November 18, 2022 / 16:47 IST

Rohan Mehta, CEO and Fund Manager, Turtle Wealth

"Turnaround businesses as the best investment ideas to create wealth. Companies that haven't been doing well for past few years but due to some fundamental or structural change, are expected to start performing well; those are the turnaround companies one should look at," Mehta said at the PMSBazaar's Alternative Investment Summit.

November 18, 2022 / 16:17 IST

Vinod Nair, Head of Research at Geojit Financial Services

Domestic market is now focusing on global trend for future direction due to lack of domestic triggers. Negative vibes in developed market and aggressive comment from Fed officials have shaken the ongoing optimistic trend across the globe. Despite a late attempt of recovery, the domestic market largely traded with a negative shade, in all sectors except PSU banks.

November 18, 2022 / 16:16 IST

Kunal Shah, Senior Technical Analyst at LKP Securities:

The Bank Nift index witnessed a volatile trading session where the first half was controlled by the bears and in the closing hours, bulls came back to hold the support. The bulls in order to gain back the momentum will have to take the index above 42,600-42,700 levels from where the uptrend will resume.

The bears will watch for 42,000 on the downside if breached and will get an upper hand on the index which will drag it further down toward the 41,500 level.

November 18, 2022 / 15:57 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets traded volatile and ended marginally lower, in continuation to the prevailing consolidation phase. After the flat start, the Nifty index gradually inched lower as the session progressed however recovery in the final hours pared the losses significantly. It finally settled at 18307 levels; down by 0.2%.

All the sectoral indices, barring PSU banking, traded in tandem and ended lower.

Markets are indicating the prevailing consolidation to continue and Nifty should decisively cross 18,450 levels to regain strength. Meanwhile, we reiterate our view to focus more on sector/stock selection citing restricted participation. Besides, we’re observing breakout failures across sectors, so maintain strict risk management rules also in place.

November 18, 2022 / 15:48 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty witnessed muted action in the week gone by & ultimately posted a negative weekly close after four consecutive positive weeks.

The short term momentum indicators have been showing negative divergence, which is a sign of weakness & the price action is expected to follow the suit.

Going ahead, the Nifty is expected to tumble towards 18100-18000 in the short term. On the higher side, 18450 has been acting as a resistance for the index & will continue to act as a cap for the short term.

The broader end of the market is expected to see deeper cut in the short term.

November 18, 2022 / 15:33 IST

Rupee Close:

Indian rupee closed marginally lower at 81.68 per dollar against previous close of 81.64.

November 18, 2022 / 15:31 IST

Market Close:

Indian benchmark indices ended lower in the volatile session on November 18.

At Close, the Sensex was down 87.12 points or 0.14% at 61,663.48, and the Nifty was down 36.20 points or 0.20% at 18,307.70. About 1424 shares have advanced, 1966 shares declined, and 119 shares are unchanged.

HCL Technologies, HUL, Asian Paints, SBI and Kotak Mahindra Bank were among the top Nifty gainers, while the biggest losers were M&M, Bajaj Auto, Cipla, IndusInd Bank and Maruti Suzuki.

Except Realty and PSU Bank, all other sectoral indices ended in the red.

The BSE midcap and the smallcap indices down 0.4 percent.

November 18, 2022 / 15:22 IST

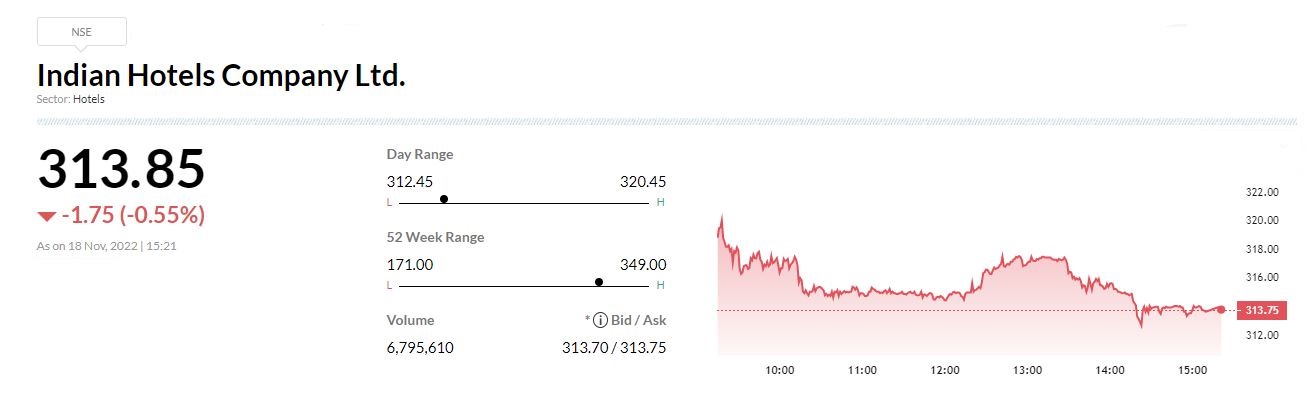

Morgan Stanley keeps 'Overweight' rating On Indian Hotels, target Rs 381

-Overweight call, target Rs 381 per share

-Demand momentum remains strong

-G20 summit in India & wedding season should support demand in Q3

-Supply growth is likely to remain slower than demand growth

-Supply growth would support a revenue PAR upcycle

-Management sees its upper midscale hotel brand, Ginger, as next driver of growth

November 18, 2022 / 15:19 IST

PMS stalwarts speak:

Anil Rego, Founder and CEO, Right Horizons said even while one is multiplying their money, they need to manage their risk well. The art of multiplying wealth is looking at stocks, their potential growth among other factors, he added at PMSBazaar's Alternative Investment Summit.

Surjit Singh Arora, Portfolio Manager and Principal Officer at PGIM India PMS, believes industrials will do well going ahead. Besides industrials, Arora also likes retail and automobile companies considering the consumption is improving.

November 18, 2022 / 15:18 IST

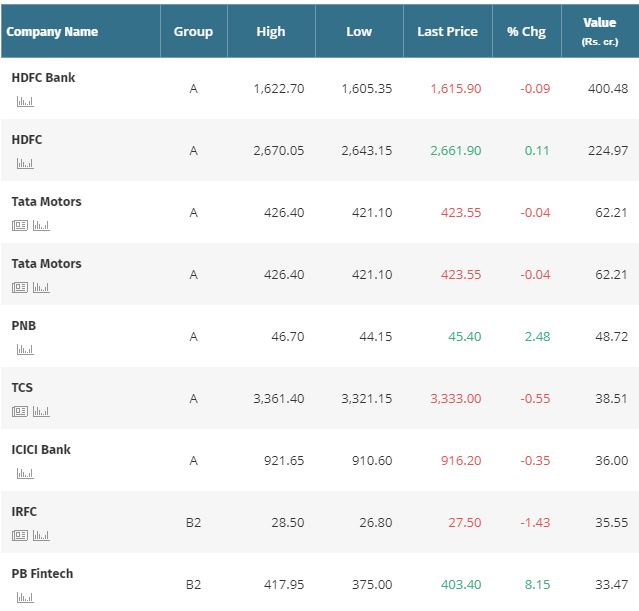

Gainers and losers on the BSE Sensex

November 18, 2022 / 15:15 IST

Nomura keeps Buy rating on Exide Industries, target Rs 221

-Buy call, target raised to Rs 221 per share

-Q2 results in-line with estimates

-Steady growth to continue; plans to invest Rs 6,000 crore in lithium-ion plant

-Raise FY23 revenue estimates by 10% to factor in higher H1FY23 run-rate

-Valuations attractive at 15.1x FY25 core EPS

Exide Industries touched a 52-week high of Rs 188 and quoting at Rs 184.45, down Rs 2.25, or 1.21 percent.

November 18, 2022 / 15:12 IST

Here are the most active stocks traded during the day on value based; click to view full list

November 18, 2022 / 15:08 IST

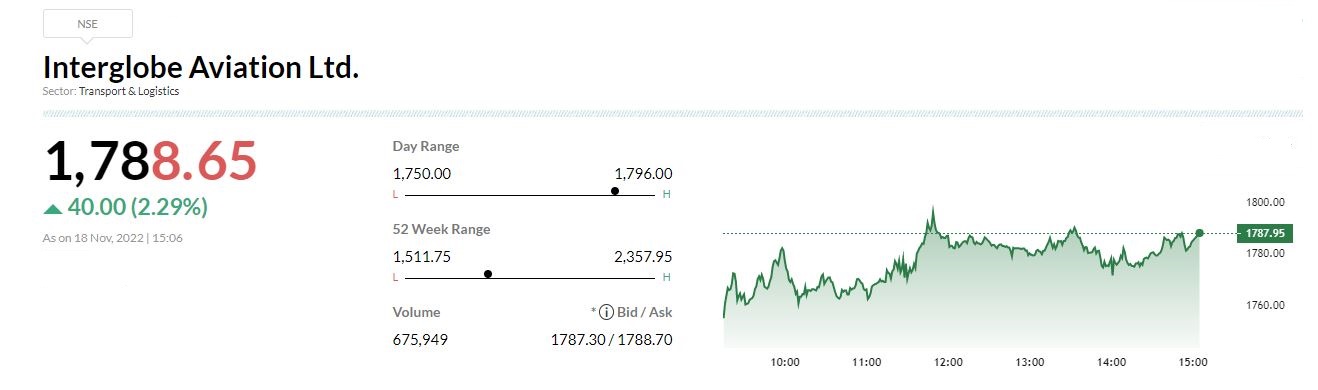

Morgan Stanley 'Overweight' call on Interglobe Aviation with target Rs 2,749 per share

-Overweight call, target Rs 2,749 per share

-Management highlighted that yields in Q3FY23 to date are well above Q1 levels

-Domestic traffic is back to pre-covid levels

-Management believes that international travel will be next leg of growth

-No change in the ASKM outlook but Q3 will face cost impact