Four-wheeler automobile stocks -- mainly Maruti Suzuki, Tata Motors, and Mahindra and Mahindra -- could likely be in trouble if the current slowdown in passenger vehicles (PV) is to persist. Inventory levels have surged to 90-120 days, with nearly every variant now available off the shelf. This is forcing automakers offer discounts, analysts tracking the sector said.

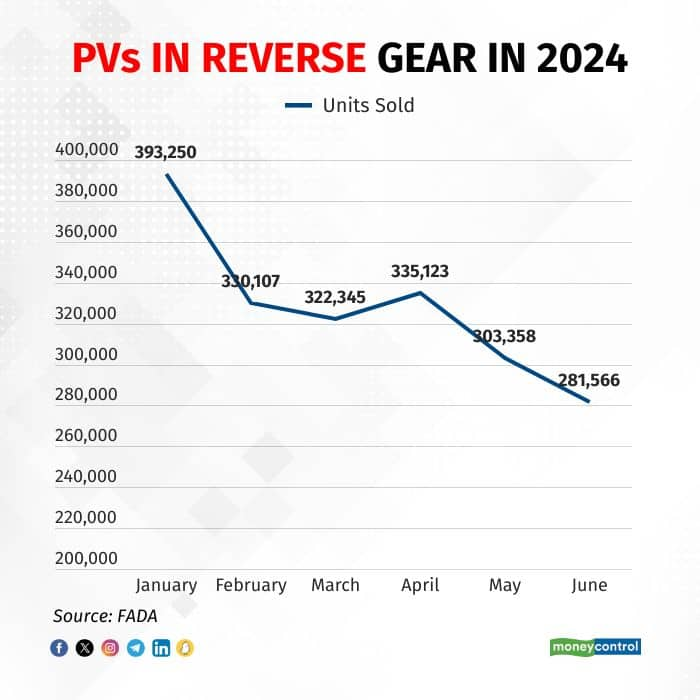

According to the Federation of Automobile Dealers Association of India (FADA), PV sales in India have dropped 28 percent since the start of the year to June 2024. In January, total sales stood at 3,93,250 and units sold in June trickled down to 2,81,55, data showed.

Follow your LIVE blog for all the latest market updates

Market experts have highlighted various reasons for the sharp decline. First, the segment comes off a high base as the sector has performed exceedingly well in the last couple of years. "High base, coupled with the election, soaring temperatures and a rise in the cost of funding has led to such a downfall in the segment," Amit Khurana, Head of Equity Research at Dolat Capital, said in a conversation with Moneycontrol.

Read: Torrent Pharma may raise up to $3 billion for KKR's stake in JB Chemicals: Report

Interestingly, the drop comes when the festive season is just around the corner. Another analyst that Moneycontrol spoke to suggests that the industry might not see sales recovering to a large extent and pressure is likely to remain on the industry. Passenger vehicle makers are likely to wait out the festive season, say analysts, but if sales don’t pick up, there could be a pullback in production.

This could also be a double whammy for the listed companies. "If the trend persists, we could see a correction in the stock prices as valuations are not cheap," Khurana said, referring to a possible decline in share prices.

Read more: Ola Electric Mobility shares pare gains, now up only 4% after a two-day upper circuit

Another expert who spoke to Moneycontrol on the condition of anonymity suggested that if the slowdown lingers, a 15-20 percent correction in stock prices is likely, like the one seen in 2018-19 when auto sales started slowing.

Unnati Bhavekar Jadhav, Lead Analyst at KR Choksey told Moneycontrol feels the situation is not dire. She said the moderation in the first half was anticipated.

"This slowdown is expected to ease, and we foresee a recovery once channel inventory is cleared,” she said, adding, "The monsoon season remains strong. Additionally, the festival season should contribute to an improvement later in the fiscal year."

As for the stock performance, Maruti Suzuki, India's largest four-wheeler OEM, has rallied nearly 20 percent since the start of the year. Meanwhile, India's largest electric vehicle player, Tata Motors, has surged 35 percent over the same period. M&M, the largest SUV player in the country, has zoomed over 60 percent to become the top performer on the Nifty. The three have comfortably topped Nifty's gain of 12 percent year-to-date returns.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.