Taking Stock: Profit booking drags Nifty below 18,200; Sensex falls 372 points

On the sectoral front, realty, metal and information technology indices shed 1 percent each, while bank, oil & gas and power indices fell 0.5 percent each.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,712.37 | 447.05 | +0.52% |

| Nifty 50 | 26,186.45 | 152.70 | +0.59% |

| Nifty Bank | 59,777.20 | 488.50 | +0.82% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Shriram Finance | 854.90 | 26.75 | +3.23% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,370.50 | -66.00 | -1.21% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8381.75 | 125.05 | +1.51% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Pharma | 22947.20 | -11.80 | -0.05% |

Markets lingered in negative territory as cautious investors continued to book profit after the recent spike. The subdued economic readings coming in from the US and China once again raises concern of a slowing economy and hence recession fears, which is making investors jittery about the future course.

Technically, the Nifty has breached the crucial support level of 18,250 and also formed a bearish candle on daily charts which is largely negative. For traders 18,250 and 18,300 would act as an immediate resistance area while 18,100-18,050 could be important support levels for the bulls.

:

The Nifty has witnessed consecutive negative days. Amid the selling pressure, the Nifty has managed to hold on to the crucial support level of 18100 and the intraday pullback has come exactly from around 18100 which indicates that until the Nifty manages to stay above this level the uptrend is intact.

The upward sloping channel has been breached on the downside and the daily momentum indicator has a negative crossover which is a sign of weakness, and this can lead to consolidation over the next few trading sessions.

On the flipside, there are multiple support parameters in the form of the 20-day moving average (18053) and the 38.2% Fibonacci retracement level (18113) of the rise from 17553 – 18459 are placed which shall provide cushion and restrict a deep correction. Stock specific action can take place over the next few trading sessions.

Markets traded volatile and lost over half a percent, in continuation to Tuesday’s fall. After the flat start, the Nifty gradually drifted lower however rebound in the final hours helped the index to recoup some losses. It eventually settled at 18,181.75 levels; down by 0.57 percent. The majority of sectors traded in tandem with the benchmark trend and edged lower wherein realty, IT and metal were among the top losers. Interestingly, the broader indices continued their outperformance for the second consecutive session.

As global markets are not offering any cue, the performance of the key sectors viz. Banking, financials, auto and FMCG will continue to dictate the trend. On the index front, Nifty has crucial support at the 18,050 mark, which also coincides with the short-term moving average i.e. 20 EMA. Though the downside seems capped, we recommend maintaining a focus on stock selection and overnight risk management.

In response to weak global sentiments, domestic investors remained cautious as the US market grappled with recession concerns led by recent economic data indicating slowdown. The US retail sales figures for April reflected a decrease in demand, and ongoing debt ceiling negotiations further dampened market sentiment.

Indian Rupee slides to six-week low following weaker regional currencies. Among the Asian currencies, the Chinese yuan slid past the key level of 7 per dollar for the first time this year which pushed the other peer currencies lower today. However, the Indian rupee remained the median performer among the group amid foreign fund inflows and better fundamentals.

Ahead of the RBI board meeting on May 19 for dividend payout, we don't expect aggressive intervention from them when the greenback is strengthening against major currencies.

The short-term direction for the rupee has turned bearish and we could see 82.50 to 82.75 and find support in the area of 82.10 to 82.25.

Nifty and Bank Nifty witnessed fall for the second consecutive day. However, both the benchmark indices were seen recovering towards the end of the trading session. Nifty has reversed its upside from 78.6 percent fibonacci retracement and has finally closed below its 10DEMA for the first time in the last 15 days implying the profit booking may continue till it does not close above 18300 levels.

Bank Nifty has reversed after attempting the fresh lifetime high level of 44150 but has managed to close above its 10DEMA of 43500. The index is expected to witness incremental pressure once it closes below this level. Till then Bank Nifty is expected to trade in the 43500-44100 range.

Indian rupee closed 18 paise lower at 82.39 per dollar against previous close of 82.21.

Indian benchmark indices ended lower for the second consecutive session on May 17 with Nifty below 18,200.

At close, the Sensex was down 371.83 points or 0.60 percentat 61,560.64, and the Nifty was down 104.70 points or 0.57percentat 18,181.80. About 1,666 shares advanced, 1,722 shares declined, and 129 shares were unchanged.

Kotak Mahindra Bank, Apollo Hospitals, SBI Life Insurance, TCS and HCL Technologies were among the biggest losers on the Nifty. Gainers were Hero MotoCorp, IndusInd Bank, ITC, UPL and BPCL.

On the sectoral front, realty, metal and information technology indices shed 1 percent each, while bank, oil & gas and power indices fell 0.5 percent each.

BSE midcap index ended marginally lower and smallcap index ended higher.

-Net profit down 18.5 percentat Rs 65. 4 crore vs Rs 80.2 crore (YoY)

-Revenue up 31.6percentat Rs 402.7 crore vs Rs 305.9 crore (YoY)

-EBITDA up 22.6percentat Rs 118.7 crore vs Rs 96.8 crore (YoY)

-Margin at 29.5percentvs 31.6percent(YoY)

Deepak Fertilizers and Petrochemicals Corporation have posted 9 percent fall in Q4 net profit at Rs 254.9 crore versus Rs 280 crore and revenue was up 39 percentat Rs 2,795.5 crore versus Rs 2,012.5 crore, YoY.

Deepak Fertilizers and Petrochemicals Coporation was quoting at Rs 595.30, down Rs 3.00, or 0.50 percent on the BSE.

-Buy rating, target raised to Rs 105 per share

-Quarterly profit at a 10-year high

-A beat led by refining

-Raise FY24 EPS by 38 percentto factor in a higher marketing margin in H1FY24

-Believe government may allow OMCs to recover part of their FY23 losses

-Marketing volume in line with an estimate but market share down QoQ

Indian Oil Corporation touched a 52-week high of Rs 88.61 and was quoting at Rs 87.60, up Rs 0.60, or 0.69 percent on the BSE.

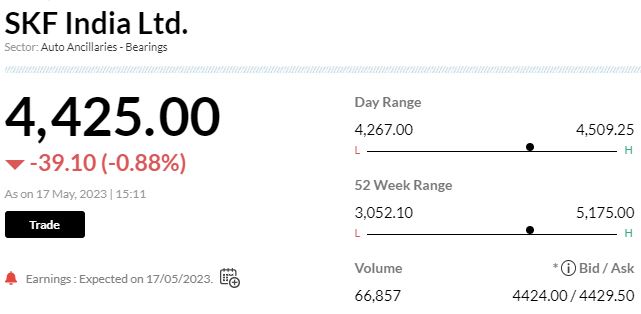

SKF has reported 12.2 percent jump in its Q4 net profit at Rs 122.9 crore versus Rs 109.5 crore and revenue was up 5.4 percentat Rs 1,094.7 crore against Rs 1,039 crore, YoY.