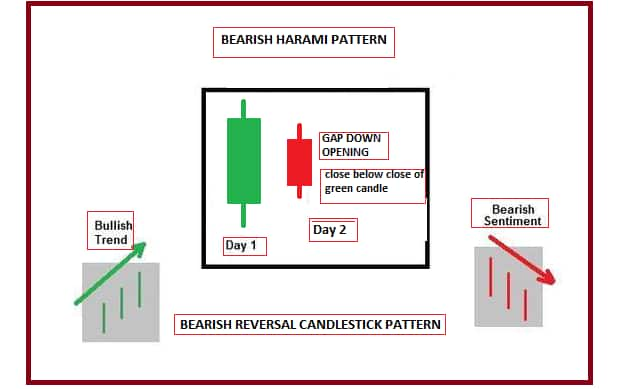

Bearish Harami Pattern

Definition

This pattern consists of a large green body on the first day followed by a small red body the next day that is completely inside the range of

the first day’s green body. It tends to act as a bearish reversal pattern.

Identification Criteria

• The market is in an existing uptrend.

• A green solid body is observed on the first day.

• The red body is formed on the second day completely engulfed by the green body of the prior day.

Interpretation

The market is in an existing uptrend and there is heavy buying interest indicated by a green body, which indicate support the bullishness.

However, the next day prices open lower or at the close of the preceding day and trades in a small range throughout the day, closing even

lower, but still within the prior day’s body. The bulls now begin to doubt the strength of the market, and trend reversal to downtrend is

confirmed by another confirmation bearish candle.

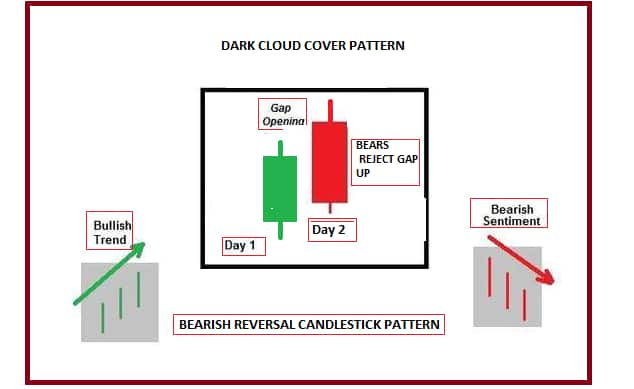

Dark Cloud Cover Pattern

Definition

This is a bearish reversal pattern with two candlesticks. A green candlestick appears on the first day while an uptrend is in progress. The

second day opens at a new high, with a gap up and closes more than halfway into the prior green body, leading to the formation of a long red

body candlestick.

Identification Criteria

• The market is in an existing uptrend.

• A green solid body is observed on the first day.

• The red large body is formed on the second day closed below mid-point of the green body of the prior day.

Interpretation

The market opens higher with a significant gap up in the direction of the existing uptrend. After the market opening, sentiment changes

rapidly and the market moves in the opposite direction towards downside. This causes fear among traders who have long positions, leading

to the unwinding of long positions faster, which further adds strength in the downfall. However the selling force overcomes the buying force

and in the end markets manages to close lower much below the open of the prior day and below the mid-point of prior green candle.

Conclusion

• Bullish engulfing is very strong bullish reversal candlestick pattern.

• Bearish engulfing is bearish reversal pattern, which does not require confirmation candle on the next day.

• Bullish Harami and Bearish Harami are reversal patterns, where by second day body is smaller as compared to first day body, and

need confirmation candle to confirm reversal of trend.

• Dark cloud cover is stronger bearish reversal pattern than bearish harami however having less strength than bearish engulfing

pattern.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on Moneycontrol are their own, and not that of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.