Markets resumed the corrective trend and lost nearly one and a half percent. Weak global cues triggered a gap down start, followed by range bound session till the end.

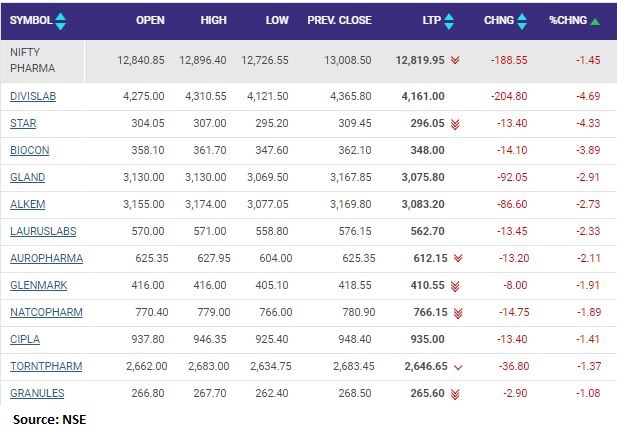

The Nifty index finally ended with losses of 1.5% to close at 16,411 levels. Amongst the sectors, except Power, all the other indices ended with losses wherein Realty, Metal and Consumer Durables ended were the top losers. The broader indices also lost in the range of 1.5%-2%.

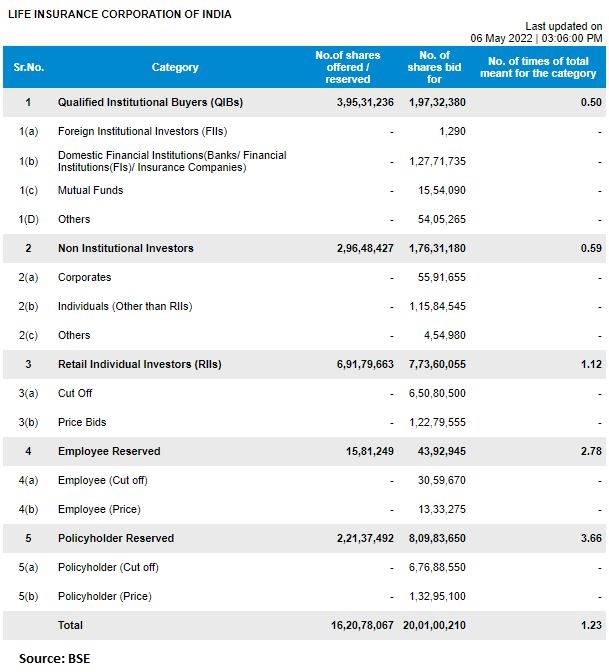

Markets will react to Reliance numbers in early trade on Monday and then focus would shift to the global cues. The increasing fear of aggressive rate hikes from the US Fed has spooked investors across the globe including India.

On the index front, the Nifty has tested the crucial support zone of 16,400 and indications are in the favour of prevailing decline to continue with some intermediate pause/rebound.

In case of any rebound, the 16650-16800 zone would act as a hurdle. Participants should align their positions accordingly and use rebound to create shorts.