The stock price of Bajaj Auto, one of the country's biggest two-wheeler makers, has rallied by over 23 percent so far in 2021 and around 50 percent since June 1, 2020. The stock has further upside and could cross Rs 5,000 in the next 6-12 months, Gautam Shah, Founder & Chief Strategist, Goldilocks Premium Research said in a report.

The stock traded in a range for almost five years in the 2015-2020 period. In this phase, the working range was Rs 2,000 on the downside and about Rs 3,400 on the upside.

This ranged behaviour was read as underperformance as other names in the sector did exceedingly well. However, in 2021, the tables turned as the stock could be in a new mega uptrend, said Shah.

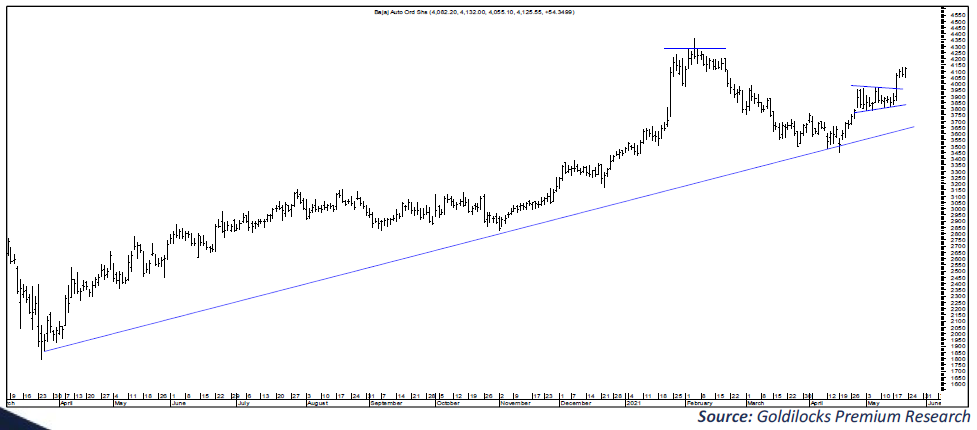

Technically, we see multiple breakouts on the charts both in the short and long-term time frames. In April 2021, the stock corrected with the overall market, but the stock found support near the important Rs 3,400 level (See Chart). This reversal has looked solid on many counts.

Shah, based on the technical evidence, suggested that the current trend should take the stock past Rs 4,300 and towards Rs 4800, and the next level of the target is placed at Rs 5,800 in a matter of 6-12 months.

It could end up being a star performer in the sector.

With the opening up of economy, the auto sector is making a comeback and is likely to outperform. In such a scenario, Bajaj Auto could see a multi-month uptrend, said Shah.

Technical Parameters:

When Bajaj Auto moved past the Rs 3400 level, it has changed the dynamics in favour of the bulls. A new “Dow Theory” buy is in play after many years of range-bound activity.

The weekly RSI hit a new 10-year high recently. This speaks volumes about the existing trend. The MACD indicator also hit a new life high while the weekly DM/ADX study is in buy mode.

All the moving averages (short and long-term) are well-placed below the price action and should provide support on any dip. A bullish crossover was spotted in the last week of Apr 2021.

Based on volume at price study all major congestion points have been crossed. The next minor resistance is only around the life high of Rs 4,300.

The advanced proprietary system triggers are all in buy mode on all time frames (daily/weekly/monthly). This is a rare set-up that has developed after many years and hence we give it extra importance.

“The stock is an excellent buy candidate. It is the best way to play the auto theme from current levels. Not only does it offer insurance and stability (limited downside risk) but the upside potential is sky high,” highlights Shah.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.