November 16, 2022 / 16:11 IST

Ajit Mishra, VP - Research, Religare Broking

Markets traded lackluster and ended unchanged, in absence of any major trigger. After the initial downtick, the Nifty index oscillated in a narrow range till the end and finally settled at 18,409 levels.

Meanwhile, sectoral indices traded mixed wherein metal, media and realty lost over a percent each. Besides, the prevailing underperformance of the broader indices continues to weigh on the sentiment.

The recent move in the index lacks decisiveness and shows an early sign of exhaustion too however we recommend following the trend until it reverses.

We’re seeing select heavyweights and midcap counters attracting buying interest while the rest are either trading in a range or witnessing pressure. We feel it’s prudent to restrict positions and focus on overnight risk management.

November 16, 2022 / 16:06 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Markets moved in a narrow range with bouts of sideways movement in intra-day trades, but selective buying in late trades helped key indices to end in positive territory. The lacklustre trend was visible across the Asian and European markets, which prompted local traders to trade cautiously.

After last week's spectacular rally, investors are in no hurry to lap up stocks despite some tailwinds in the domestic economy.

Technically, the Nifty has formed a small Doji candle on daily charts. The current market texture is non directional and fresh uptrend is possible only after the 18450 breakout level. Above which, the index could hit the level of 18550-18600. On the flip side, dismissal of 18350 could accelerate the selling pressure, which could see the index retest the level of 18250-18200.

November 16, 2022 / 15:56 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty witnessed a tough battle between the bulls & the bears today & ultimately posted a marginal positive close. The volatility is likely to increase going ahead as indicated by the India VIX, which is set for a spike on the upside.

On the higher side, the index once again paused near the rising trendline drawn from the previous key swing highs on the hourly chart.

18450-18500 is the key zone to monitor on the higher side. On the flip side, 18300-18280 is a key support zone, which will decide further course of action for the index.

If the Nifty breaches 18280 on the downside, then the structure will turn in favor of the bears for the short term. The broader end of the market continues to show short term weakness.

November 16, 2022 / 15:54 IST

Vinod Nair, Head of Research at Geojit Financial Services:

As the domestic market has started to trade around the all-time high levels, it is trending indecisively following the recent geopolitical tensions and weak performance by global counterparts.

Although domestic macroeconomic indicators and FII inflows are favourable, given the high valuations, domestic markets can behave cautious in the short to medium-term.

Rest of the other EMs look more attractive when the global market is attempting to bounce back after a long period of consolidation.

November 16, 2022 / 15:32 IST

Rupee Close:

Indian rupee ended 20 paise lower at 81.30 per dollar on Wednesday against previous close of 81.10.

November 16, 2022 / 15:30 IST

Market Close

: Indian benchmark indices ended on flat note in the volatile session on November 16.

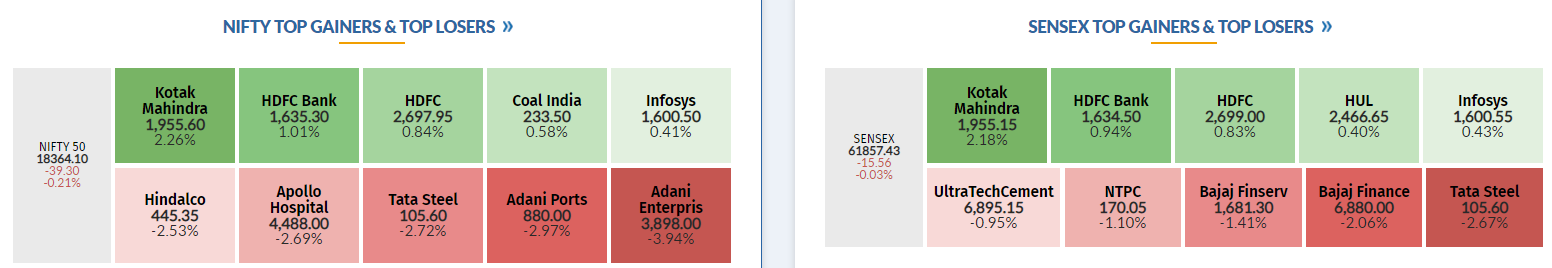

At Close, the Sensex was up 107.73 points or 0.17% at 61,980.72, and the Nifty was up 6.30 points or 0.03% at 18,409.70. About 1394 shares have advanced, 2011 shares declined, and 115 shares are unchanged.

Kotak Mahindra Bank, Coal India, HDFC Bank, Dr Reddy's Laboratories and HUL were among the top Nifty gainers, while the biggest losers were Apollo Hospitals, Adani Enterprises, Hindalco Industries, Adani Ports and JSW Steel.

Power, realty and metal indices fell 1 percent each, while some buying was seen in the banking names.

BSE midcap index shed 0.6 percent and smallcap index was down 0.3 percent.

November 16, 2022 / 15:17 IST

Morgan Stanley keeps Underweight rating on Balkrishna Industries with a target at Rs 1,649 per share

-Underweight call, target Rs 1,649 per share

-Including realized FX gains, margin stood at 20%, largely in-line

-Management did not provide guidance on FY23 volumes citing emerging macro risks

-Limited earnings visibility keeps us underweight

November 16, 2022 / 15:10 IST

Navneet Damani, Senior VP – Commodity Research at Motilal Oswal Financial Services

Gold prices steadied near a three-month peak as signs of cooling U.S. inflation boosted bets for smaller rate hikes, while reports around Russian missiles killing two people in Poland led to some demand for safe-haven assets.

The United States and Western allies said they were investigating but could not confirm a report that a blast in NATO member Poland resulted from stray Russian missiles, while Russia’s defence ministry denied it.

Volatility was a bit high in the yesterday's session as apart from fed officials comments we also had the U.S. PPI and NY state manufacturing index. The U.S. PPI increased 8.0% for the 12 months through October compared with economist expectations for 8.3%. While the NY empire state manufacturing index was positive showing the level of general business conditions improving in NewYork.

After two fed officials hinting a slowdown in the pace of rate hike, Fed official Bostic mentioned that more hikes will be needed to get the inflation down to the Fed's target rate. Focus today will be on the U.S. Retail sales and IIP data. Broader trend on COMEX could be in the range of USD 1740-1800 and on domestic front prices could hover in the range of Rs 52,700-53,400 could be expected.

Navneet Damani, Senior VP – Commodity Research at Motilal Oswal Financial Services Gold prices steadied near a three-month peak as signs of cooling U.S. inflation boosted bets for smaller rate hikes, while reports around Russian missiles killing two people in Poland led to some demand for safe-haven assets. The United States and Western allies said they were investigating but could not confirm a report that a blast in NATO member Poland resulted from stray Russian missiles, while Russia’s defence ministry denied it. Volatility was a bit high in the yesterday's session as apart from fed officials comments we also had the U.S. PPI and NY state manufacturing index. The U.S. PPI increased 8.0% for the 12 months through October compared with economist expectations for 8.3%. While the NY empire state manufacturing index was positive showing the level of general business conditions improving in NewYork. After two fed officials hinting a slowdown in the pace of rate hike, Fed official Bostic mentioned that more hikes will be needed to get the inflation down to the Fed's target rate. Focus today will be on the U.S. Retail sales and IIP data. Broader trend on COMEX could be in the range of USD 1740-1800 and on domestic front prices could hover in the range of Rs 52,700-53,400 could be expected.

November 16, 2022 / 15:05 IST

Citi maintains 'Buy' on Apollo Tyres, target raised to Rs 340 per share

-Buy call, target raised to Rs 340 per share

-Q2FY23 results ahead of estimates; outlook mixed

-Consolidated earnings estimates increased by 5-11% over FY23-25

-India business is steady

-Focus is on market share gains & premiumiation in EU business

Apollo Tyres was quoting at Rs 279.35, down Rs 18.50, or 6.21 percent on the BSE.

November 16, 2022 / 15:01 IST

Market at 3 PM

Benchmark indices were trading flat amid volatility.

The Sensex was up 110.13 points or 0.18% at 61983.12, and the Nifty was up 1.20 points or 0.01% at 18404.60. About 1252 shares have advanced, 1999 shares declined, and 104 shares are unchanged.

November 16, 2022 / 14:55 IST

Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas

Indian Rupee depreciated by 0.43% on risk aversion in global markets weak Asian currencies. Disappointing macroeconomic data from FII outflows also weighed on Rupee.

We expect Rupee to trade with a negative bias on risk aversion in global markets and Dollar demand from importers.

However, weak Dollar and decline in crude oil prices may prevent sharp fall in rupee.

Geopolitical tensions eased somewhat after investigations revealed that the missile which hit Poland was fired from Ukraine and not Russia. Investors may also remain cautious ahead of retail sales and industrial production data from US.

USDINR spot price is expected to trade in a range of Rs 80.50 to Rs 82.50

November 16, 2022 / 14:52 IST

Sharekhan maintains ‘Buy’ on Ashok Leyland with an unchanged Price Target of Rs 181

-Maintain Buy with an unchanged Price Target of Rs 181

Expect company to benefit from the faster recovery in CV volumes and improved EBITDA margins, led by operating leverage benefits

-The company is well placed in the industry to benefit from increased economic activities related to infrastructure, mining, and e-commerce

The company’s profitability is expected to improve significantly in the medium term, with its EBITDA expected to post an 84.8% CAGR over FY2022-FY2024E

-Investments by investors and strategic partners in its EV subsidiary can lead to value unlocking and re-rating of the stock in the future

Ashok Leyland was quoting at Rs 147.65, down Rs 2.50, or 1.67 percent on the BSE.

November 16, 2022 / 14:47 IST

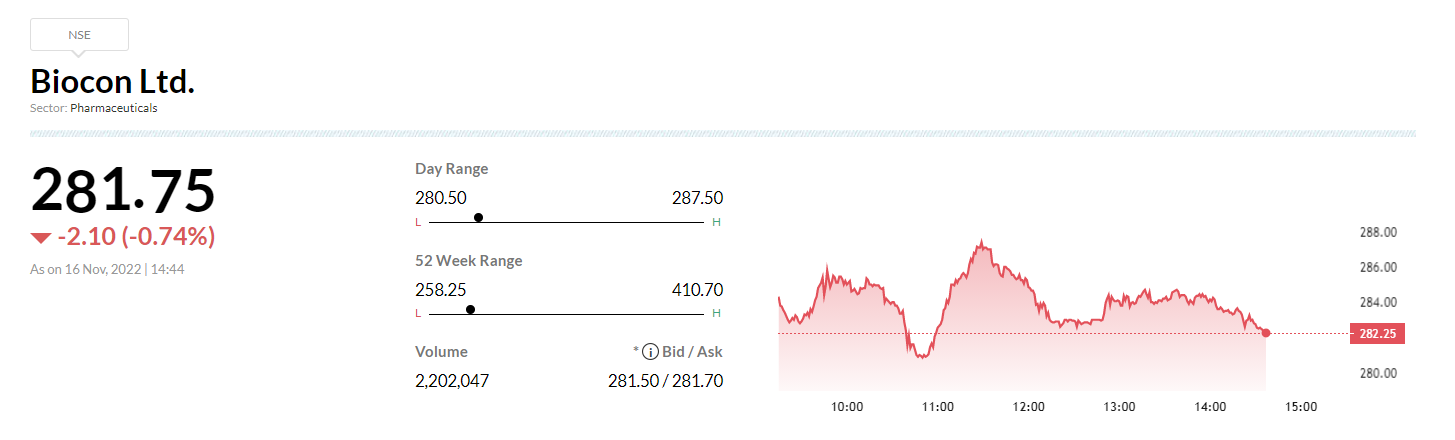

Goldman Sachs maintains 'Buy' call on Biocon, target Rs 350 per share

-Buy call, target Rs 350 per share

-Q2 broadly below estimate, from a profitability standpoint

-Sales/EBITDA grew 26%/6% YoY respectively

-Biosimilar sales & research services reported in-line growth

-Believe company is on course to meet earlier FY23 guidance of double-digit topline growth

-Driven by growth across multiple business segments.