India’s stock market had a strong run in August with the S&P BSE Sensex consistently hitting record highs and gaining 9.4 percent, including almost 4 percent in the second fortnight, when foreign institutional investors sold a net Rs 6,063.76 crore of shares against net purchases of Rs 3,495.24 crore in the first fortnight.

The market was supported by the US Federal Reserve Chair’s dovish commentary, increased pace of vaccination and controlled Covid-19 infections in the second half of last month, whereas there was some volatility in the first half.

“Initial selling in the previous month was primarily due to global factors turning negative like Chinese stance on metals price hike, increasing Covid third wave and uncertainty about US Fed’s taper roadmap,” said Narendra Solanki, head-equity research (fundamental) at Anand Rathi Shares & Stock Brokers. “All these factors led to a broad selloff in sectors and a larger selloff in sectors where we had already seen a sharp rally. So it appeared investors booked some profit.”

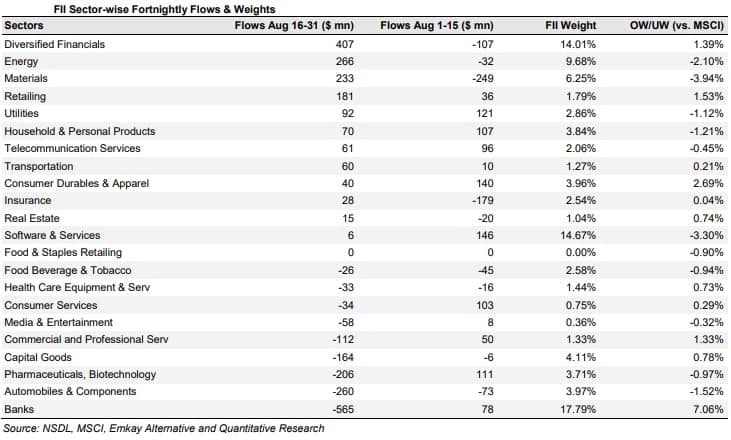

The maximum FII outflow in the second fortnight of August was from banks, automobiles & components, pharmaceuticals & biotechnology, and capital goods. These sectors, except pharma, had seen outflows in the first fortnight as well.

“Banks, which are the highest-weight sector in FII portfolios (17.79 percent) and also the highest overweight position compared to MSCI, saw outflows to the tune of $565 million,” Emkay Global Financial Services said in a research report. “This could potentially continue over the next fortnight.”

The brokerage said automobiles & components saw follow-up sales to the tune of $260 million in the second fortnight after selling in the previous fortnight ($73 million).

“Pharmaceuticals and biotechnology segment saw outflow of $206 million in the second fortnight against inflow of $111 million in the first fortnight,” it said.

The BSE Auto index fell almost 1 percent in the second fortnight of August against a gain of 1.3 percent in the first. The BSE Bankex gained 0.77 percent against 5 percent in the first fortnight, while the BSE Healthcare was up 2.66 percent in the second fortnight compared with a fall of 1 percent in the first fortnight.

“I think FII as a category is very fluid and not anchored to MSCI, more so if you remove ETF-based funds,” said Solanki of Anand Rathi. “Historically, FIIs have always been heavy on banks & financials and the primary reason could be them playing a proxy growth on the overall economy, especially unlisted sectors like MSME.”

However, “recently we have seen that credit growth continues to remain low and looks like recovery is likely by H2-FY22. Hence, some small shifts or sector rotation can’t be ruled out,” he added.

Emkay said there was buying interest in diversified financials ($407 million), energy ($266 million) and materials ($233 million) in the second fortnight of August after selling in the previous fortnight. Retailing ($181 million), utilities ($92 million), households & personal products ($70 million) saw follow-up buying for a second fortnight.

Overall, energy and materials look strong, while banks and automobiles & components appear weak, the brokerage said.

The BSE Diversified Financials Revenue Growth Index gained 3.25 percent, and the BSE Energy index jumped 6.35 percent in the second fortnight against gains of 1.34 percent and 4.14 percent, respectively, in the first fortnight.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.