Taking Stock: Nifty, Sensex record closing high on fabulous Friday

The previous record high close for Nifty and Sensex was on December 1, 2022... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,138.27 | -503.63 | -0.59% |

| Nifty 50 | 26,032.20 | -143.55 | -0.55% |

| Nifty Bank | 59,273.80 | -407.55 | -0.68% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Asian Paints | 2,954.40 | 86.80 | +3.03% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,697.50 | -96.50 | -1.67% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Pharma | 22905.00 | 17.20 | +0.08% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Bank | 59273.80 | -407.50 | -0.68% |

Indian equities are set to make an all-time high on the back of a strong rally in global markets supported by healthy domestic cues. Nifty continued its northbound journey to end at an all-time high on closing basis, with gains of 138 points (+0.7%) at 18826 levels. The broader market too ended in green with the Nifty midcap 100 up +0.7% and the Nifty smallcap 100 up +1%.

Majority of the sectors ended in positive territory with Banking and Financial being top gainers up 1% each. Falling inflation and healthy economic data along with consistent FIIs buying cheered the domestic sentiments.

Nifty came within striking distance of an all-time high. We expect the overall structure to remain positive with major events now behind. All eyes would be on PM Modi’s visit to the US next week, as it would bring in cross-border agreements with a key focus on Defence. Sectors like Pharma, Healthcare, and Insurance companies would remain in focus after recovery was seen in monthly industry data.

Upbeat global market cues sparked a major rally that pushed benchmark Sensex above the 63000-mark, as investors shrugged off negative catalysts such as the US rate hike worries going ahead, slowing growth in China, and India's rising trade deficit in view of sluggish global demand.

Among sectors, Banks, Metal and Pharma stocks outperformed, whereas IT stocks witnessed selling pressure at higher levels. Technically, the Nifty is still holding higher high and higher low formation and is comfortably trading above the 20-day SMA (Simple Moving Average).

On weekly charts, the index has a formed bullish candle which also supports further uptrend from the current levels. For the trend following traders, 18720 would be the key level to watch out, and above the same the index could move up till 18980. On the other hand, below 18720 or 20-day SMA, any uptrend would be vulnerable, below which the market could slip till 18600-18550.

For Bank Nifty, as long it is trading below the 20 day SMA or below 44000, the weak sentiment is likely to continue. Below the same, it could slip till the 50-day SMA or 43250. On the flip side, a fresh uptrend is possible only after the dismissal of 44000, and above the same it could retest the level of 44300.

Markets surged strongly on Friday and inched closer to the record high, tracking firm global cues. After the firm start, the Nifty index hovered in a narrow band in the first half however a sharp surge in the latter half helped the index to test 18,864.70 but it finally settled at 18,826 levels. Recovery in banking and financials combined with buying in FMCG, pharma and energy majors largely aided the rebound. Besides, the continued buying in midcap and smallcap space further added to the positivity.

The buoyancy in the global markets, especially the US, is helping the index to maintain a bullish tone amid mixed domestic cues. We reiterate our positive view but suggest limiting positions citing intermediate choppiness. Instead of waiting for a new high in the index, we feel participants should maintain their focus on identifying stock-specific trading opportunities.

The domestic market rebounded with strong buying in banking, pharma, and consumer stocks, along with positive cues from global markets. The US market's optimism was bolstered by better-than-expected retail sales, reflecting the robustness of the economy.

Furthermore, jobless claims remain elevated and a decline in import prices raised hopes for a prolonged pause in interest rate hikes by the Fed, contradicting their announcement of potential future rate hikes made the previous day.

Nifty witnessed a strong opening on the back of buoyant US markets which was followed by consolidation during the first half of the trading session. The momentum picked up in the second half of the trading session supported by Reliance and Bank Nifty which witnessed increased traction towards the end of the day.

Nifty as well as the RSI has witnessed a bullish triangle pattern on the hourly charts which can keep the strength in the stock intact. A bullish crossover has been seen in MACD which can give an additional thrust to the index going forward.

Nifty traded within the striking distance of lifetime high levels and managed to close comfortably above 18,800 levels which can push the index towards 19,000 levels in the coming days.

Indian rupee gained 25 paise to close at 81.93 per dollar against previous close of 82.18.

Benchmark indices ended on a strong note on June 16 with Nifty above 18,800.

At close, the Sensex was up 466.95 points or 0.74% at 63,384.58, and the Nifty was up 137.90 points or 0.74% at 18,826. About 2050 shares advanced, 1388 shares declined, and 116 shares unchanged.

Top gainers were HDFC Life, SBI Life Insurance, Bajaj Finserv, Dr Reddy's Laboratories and Titan Company, while losers were Wipro, Bajaj Auto, TCS, BPCL and ONGC.

Among sectors, PSU Bank index up 1 percent, and capital goods index up 1 percent, while FMCG, healthcare up 0.5 percent each. However, information technology index down 0.38 percent.

BSE midcap and smallcap indices rose 0.7 percent each.

-Buy rating, target at Rs 485 per share

-Cigarettes business, volume trajectory remains strong

-Growth over coming quarters will optically come down to mid-to-high single digits

-FMCG business, company endeavours to outpace industry growth over the medium term

-Hotels business, divestment is on cards, evaluating alternatives to ensure cost & tax efficiency

ITC touched a 52-week high of Rs 455.50 and quoting at Rs 452.75, up Rs 4.90, or 1.09 percent on the BSE.

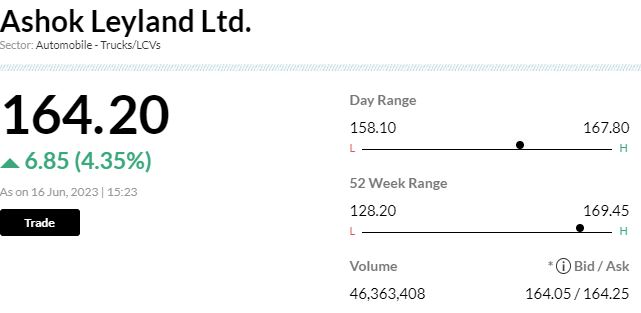

-Overweight rating, target at Rs 175 per share

-Company targeting market share improvement in M&HCVs & LCVs via expansion in North & East markets

-Expansion will also foray into the less than 2 tonne segment in LCVs

-Strong focus on margin improvement & price discipline in CV industry continues

-New energy portfolio will be ready in 24 months

-Company’s modular platforms will accelerate the transition to alternate energy vehicles

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Schaeffler Ind | 3,176.40 | 4.81 | 5.30k |

| AIA Engineering | 3,480.00 | 4.72 | 7.44k |

| Hindustan Aeron | 3,839.60 | 3.54 | 201.52k |

| Grindwell Norto | 2,170.10 | 3.23 | 1.40k |

| BHEL | 86.68 | 2.62 | 1.39m |

| Bharat Elec | 125.10 | 2.58 | 1.64m |

| Lakshmi Machine | 12,721.05 | 2.38 | 637 |

| Suzlon Energy | 14.78 | 2.21 | 53.24m |

| Bharat Forge | 836.15 | 1.81 | 18.79k |

| Thermax | 2,392.35 | 1.74 | 5.42k |

Shares of FSN E-Commerce Ventures, which operates Nykaa, zoomed 5 percent to Rs 144.85 on BSE in late trade after the company talked at length about emerging growth areas on its investor day.

The company said it has been working to generate revenue from its innerwear product line Nykd, which is showing signs of promise. In just two years of operation, the product has reached annual revenue of Rs 85 crore and is EBITDA positive.

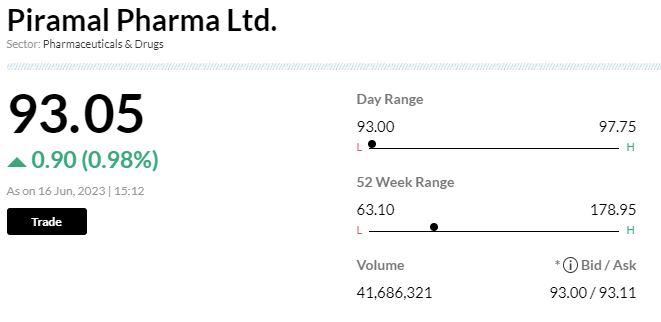

-Buy call, target Rs 115 per share

-Started the year on a strong note with healthy order book in CDMO division

-See rise in FTE discovery demand & supply normalisation in complex hospital generics

-Deep dive into NCE contracts gives confidence on significant margin expansion in FY24

-Upside risk to our estimate could come from strong demand in CHG products