Taking Stock: Market ends flat amid volatility; auto, pharma, midcap indices up 1% each

NTPC, Reliance Industries, TCS, Power Grid Corporation and Coal India were among the top losers on the Nifty.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,901.92 | 292.41 | +0.34% |

| Nifty 50 | 26,285.45 | 80.15 | +0.31% |

| Nifty Bank | 59,753.90 | 225.85 | +0.38% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Bajaj Finance | 1,032.60 | 21.90 | +2.17% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| ONGC | 245.60 | -2.10 | -0.85% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 37540.80 | 176.20 | +0.47% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8520.60 | -31.35 | -0.37% |

Domestic equities were lacklustre amid an uncertain global environment. Nifty opened on a tepid note and traded in a narrow range to close with gains of 27 points at 18692 levels. The broader market outperformed with the Nifty midcap 100 and Nifty smallcap 100 up almost 1% each. Pharma, Auto, FMCG, and Consumer Durables were top gainers today. However, PSU Bank and Oil & Gas witnessed selling and closed in the red. Sentiments have been dented on account of concern surrounding economic growth globally and rising geopolitical issues within Russia.

We expect the market to consolidate in the near term before resuming the upward journey. Sectors like Auto, and FMCG would be in focus with the progress of the monsoon.

The primary market is also in buzz with the Ideaforge IPO getting subscribed 2.5x on the first day itself, while Cyient DLM IPO will be open for retail participants on Tuesday.

Nifty remained in a 76 point range on June 26 and repeatedly rose and fell before closing mildly in the positive. At close, Nifty was up 0.14% or 25.7 points at 18691.2. Volumes on the NSE were lower than recent average. Broad market indices closed higher than the Nifty even as the advance decline ratio remained positive at 1.31:1.

Global shares were mostly lower, while gold rose after an aborted uprising by Russian mercenaries raised questions about the authority of President Vladimir Putin and as a sharp decline in financial stocks more than offset gains in the energy sector on concerns about political instability in top oil producer Russia.

Nifty did not follow through on the downside post the bearish formation on weekly charts. It could now show a small bounce before correcting again. 18646 and later 18555 could provide support while 18756-18771 band could provide resistance in the near term.

Weak Asian and European cues dampened the domestic market sentiment, as benchmarks ended mixed in a range-bound session amid selective buying in key sectoral stocks. Global markets are dictating trends back home and investors don't want to be in a hurry to take long positions in times of high uncertainty.

Technically, after a short-term correction the index witnessed range bound activity near 18650 or 20-day SMA (Simple Moving Average) important support level. For day traders, 18725 would be the key resistance level while 18650 could be the crucial support zone. Above 18725, a fresh uptrend rally could be seen till 18800-18820. On the flip side, below 18650 selling pressure is likely to accelerate and could slip till 18600-18550.

The global market exhibited a negative bias as concerns regarding economic growth emerged in light of the political instability in Russia. This instability led to an increase in oil prices, driven by worries over potential supply disruptions, given Russia's status as one of the largest oil producers. On the domestic front, the market experienced limited downside as the pharma and auto sectors provided support. Additionally, mid and small-cap stocks were seen recovering their positions following a recent sell-off, indicating a regained investor confidence in these segments.

Indian rupee closed flat at 82.04 per dollar.

: Benchmark indices ended flat in the volatile session on June 26.

At close, the Sensex was down 9.37 points or 0.01percentat 62,970.00, and the Nifty was up 25.70 points or 0.14percentat 18,691.20. About 1,818 shares advanced, 1,715 shares declined, and 170 shares were unchanged.

NTPC, Reliance Industries, TCS, Power Grid Corporation and Coal India were among the top losers on the Nifty, while gainers included Cipla, Hero MotoCorp, Adani Enterprises, Tata Consumer Products and Divis Laboratories.

On the sectoral front, auto and pharma were up 1 percent each, while FMCG and metal indices rse0.5 percent each.

The BSE midcap index rose 1 percent and smallcap index added 0.7 percent.

The deeper cut by OPEC has less effect on the prices as Russia is offering crude oil to Asian buyers at deep discounts, thus hurting the OPEC voluntary cuts. In May 2023, India and China accounted for almost 80percentof Russian crude oil exports. On the other hand, Energy producers in the US further cuts down drilling activities for the 8th straight week. The market looks forward to the Chinese PMI and US job numbers as the next catalyst.

We believe oil prices to trade in the range bound this week amid weakening macros and tight supplies. If crude oil falls back to $66 inventors should consider it as a buying opportunity as we see oil prices could rally higher to touch the resistance of $73.

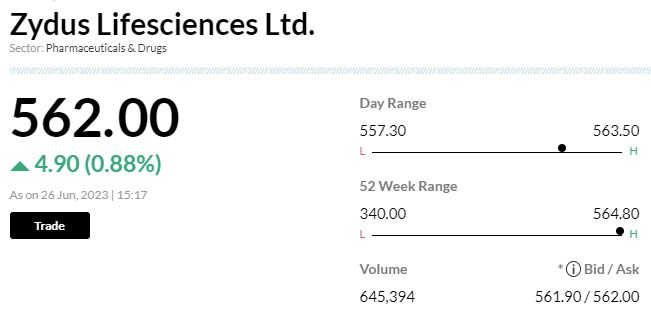

Zydus Lifesciences' subsidiary Zydus Animal Health and Investments has entered into a share purchase agreement with Rising Sun Holdings and Mylab Discovery Solutions to acquire 6.5 percentstake in Mylab from Rising Sun Holdings, for Rs 106 crore.

The proposed investment in Mylab will help Zydus to participate in the growing diagnostics space.

-Add rating, target at Rs 725 per share

-Company exhibited its insure-tech capabilities in its virtual analyst meeting

-Company leverages tech to support insurance partners in product development & fraud detection

-Tech enables partners to cater to new customer segments & improve profitability

-Operating efficiency is improved by documenting vast telephone calls

Meet reinforced conviction on company’s domain capabilities that will keep it ahead of peers

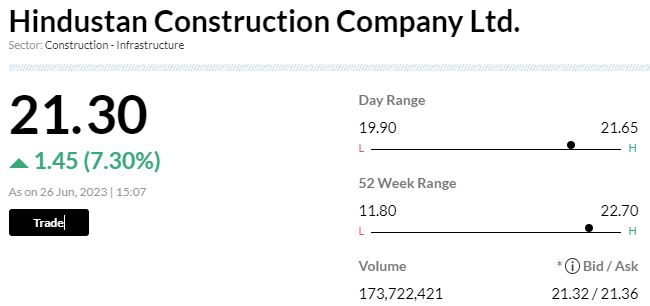

Asia Opportunities (Mauritius) sold its entire 3.34 percent stake on June 22 via the open market, said Hindustan Construction Company

The initial public offering (IPO) of drone maker IdeaForge Technology was fully subscribed by the afternoon on June 26, the first day of bidding.

The offer received bids for 99.76 lakh equity shares against an issue size of 46.48 lakh, the latest data on exchanges showed, which means the issue was subscribed 2.15 times.

Retail investors bought 8.28 times their allotted quota and employees 5.6times the small portion set aside for them. As many as 13,112 shares have been set aside for employees who get them at a discount of Rs 32 a share to the final issue price.

The company has reserved 75 percent shares of the offer for qualified institutional buyers (QIB), 15 percent for high networth individuals (HNI) and the remaining 10 percent for retail investors.