Taking Stock | It's Happy Holi on D-Street as Sensex gains 415 points, Nifty tops 17,700

The BSE midcap index rose 0.7 percent while the smallcap index added nearly a percent.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 83,311.01 | -148.14 | -0.18% |

| Nifty 50 | 25,509.70 | -87.95 | -0.34% |

| Nifty Bank | 57,554.25 | -272.80 | -0.47% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Asian Paints | 2,602.90 | 116.20 | +4.67% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Grasim | 2,700.10 | -181.90 | -6.31% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 35337.60 | 63.00 | +0.18% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10281.90 | -217.10 | -2.07% |

After a gap up opening at 17,680, Nifty continued to rally higher and closed the gap area between 17,800 and 17,782 made in 21st and 22nd Feb 2023.

50-day SMA is placed at 17,811 while 20-day SMA is at 17,650. For further strength, Nifty has to move beyond 17,811 levels decisively. Above 17,811, will open gate for 18,030-18,100 in the short term.

Only a decisive break of 17,650 levels with change the short term from Up to Down and then Nifty might slip towards 17,450 levels sharply.

Nifty pared early gains as the benchmark index failed to surpass resistance at 17,800. On the daily chart, the Nifty closed within the falling channel following an intraday breakout from the said channel.

On the daily chart, a shooting star kind of candlestick pattern has formed, suggesting a bearish reversal. A fall below 17,650 may trigger a steep correction in the market. While a sustained trade above 17,750 may induce buying in the market.

The Bank Nifty index witnessed some selling pressure from higher levels but the broader trend remains bullish and one should keep a buy-on-dip approach.

The index lower-end support stands at 41,000 where the highest open interest is built up on the put side and the upside resistance is at 42,000. The index is likely to trade in this range for the next couple of trading sessions.

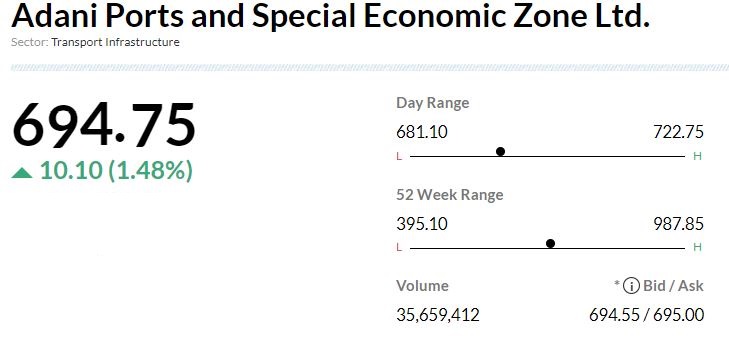

The major concerns that prevailed in the market during the previous weeks were the fear of aggressive Fed policy action, which led to a rise in treasury yields & US dollar, and the uncertainties surrounding Adani.

All of these have now shifted in favour of the bulls, as US officials reduced the likelihood of a sharp rate hike, forcing yields and the dollar index to moderate.

Additionally, improved market sentiment due to the foreign bulk deal at Adani, the oversold stage of the domestic market, and FII buying helped sharpen the recovery.

Indian rupee closed marginally higher at 81.92 per dollar on Monday against Friday's close of 81.97.

Benchmark indices ended higher for the second consecutive session on March 6 with Nifty above 17,700.

At close, the Sensex was up 415.49 points or 0.69% at 60,224.46, and the Nifty was up 117.20 points or 0.67% at 17,711.50. About 2049 shares have advanced, 1430 shares declined, and 189 shares are unchanged.

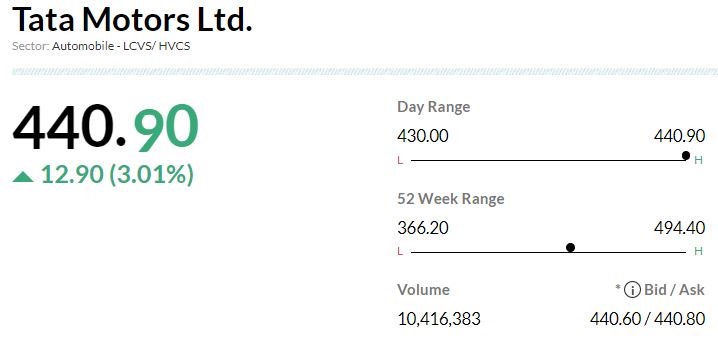

Adani Enterprises, Tata Motors, ONGC, NTPC and Power Grid Corporation were among the top gainers on the Nifty, while losers included Britannia Industries, Tata Steel, JSW Steel, Hindalco Industries and IndusInd Bank.

Except metal, realty and PSU Bank, all other sectoral indices ended in the green.

The BSE midcap index rose 0.7 percent and smallcap index added nearly a percent.

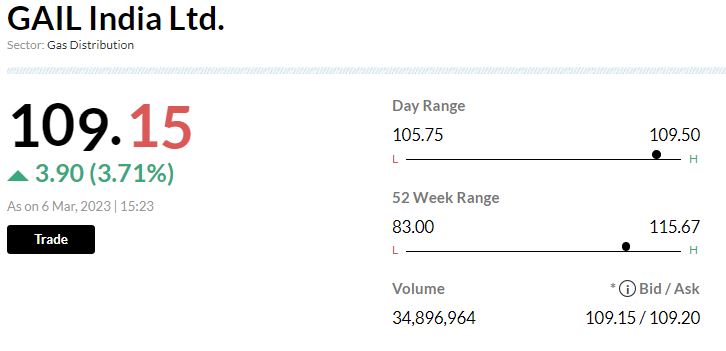

-Buy rating, target at Rs 125 per share

-Indication from regulator raises hopes of over 50 percent tariff hike

-Important progress in achieving a unified national gas grid system

-Revenue neutral now but a long-term positive for gas transmission players

-Final tariff order is likely any time after open house on 6 March

-Model a 40 percent hike, while a 52 percent hike would boost FY24 EPS estimate by 7 percent

-Higher share of stable utilities earnings would also drive a re-rating

Indian Rupee touched a fresh one month high of 81.62 on extended rally in the domestic markets and fresh foreign inflows. Positive Asian currencies also supported the domestic currency.

We expect Rupee to trade with a slight positive bias on rise in risk appetite in global markets and a soft Dollar. Overall weak tone in crude oil and FII inflows may also support Rupee.

However, global economic slowdown may cushion the downside. Dollar can witness some volatility this week ahead of Fed Chair Powell’s testimony and labour market data from US later this week. USDINR spot price is expected to trade in a range of Rs 81.20 to Rs 82.20.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tata Motors | 438.95 | 2.56 | 9.41m |

| TVS Motor | 1,096.30 | 2.42 | 792.95k |

| Tube Investment | 2,750.40 | 1.6 | 81.08k |

| Eicher Motors | 3,164.00 | 1.17 | 287.82k |

| Exide Ind | 182.35 | 0.97 | 1.40m |

| Hero Motocorp | 2,480.00 | 0.75 | 159.12k |

| Ashok Leyland | 146.05 | 0.69 | 5.06m |

| Balkrishna Ind | 2,061.90 | 0.62 | 84.67k |

| Bosch | 18,075.00 | 0.51 | 12.77k |

| Bharat Forge | 828.70 | 0.44 | 339.18k |